On 21 June 2018, aerospace company Airbus published a risk assessment highlighting its concerns about Brexit, especially if the UK were to leave the EU without a deal. These centred on the potential for changes to the Customs Union and Single Market rules which currently enable highly-integrated supply chains to operate across Europe, and possible restrictions to the free movement of Airbus staff. The aerospace industry – with Airbus as the biggest player – is a very productive industry that employs a proportionately high number of people in Wales.

What has Airbus said?

Airbus’s risk assessment describes its current business model, and how it takes this to rely on “frictionless trade”, which “today is provided by the EU Customs Union and Single Market rules”. Its supply chain involves parts crossing the channel “multiple times”, with parts arriving “just in time”: meaning costly delays if any new barriers are introduced to this process.

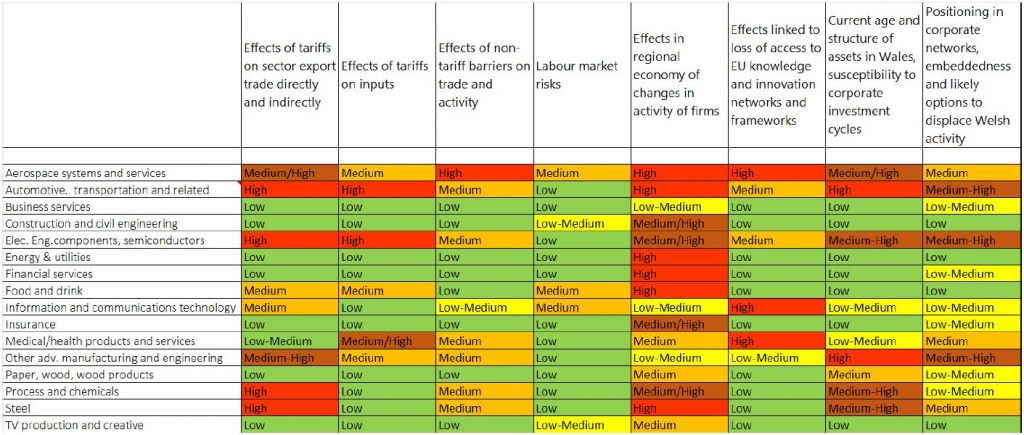

Airbus thinks that the “unique, safety driven and heavily regulated environment” of the aerospace sector makes it particularly susceptible to risks posed by Brexit. Cardiff University Business School agrees about the industry’s exposure to Brexit threats: in a 2017 report, EU Transition and Economic Prospects for Large and Medium Sized Firms in Wales, it highlighted “aerospace systems and services” as the sector most at risk in the Brexit process of those it looked at.

Table 1: Summary of how different sectors were rated on different aspects of risk  The report’s authors went on to say:

The report’s authors went on to say:

For a number of firms the prospect of Brexit resulting in significant disinvestment from Wales (and the UK) – and in some cases potentially complete exit – was a real one. The companies in this bracket tended to be multinationals with a large presence in Wales; a number of these in the Aerospace systems and services, Automotive, transportation etc., and Electrical engineering etc. sectors.

Airbus notes that, in the event of a no-deal Brexit, “production is likely to be severely disrupted”. It envisages “up to $1 billion weekly loss of turnover”, which is likely to “add up to several weeks; potentially translating into a multi-billion impact on Airbus”. Furthermore, UK aerospace companies would not be covered by regulatory approvals – including the European Air Safety Agency – which facilitate the free movement of aerospace goods throughout the EU.

Although the firm does not explicitly say it would withdraw from the UK in such an eventuality, it does say that no-deal would be “catastrophic” and “would force Airbus to reconsider its footprint in the country, its investments in the UK and at large its dependency on the UK”.

The risk assessment also considers an “orderly Brexit”, whereby after a transition phase (March 2019 – December 2020) the UK leaves the Customs Union, Single Market and jurisdiction of the European Court of Justice. It states that this proposed transition phase “seems too short”, both for governments to agree details of the new UK-EU agreement, and for Airbus and its key suppliers to ready their supply chain to the new regulatory order.

Following the transition phase, it notes the likelihood of short-term production disruptions of several weeks as the supply-chain is adjusted to the new relationship between the UK and the EU. If this new relationship involves regulatory divergence between the two parties, Airbus envisages “potentially … higher complexity, more effort, more cost; more friction/delay in our cross-channel, deeply integrated supply chain”. Consequently, the company states:

Until we know and understand the new EU/UK relationship, Airbus should carefully monitor any new investments in the UK and should refrain from extending its UK suppliers/partners base.

The company cautions that “Any change in customs procedures, logistics and environmental standards would have major industrial and cost impact”. Such a form of Brexit would seem to be a logical consequence of the Prime Minister’s “red lines” in Brexit negotiations (control of immigration; ability of the UK to make its own free trade agreements; independence from the European Court of Justice; and an end to substantial contributions to the EU budget). A change in customs procedures is implied by the Prime Minister’s requirement for the UK to make its own free trade agreements, and therefore leave the customs union. The Prime Minister’s commitment to leaving the Single Market raises the question as to whether there will be regulatory divergence between the UK and the EU. The end of free movement raises question marks over the ease with which Airbus will be able to move its staff: which it describes as a “critical issue”.

If the UK were to leave the EU without a deal, it would default to trading with the EU on WTO terms. The WTO Agreement on Trade in Civil Aircraft has eliminated tariffs on aircraft and most civil aircraft components between its signatories, which include the EU, and other WTO members. Accordingly, tariffs are not mentioned in Airbus’s risk assessment. Airbus’s concerns – new customs processes, regulatory divergence and free movement of its staff – were all shared by the House of Commons Business, Energy and Industrial Strategy Committee in its recent report on The impact of Brexit on the aerospace sector.

Does it matter?

Airbus’s importance to the Welsh economy can be considered in a number of ways. The document The impact of Airbus on the UK economy, prepared for Airbus by Oxford Economics, does this looking both at the Welsh and UK footprints of the company.

- In 2015, Airbus directly employed 6,400 at its Welsh sites, including almost 6,000 at the site in Broughton. Of those employed by Airbus in Wales, almost 3,300 live in Wales. Oxford Economics estimates that Airbus’s activities support 11,700 jobs across Wales in total.

- In 2015, the wages it paid to its employees in Wales, and the profits it made on its operations in the nation, led it to make a direct value added contribution to Wales’ GDP of £563 million. In the same year it spent £199 million on goods and services from Wales-based suppliers.

- Airbus’ total economic impact in Wales is the sum of its direct (wages paid to staff in Wales and profits made on operations here), indirect (value of products purchased by Airbus and the associated supply chain) and induced (the wage-spend of Airbus workers and those supported by Airbus’s supply chain) impact. By combining these three channels of impact, Oxford Economics estimate Airbus supported a £854 million contribution to GDP through its expenditure in Wales.

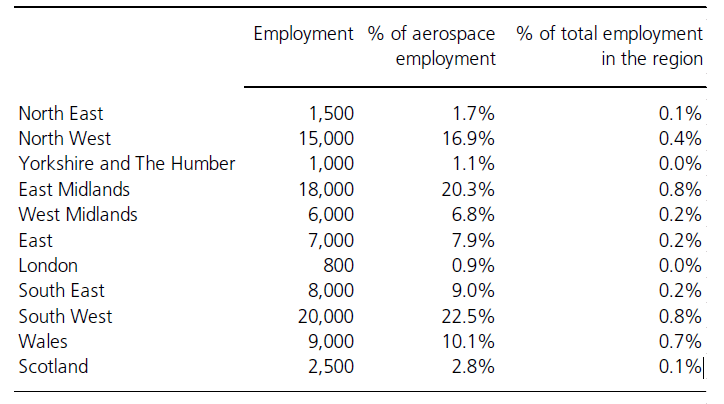

Airbus is not the only aerospace employer in Wales. In total, the sector employed 9,000 people in Wales in 2016. This represented 10.1% of total aerospace employment in Great Britain, or twice what one might expect if these jobs were distributed evenly by population share.

Table 2: Employment in the aerospace industry, by region, 2016  The aerospace industry in Wales is a highly productive one. In 2015, GVA per hour worked in the UK aerospace sector was almost 40% higher than the UK average across all industries. In Wales, GVA per hour worked in the aerospace sector is almost 160% higher than the UK average for this sector. In short, the aerospace industry currently has a large and very productive presence in Wales.

The aerospace industry in Wales is a highly productive one. In 2015, GVA per hour worked in the UK aerospace sector was almost 40% higher than the UK average across all industries. In Wales, GVA per hour worked in the aerospace sector is almost 160% higher than the UK average for this sector. In short, the aerospace industry currently has a large and very productive presence in Wales.

The UK Government is expected to publish its White Paper on a Future Relationship with the EU before the summer recess. This should give a clearer indication of the kind of deal the UK wants, and what impact this may have on the aerospace sector in the UK.

Further sources:

- Airbus, Brexit risk assessment

- Cardiff University Business School, EU Transition and Economic Prospects for Large and Medium Sized Firms in Wales

- House of Commons Business, Energy and Industrial Strategy Committee, The impact of Brexit on the aerospace sector.

- House of Commons Library, The aerospace industry: statistics and policy.

- Oxford Economics, The impact of Airbus on the UK economy

- UK Government, PM speech on our future economic partnership with the European Union

Article by Robin Wilkinson, National Assembly for Wales Research Service

Source (Table 1): Cardiff University Business School, EU Transition and Economic Prospects for Large and Medium Sized Firms in Wales

Source (Table 2): ONS, Business Register and Employment Survey, as presented in House of Commons Library, The aerospace industry: statistics and policy.