The Welsh Local Government Association (WLGA) says funding for local authorities next year is “one of the best financial settlements since the beginning of devolution, recognising the significant challenges which remain for council budgets”. In this article we take a look at the 9.4% increase for local authority core revenue funding in 2022-23 and the pressures facing local government.

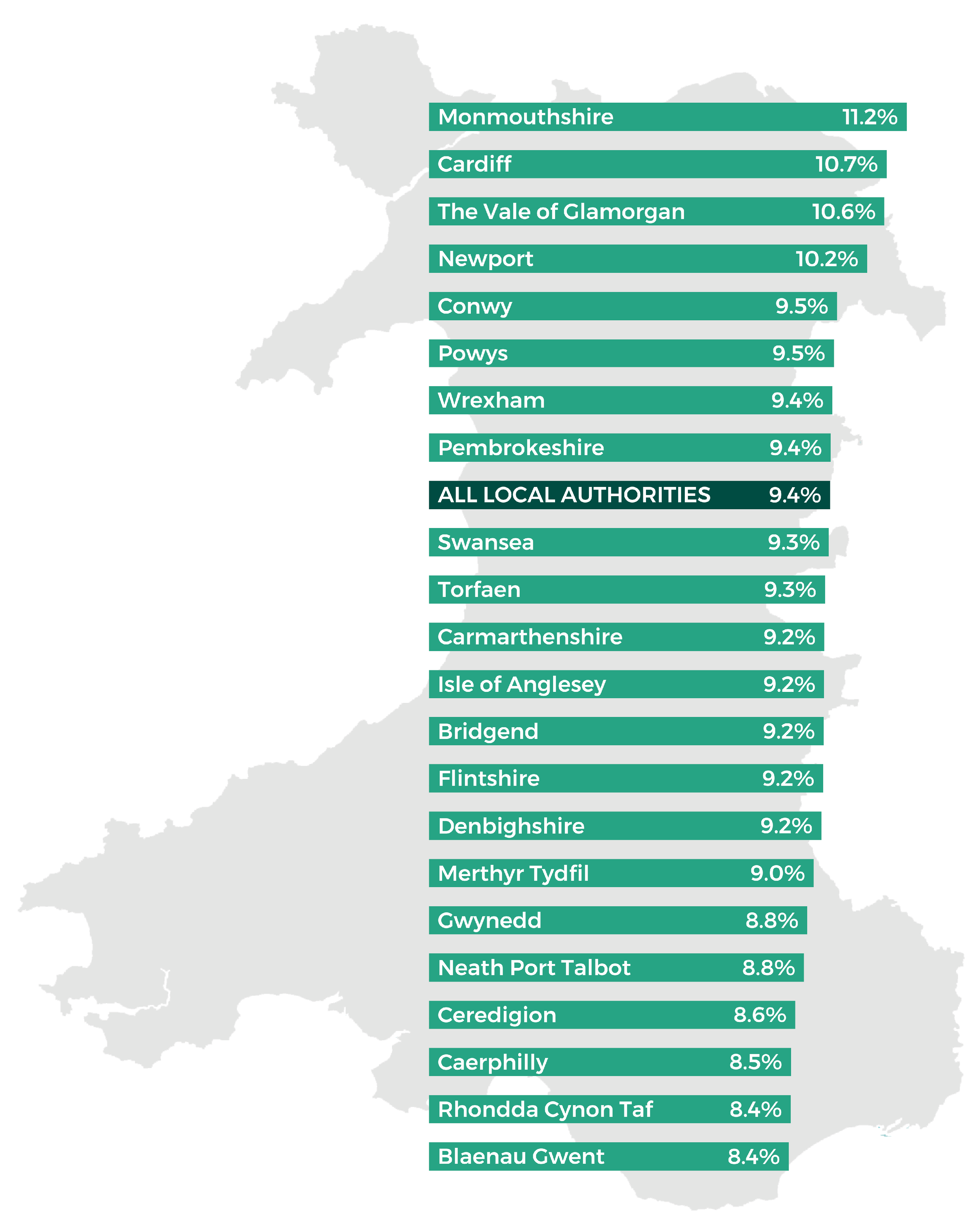

All local authorities will receive an increase of at least 8.4% in 2022-23

Aggregate External Finance (AEF), which is the core revenue funding allocated across the 22 local authorities annually, is due to be £5.1bn in 2022-23. This is an increase of £437m, or 9.4%, compared with 2021-22. No authority is due to receive less than an 8.4% increase.

The largest percentage increase is for Monmouthshire (11.2%) and the lowest for Blaenau Gwent and Rhondda Cynon Taf (8.4%). For context, the overall change between 2020-21 and 2021-22 was an increase of 3.8%, the biggest increase for an individual local authority was for Newport at 5.6%.

Figure 1: Provisional change in AEF by local authority (2021-22 to 2022-23)

Source: Senedd Research and Welsh Government local government revenue and capital settlement 2022 to 2023

The Minister for Finance and Local Government, Rebecca Evans MS, describes this as a “good” settlement, but acknowledges it will not reverse the impact of austerity and local government will need to “make some difficult decisions” in setting their budgets for next year. Cardiff University’s Wales Fiscal Analysis estimate that between 2009-10 and 2019-20 spending on local authority services fell by 6.0% in real terms, with the value of government grants to local authorities falling by 16.8% in real terms in that time.

Is this a better settlement than expected?

The Welsh Government’s Chief Economist describes the Welsh Government’s overall budgetary position as “less bleak than previously expected”, something Wales Fiscal Analysis referred to as “probably an understatement”. The Chief Economist’s report 2021 outlines an additional £1.8bn of core day-to-day funding for the Welsh Government following the UK Government’s Autumn Budget and Spending Review 2021. The WLGA referred to the settlement as “exceptionally generous”.

For the first time since 2017 the Welsh Government also has a multi-year settlement, enabling it to provide indicative budget allocations for future years. Something that has been called for by local government bodies and the Finance Committee during previous budget scrutiny.

While the indicative core funding allocations for 2023-24 and 2024-25 show an increase in funding for local authorities, those increases are not as large as seen in 2022-23. Core funding for local government is due to increase by £177m (3.5%) in 2023-24 and £128m (2.4%) in 2024-25. Actual amounts for individual local authorities for future years won’t be known until closer to the time.

Is funding provided for a specific purpose?

The main element of funding allocated through the settlement is unhypothecated, meaning local authorities have discretion in how they spend it. However, the Minister describes pay in particular as a driver for this year’s uplift (including the staff costs associated with the UK Government’s proposed National Insurance Contributions increase).

In addition to the core revenue funding, local authorities receive Welsh Government grants that are tied to specific areas. Revenue grants total over £1bn in 2022-23, a similar level to last year (excluding COVID-19 grants).

General capital funding for local authorities is due to be set at £150m, a decrease from the £198m set out in the Final Settlement for 2021-22. In addition, the Minister outlines specific capital grants of £760m next year, with the value of some grants yet to be confirmed.

What other sources of funding are available to local authorities?

Outside of government funding, local authorities have a number of ways of generating income. One of the most significant is council tax, which has become a larger proportion of local authority expenditure in recent years. Wales Fiscal Analysis estimate that council tax funded 20.4% of revenue expenditure in 2019-20, up from 13.8% in 2009-10.

Local authorities are in the process of setting their budgets for the forthcoming financial year, so we don’t yet have a complete picture of what will happen with council tax levels across Wales. The WLGA suggests local authorities would “do all [they] can to keep council tax rises as low as possible”, but it also noted that local authorities needed to consider longer term objectives in setting council tax.

Audit Wales also reported local authorities held over £1bn of usable reserves at the end of March 2020. It found all councils had increased the amount of reserves they held at the end of 2020-21, with £450m added to overall reserves. Although it notes that using reserves to balance the budget was “unlikely to be sustainable”.

Spending pressures

A survey conducted by the Society of Welsh Treasurers estimates cost pressures of £407m next year for local authorities (just over £1bn over the three years). Within that, pay inflation is identified as the biggest pressure, closely followed by demand related pressure.

Covid related pressures of £76m are also identified. The Minister notes that the Comprehensive Spending Review did not provide additional financial support for the pandemic and that this is a concern, particularly given the emergence of Omicron, adding:

I have carefully considered how to manage pandemic support for authorities and concluded the balance lies in providing funding in the first year through the Settlement. But in determining the overall Settlement, I have recognised the ongoing impact of the pandemic on services which authorities will need to manage.

What about budgets elsewhere?

The Welsh Government’s budget includes funding for a number of other public bodies, including Police and Crime Commissioners. Similar to local government, the Welsh Government publishes a Provisional Police Settlement around the time of its draft budget and published its Final Police Settlement 2022-23 on 2 February 2022. The Welsh Government funds a proportion of police spending. The police also receive funding from the Home Office and through council tax.

A common needs-based formula, operated by the Home Office, is used to distribute funding across English and Welsh police forces. However, the Home Office has overlaid that formula with a mechanism that means police forces in England and Wales can expect to receive an increase in core funding of 5.9% for 2022-23 (before transfers).

Read our article published on 4 February to find out more about the funding in the Welsh Government’s Draft Budget.

When can I find out about the final settlement?

The Welsh Government announces the Provisional Local Government Settlement around the time it publishes its draft budget each year. The Final Budget for 2022-23 is expected on 1 March, so we’ll get a Final Settlement around then. While the figures for local government could change in the interim, the Minister suggested “all the available funding” has been allocated in the Provisional Settlement.

The Senedd will debate the Draft Budget tomorrow (8 February). The following Tuesday it will debate the Police Settlement (15 February). You can watch both live on SeneddTV.

Article by Owen Holzinger and Joe Wilkes, Senedd Research, Welsh Parliament