The Welsh Government published its Outline Draft Budget 2026-27 on 14 October 2025. This is the last draft budget of this Senedd term and also the first of this Senedd term to take place according to the two-stage process set out in the budget protocol. The Welsh Government will publish a detailed budget, which will provide information on proposals for each portfolio, on 3 November.

Business as usual

In July 2025, the Cabinet Secretary for Finance and Welsh Language (the ‘Cabinet Secretary’), Mark Drakeford MS, told Plenary he was planning a “business-as-usual” budget for 2026-27. The Welsh Government would restate the 2025-26 budget allocations in line with inflation. It would not focus on new priorities or fresh policies.

Despite the UK Government’s Spending Review in June 2025 setting out allocations for revenue spending until 2028-29 and until 2029-30 for capital investment, the Cabinet Secretary said the Welsh Government’s Draft Budget 2026-27 would cover one year.

The Outline Draft Budget for 2026-27 includes uplifts for inflation (2% applied to non-pay fiscal (or ‘revenue’) resource, general capital and Financial Transactions Capital allocations) and pay growth forecasts (2.2% applied to the public sector pay elements for each department). However, the Outline Draft Budget 2026-27 also includes other changes. For example, it allocates an additional £41.3m in fiscal revenue and £155.1m in general capital funding to departments. We’ll have to wait until the detailed budget for information about how the Welsh Government departments propose to allocate funding between expenditure lines.

The Cabinet Secretary told the Finance Committee that regarding a local government settlement, local authorities “will see a 2.5 per cent increase in their budgets, not a 2 percent as everybody else is seeing, and that the minimum uplift will be 2.3 per cent”. However, these figures are indicative and a draft settlement is due “sometime in November”.

A total of £380.2m (1.4% of the budget) remains unallocated in the Outline Draft Budget for 2026-27, which includes £230.8m of fiscal revenue funding (for day to day spending). Wales Fiscal Analysis says this may mean “significant calls for additional allocations from all directions”.

Perhaps mindful of the potential impact of not agreeing a budget, in his foreword to the Outline Draft Budget, the Cabinet Secretary said:

My door therefore remains firmly open to working with other political parties in the Senedd who share my conviction that we have a collective responsibility to pass the Welsh Budget and believe a more ambitious budget could be agreed.

Revised baselines

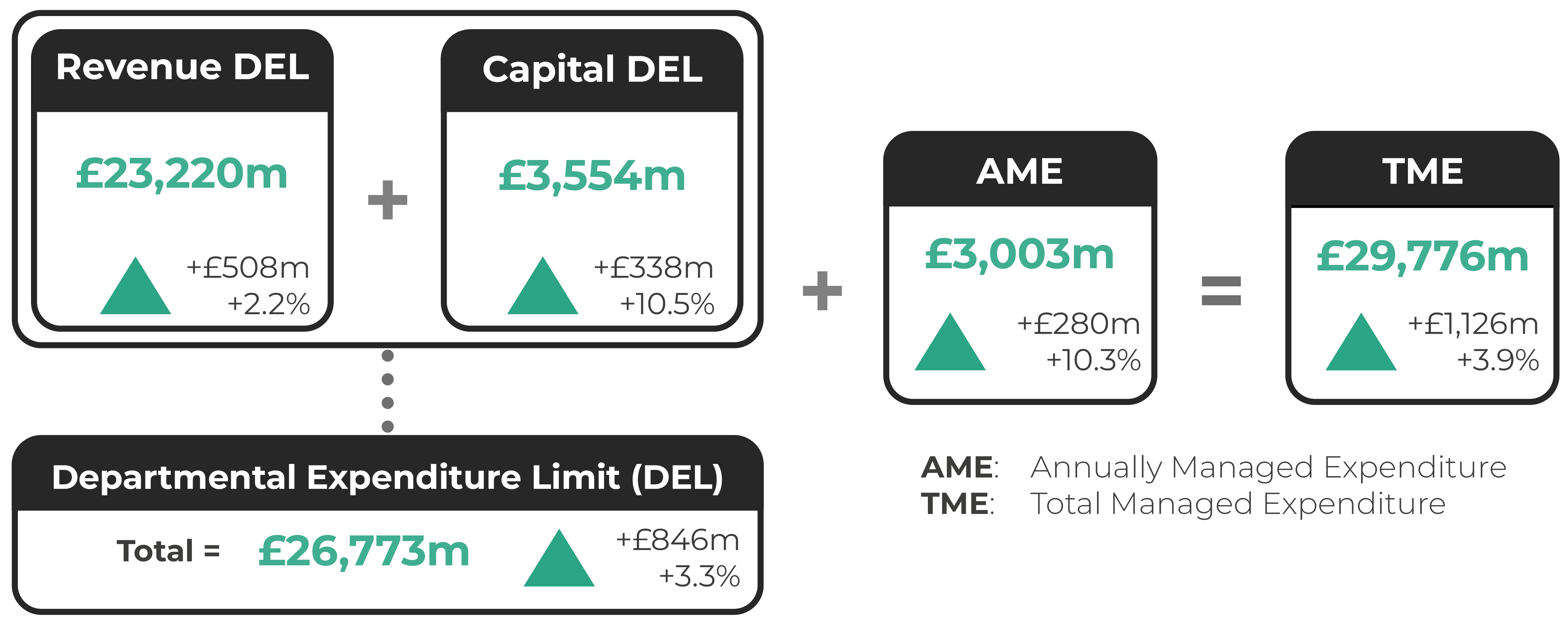

The infographic below shows the key changes between the Draft Budget 2026-27 and the Revised Baseline 2025-26 for each budget element.

Figure 1: Headline changes between the Draft Budget 2026-27 from the Revised Baseline 2025-26

The Welsh Government shows the changes in departmental allocations in its Draft Budget Explainer. However, this only shows the impact on departmental budgets of the uplifts for inflation and public sector pay for 2026-27 for fiscal revenue and general capital. Therefore, it does not set out the total allocations proposed in its Outline Draft Budget 2026-27 as the Welsh Government does not include the allocations for non-fiscal revenue and Financial Transactions Capital. Nor does it include other changes in the Outline Draft Budget 2026-27, such as the additional fiscal revenue and general capital allocations we refer to earlier.

Consistent with its approach last year, the Welsh Government compares its allocations in the Outline Draft Budget 2026-27 to a revised baseline for the current year, 2025-26.

In calculating the Revised Baseline for 2025-26, the Welsh Government has taken into account any recurrent changes made since the Final Budget 2025-26 in February. The most significant of these is £220m allocated to support public services and further education with increased Employer National Insurance Contributions costs, which the Welsh Government included in the First Supplementary Budget 2025-26. The Welsh Government’s allocation of £126m to support public sector pay in 2025-26 has also been included in the Revised Baseline for 2025-26. However, the Welsh Government has deducted from the baseline one-off funding in 2025-26 which was not “recurrent” in nature. It also deducted in entirety the allocations for Financial Transaction Capital in 2025-26. While the overall impact is an increase in the baseline for fiscal revenue of £285.8m, the baselines for general capital and Financial Transactions Capital decrease, by £170.6m and £99.1m respectively.

The impact of not agreeing a budget for 2026-27

If a Budget resolution for a financial year is not passed by the Senedd before the start of that financial year (1 April), then initially only 75% of the budget authorised to be used in the previous financial year is available.

The figure increases to 95% if a Budget resolution has not been agreed by the end of July.

However, an Annual Budget Motion can be tabled by a Welsh Minister and considered by the Senedd during the financial year to which it relates – so a budget for 2026-27 could be passed after 1 April 2026, if the Senedd had not agreed a budget by that point.

The budgets of directly funded bodies (Wales Audit Office, Public Services Ombudsman for Wales, Senedd Commission, and the Electoral Commission Wales) are also included within the annual budget motion.

In the event a budget was not agreed, these directly funded bodies, along with the Welsh Government, would only be able to access 75% / 95% of their budget until an annual budget motion was authorised.

Local authorities in Wales, which receive the majority of their funding from the Welsh Government, are legally required to set their budgets and council tax before 11 March in the financial year preceding the one to which the budget applies. This deadline ensures billing authorities can issue council tax bills in time for the start of the financial year on 1 April.

Impact on the Welsh Rate of Income Tax (‘WRIT’)

A resolution on the Welsh Rate of Income Tax (‘WRIT’) must be made before the start of the tax year, which begins on 6 April. It can only be made for one tax year and must apply to the whole of that tax year.

A Welsh rate resolution can only be considered once the Annual Budget Motion is published, but no earlier than 12 months before the start of the relevant tax year.

The Senedd cannot pass a budget until it has first agreed a Welsh rate resolution. This is based on the principle that the Senedd cannot take a decision on the spending plans contained in the Annual Budget Motion without first agreeing how the revenues to pay for those funds will be raised through taxation.

Once agreed, a Welsh rate resolution can be cancelled before the start of the tax year, but it cannot be cancelled or changed once the tax year it applies to has started, so from 6 April onwards.

If the WRIT resolution is not passed by the Senedd, the Welsh Government risks not being able to collected and use the £3.9 billion tax revenue included within the 2026-27 Draft Budget.

The next steps

Scrutiny of the Draft Budget 2026-27 is currently underway by the Finance Committee of the Senedd.

On 3 November, the Welsh Government will lay before the Senedd the Detailed Draft Budget. The Draft Budget debate is set to take place on 16 December. You can watch it live on SeneddTV.

The Welsh Government currently plans to publish a Final Budget for 2026-27 on 20 January 2026, with a vote on the Final Budget Motion on 27 January 2026.

Further information on the Draft Budget can be found on Senedd Research’s Draft Budget timeline and glossary.

Article by Božo Lugonja, Senedd Research, Welsh Parliament