The Welsh Government published its Update on 2023-24 Financial Position on 17 October 2023.

The update details how the Welsh Government has changed its spending plans for 2023-24. This article explores what is different as a result of the update and the context around why these spending reallocations have been made.

Why is this update happening now?

In December 2022 the Welsh Government’s Draft Budget 2023-24, stated that as inflation was significantly higher than forecast, the Welsh Government’s settlement could be worth “£1bn less in 2023-24 alone” in real terms. This is compared to when spending was set at the Spending Review 2021 by the UK Government.

The consumer price inflation (CPI) rate was 4.2% in October 2021, it rose to a peak of 11.1% in October 2022 and dropped to 6.7% in October 2023.

Following the announcement of the Spring Budget in March 2023, the Minister for Finance and Local Government described the 2023-24 Wales settlement as “still up to £900m lower in real terms than expected at the time of the 2021 spending review”. This is approximately equal to 4% of the total Welsh Government Budget for 2023-24.

Since this Draft Budget was published, pay agreements for many public sector workers have been offered or agreed in excess of expectations that had been budgeted for by the Welsh Government.

In a statement on 9 August the First Minister described the situation as the “toughest financial situation we have faced since devolution”, going on to confirm the Cabinet would be working over the summer to mitigate budgetary pressures.

The timing of the announcement and concerns regarding cuts to budgets have generated significant media interest.

The Welsh Government does not plan to publish a supplementary budget to give the Senedd the opportunity to see the detail and scrutinise the changes, most likely until February 2024.

How has the £900m shortfall been calculated?

The Minister described how the £900m was calculated using the Office for Budget Responsibility’s March 2023 forecast for consumer price inflation (CPI) and combined with the CPI since the 2021 spending review. This was compared to the level of inflation that was expected when the 2021 spending review was published. So, inflation is higher than planned for which has affected budget setting.

The overall £900m figure was produced by applying those figures to both the revenue and capital budgets.

In response to the Minister’s statement, Peter Fox MS said:

Challenges facing the budget due to inflationary factors should have been pre-empted far earlier. It is crucial that forward planning and contingency thinking should have been at the forefront of Government’s mind far earlier.

How has the update been prepared?

The Finance Minister confirmed that “every Ministerial portfolio was asked to make a contribution to meeting the pressures we have on a cross-government basis”.

The Welsh Government says that rather than stopping programmes entirely, savings have been made by reforecasting (due to changes in demand or uptake of services), maximising income and reprioritisation of activities.

To achieve this, the Welsh Government says Ministers have:

- maximised the use of in-year and Wales reserves (up to £100m)

- planned based on using consequentials that are expected from the UK Government as a result of increased spending in England

- requested a switch from capital to revenue from the UK Government

- made revenue and capital savings in departmental budgets

Peredur Owen Griffiths MS, Chair of the Senedd’s Finance Committee, has requested the Minister attends Finance Committee to explain timescales and decisions taken. He commented:

Since many of the savings that have been outlined here are coming from anticipated consequentials from NHS pay awards and draw-downs from the Wales reserve, both of which have been known for sometime, I’m not clear why it has taken over four months after the supplementary budget to provide this clarity.

What are the key changes?

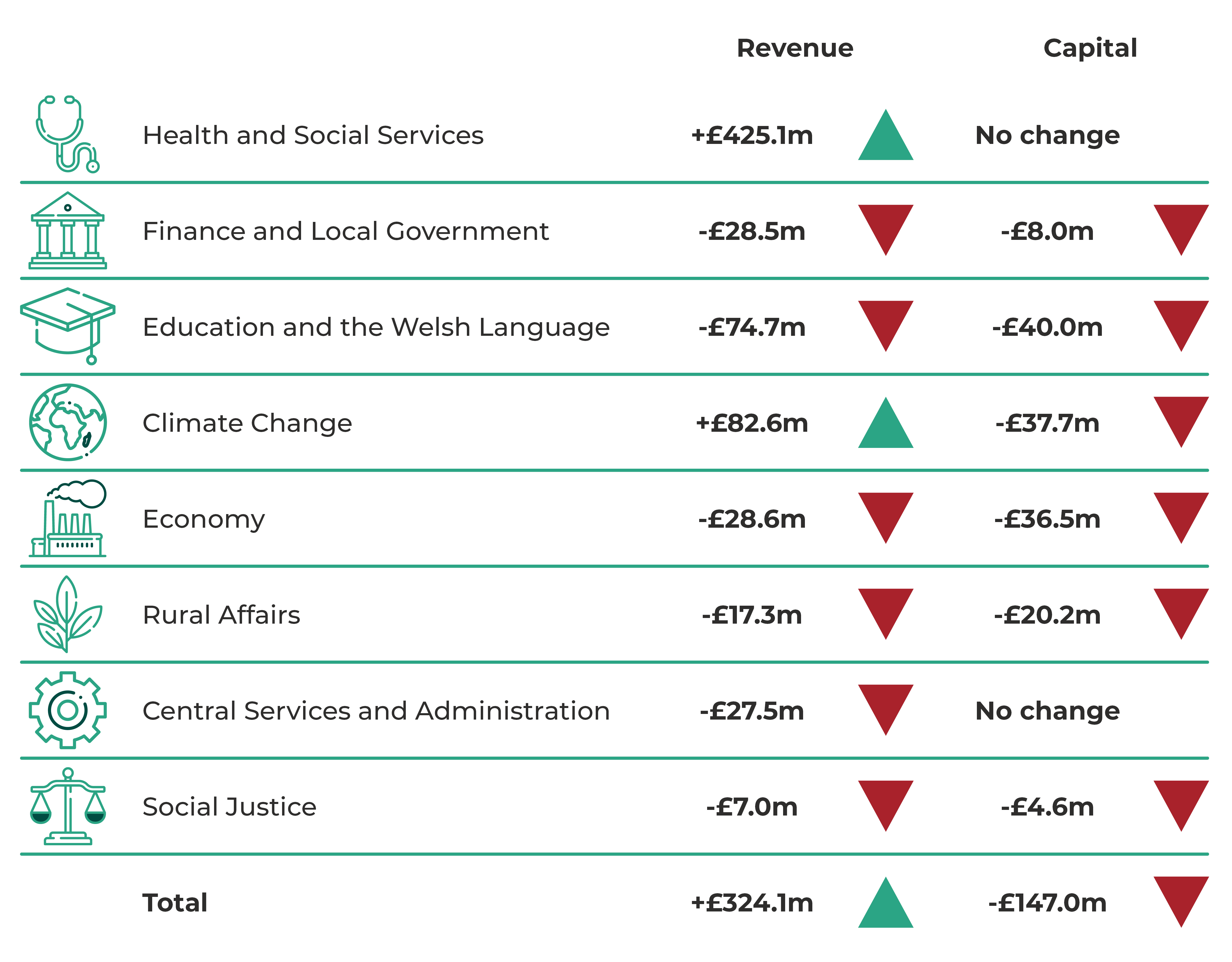

Changes are taking place in both revenue and capital budgets, headline changes are outlined in the Update on 2023-24 Financial Position.

Two departments are receiving increased funding:

- £425.1m to Health and Social Services; and

- £44.9m to Climate Change. Transport for Wales will receive an increase of £125m partly funded by re-prioritisations within the Climate Change portfolio.

All other departments will see net reductions in funding allocations.

£16.1m will be cut from the budgets supporting Early Years, Childcare and Play activities as a result of updated forecasts on take up of the Childcare Offer for Wales.

Figure 1: Headline figures from the Update on 2023-24 Financial Position

Figures are rounded.

Source: Welsh Government

Whilst the Finance and Local Government total revenue and capital budget is being reduced by £36.5m; the Revenue Support Grant (which provides core funding for local authorities) will be unchanged.

The Education and Welsh Language revenue and capital budgets will both see a reduction, with £11.5m being released from the Universal Primary Free School Meals (UPFSM) budget, £40.5m of capital from the Sustainable Communities for Learning Programme and a reduction in post-16 provision by £8.5m.

Social Justice will see a reduction of £7m in revenue, including £1.5m released through a recruitment freeze of Police Community Support Officers, and £4.6 in capital funding. A reduction of £17.3m in revenue and £20.2m in the capital budgets of Rural Affairs will largely be done through reprioritising £30m of revenue and capital from the Rural Investment Schemes.

The budget for Central Administration and Services (the budget for the running costs of the Welsh Government) will be reduced by £27.5m. The Economy budget will see a reduction of £28.6m in revenue and £36.5m in their capital budgets, which the Welsh Government says will be found as a result of revised forecasts or one off receipts (including property sales and EU income).

The Welsh Government says:

Some of the decisions arising from this approach are one-off spending decisions, but some will have implications for the next financial year. These will be worked through as we develop the 2024-25 Draft Budget.

What happens next?

Currently information has only been published showing the changes at an overall departmental level. The changes made to detailed spending plans will be published in a Second Supplementary Budget, which is likely to be laid before the Senedd in February 2024.

The Welsh Government is also due to publish the Draft Budget 2024-25 on 19 December 2023.

Article by Božo Lugonja and Joe Wilkes, Senedd Research, Welsh Parliament