The Second Supplementary Budget 2017-18 was laid by the Welsh Government on 6 February 2018. This supplementary budget amends the First Supplementary Budget 2017-18 approved by the National Assembly in July 2017. The Finance Committee published its report on Scrutiny of the Welsh Government Second Supplementary Budget 2017-2018 on 5 March.

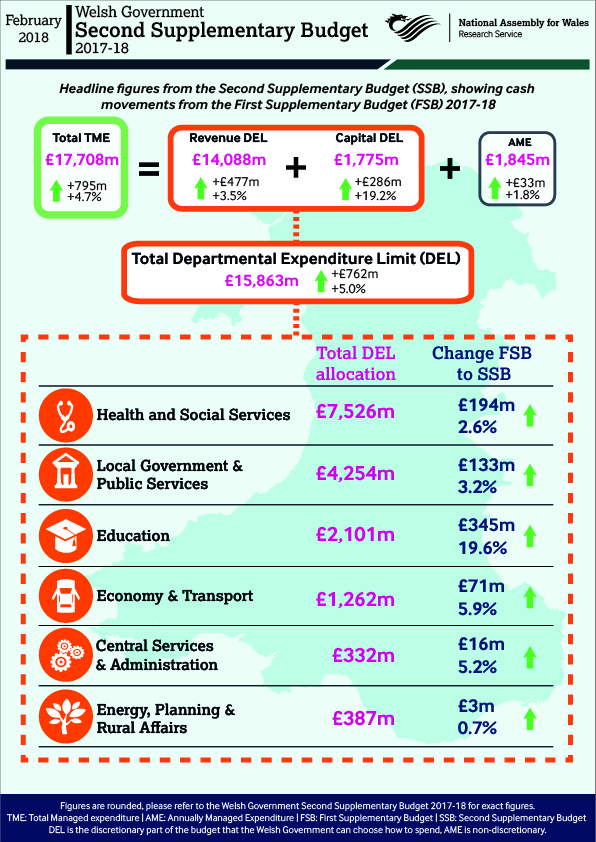

Changes in overall budget allocations, and in allocation of revenue and capital expenditure between the previous Supplementary Budget and this one, are summarised in the accompanying chart.  There are significant changes in this Supplementary Budget, including a number of allocations from reserves, switches between revenue and capital, and transfers between portfolios. It includes adjustments to the Welsh block to reflect transfers and consequentials received in the UK Government’s Autumn Budget 2017, and also changes in Annually Managed Expenditure forecasts in line with updates provided to HM Treasury.

There are significant changes in this Supplementary Budget, including a number of allocations from reserves, switches between revenue and capital, and transfers between portfolios. It includes adjustments to the Welsh block to reflect transfers and consequentials received in the UK Government’s Autumn Budget 2017, and also changes in Annually Managed Expenditure forecasts in line with updates provided to HM Treasury.

The UK Government’s Autumn Budget 2017 included £90m additional repayable financial transactions funding for 2017-18.

Documents published alongside the Supplementary Budget motion includes an Explanatory Note which provides details of:

- transfers between Departments, or Ministerial portfolios, and major transfers within Departments;

- transfers to/from UK Government;

- transfers to/from Reserves; and

- breakdowns within Departments.

The major additional funding allocated in this budget from reserves is:

- £146m Revenue and £41m Capital for Health and Social Services including: £50m NHS performance; £35m winter pressures and deficits; £30m Personal injury claims discount rate; £26m shortfall in Pharmaceutical Price Regulation Scheme; £3.8m immigration health surcharge; and £41.2m capital for the All Wales Capital Programme.

- £3.7m Revenue and £134.8m Capital for Local Government and Public Services including: £4.1m Coastal Communities Fund revenue; £49.8m affordable homes; £40m Stalled sites fund; £30m road refurbishment; £10m Help to Buy Scheme; and £5m town centre regeneration scheme.

- £16.7m Revenue and £51.6m Capital for Economy and Transport including: £7.9m Transport for Wales, £4m Public sector broadband aggregation, £3.6m Champions League ‒ all revenue; £27.8m M4 project; £13m Neptune 6; £8.7m Steel industry; and £2.1m broadband extension programme – all capital.

- £3.1m fiscal Revenue and £300m non-fiscal Revenue and £41.7m capital for Education, including: £300m non-fiscal revenue in relation to Student Loans stock and Resource Accounting and Budgeting charges. £30m for C21st Schools, £6.2m for Diamond Report recommendations delivery and £5.7m Support for Higher education sector – capital.

- £3m revenue for Energy efficiency scheme.

- £20m Revenue for Central Services and Administration, including: £4m Welsh Revenue Authority running costs; £3.8m for EU structural funds match funding; £2.1m devolved taxes; and £2m voluntary exit scheme costs.

Article by Martin Jennings and David Millett, National Assembly for Wales Research Service