The Welsh Government published its First Supplementary Budget 2021-22 (the Supplementary Budget) on 22 June 2021. This is the first Supplementary Budget since the Senedd Election 2021 and therefore the first prepared by the Welsh Government administration of the Sixth Senedd. This article summarises the key allocations contained in the Supplementary Budget.

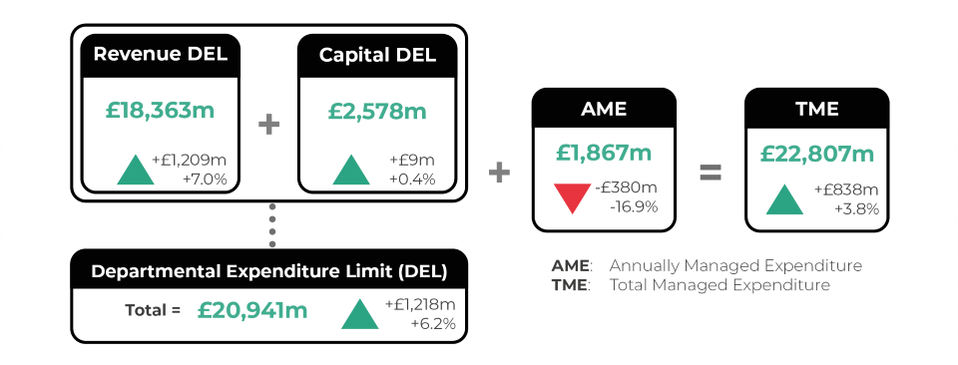

The Supplementary Budget proposes changes to the Final Budget 2021-22 (the Final Budget), which include a series of spending decisions made in the period since the Final Budget. It allocates an additional £1.2bn in revenue and capital resources to departments (or ‘Departmental Expenditure Limit’, ‘DEL’), a 6.2% increase compared to the Final Budget. For context, the First Supplementary Budget 2020-21 increased revenue and capital resources to departments by £2.5bn, an overall increase of 13.9%, as the Welsh Government grappled with the early challenges of responding to the COVID-19 crisis.

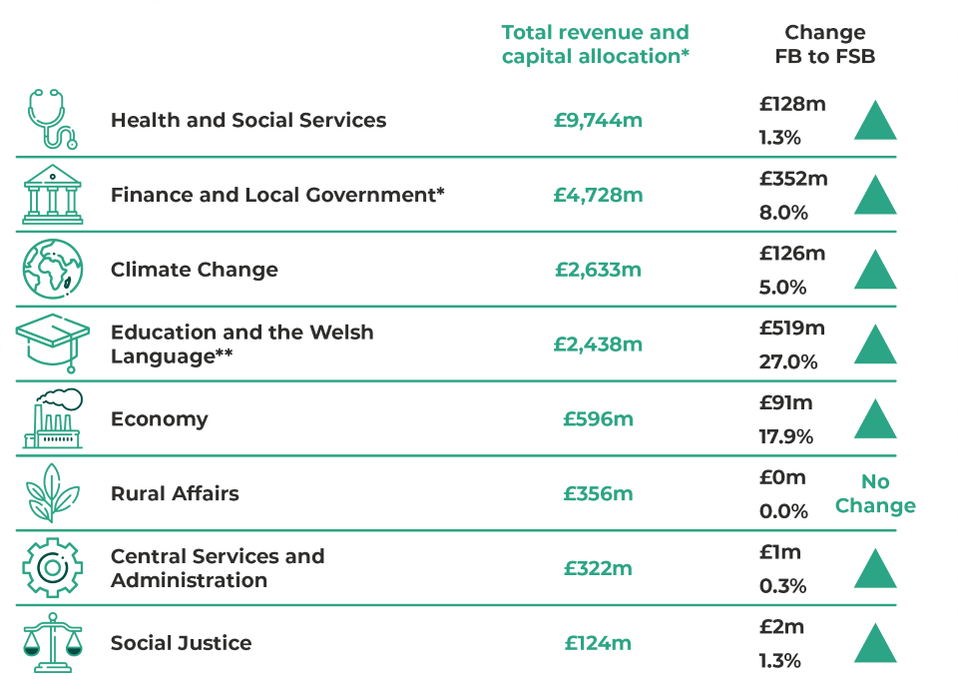

The graphic below shows the changes in departmental allocations to departments in this latest Supplementary Budget:

Headline figures from the First Supplementary Budget 2021-22, showing changes from the restated Final Budget 2021-22 (£m)

*Excludes around £700m non-domestic rates income.

**Includes allocation of £387 million of non-fiscal revenue due to student loans.

FB: Restated 2021-22 Final Budget.

FSB: 2021-22 First Supplementary Budget.

Figures are rounded. Refer to the Welsh Government Supplementary Budget 2021-22 for exact figures.

Comparisons are made with the restated Final Budget for 2021-22 which reflects the changes in ministerial portfolios following the Senedd Election 2021, announced by the Welsh Government on 13 May 2021. Further information is included at Annex 1 of the Supplementary Budget.

The largest increase in absolute and percentage terms is allocated for Education and the Welsh Language (£519.0m or 27.0%). This accounts for 42.6% of the total increase in the Supplementary Budget. Taken together, the increase for two Departments (Education and the Welsh Language, and Finance and Local Government) accounts for over 70% of the total additional resource allocated.

Allocations

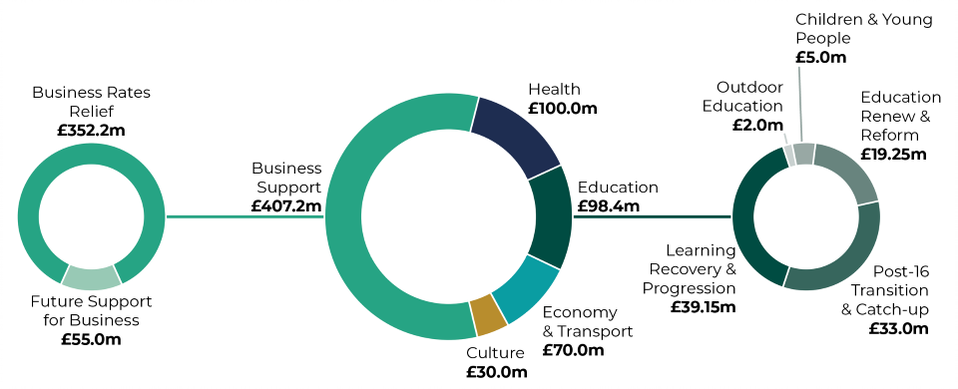

The Supplementary Budget sets out a series of key funding announcements, with £706m allocated for COVID-19 recovery, including:

- £352.2m to provide a year-long business rates holiday for retail, leisure and hospitality businesses with rateable values up to £500k and charities during 2021-22. The Welsh Government suggests this extension, along with the Small Business Rates Relief scheme, will mean that 70,000 businesses in Wales will not pay any rates in 2021-22. This is the largest fiscal allocation for a specific policy in the Supplementary Budget;

- £100.0m to help the health and care system to recover from the pandemic, with money for new equipment, more staff and new technology with the aim of improving services, boosting capacity and cutting waiting times;

- £55.0m to support businesses who remain affected by COVID-19 restrictions, such as nightclubs, events or conference venues and hospitality businesses. These businesses can apply to receive between £2,500 and £25,000;

- A series of education announcements including £39.2m for learning recovery and progression, £33.0m for post-16 transition and catch-up support for learners in colleges and sixth forms and £19.3m to support education and early year settings;

- £70.0m of revenue resources to support Transport for Wales to meet operating costs from September until the end of November, whilst “passenger numbers and fares remain uncertain”. This is in addition to the £177m allocated to support rail services during 2020-21;

- £30.0m to extend the Cultural Recovery Fund to support the culture, creative, events and heritage sectors. The Fund allocated over £60m to theatres, music venues, heritage sites, events, museum and others during 2020-21. The Fund was originally due to close on 20 April 2021. The First Minister told Plenary on 8 June 2021 that the Fund would be extended;

- £5.0m to help children and young people access sporting, cultural and play based activities and £2.0m to support residential outdoor education centres with operating costs over the summer.

COVID-19 Funding Allocations in the First Supplementary Budget 2021-22 (£m)

The Supplementary Budget also contains other allocations from Welsh Government reserves, including £26.0m to launch an International Learning Exchange Programme for Welsh learners, providing a replacement for the Erasmus+ programme. There is also £16.0m to support Cardiff Airport, comprising of £11m of revenue funding and £5m of capital, which is part of a £42.6m grant to the Airport to “restructure its operations and secure its long term viability” over the “medium term”.

An additional £387m has been allocated to Education and Welsh Language for student loans, which accounts for three-quarters of the overall increase for that Department (£519.0m). This is allocated as non-fiscal resource (sometimes called ‘non-cash’), which is ring-fenced and not available to the Welsh Government to fund its spending plans.

How has the funding position changed?

The Supplementary Budget documents a net increase of £1.39bn in fiscal resource compared to the Final Budget, largely comprised of £1.35bn in Barnett formula consequential funding, coming to the Welsh Government from UK Government’s spending decisions for England in areas that are devolved to Wales. An additional £735.3m and £614.7m of funding has been allocated as a result of announcements made in the UK Government’s Budget 2021 and its Main Supply Estimates 2021-22, respectively.

The Office for Budget Responsibility (OBR) published updated Welsh tax forecasts in June 2021, which showed increases in the forecasts for the Land Transaction Tax of £49.2m from £231.0m, an increase of 21.3%, and Landfill Disposals Tax of £1.6m from £32.7m, an increase of 4.9%. Conversely, the forecast for Non-Domestic Rates income is reduced by £379.5m from £1.1bn, a reduction of 34.5%, following the aforementioned business rates holiday announcement.

The Supplementary Budget confirms that £2.0bn is presently held unallocated by the Welsh Government in reserves. The UK Government agreed in February 2021 that the Welsh Government could carry £650m of COVID-19 funding from 2020-21 to spend in this financial year “in recognition of the exceptional circumstances and in response to calls for flexibility”. This is on top of the agreed limits within the Fiscal Framework (you can find out more about the Fiscal Framework in this Senedd Research article).

The Welsh Government reaffirms its intention to borrow the full £150m permitted by the Fiscal Framework, which restricts annual capital borrowing to that amount. This contrasts with the Third Supplementary Budget 2020-21, which confirmed, after reflecting the maximum sum permitted in its earlier budgets for 2020-21, the Welsh Government would not be drawing down any capital borrowing for that year after all. In response to criticism from opposition parties, the Welsh Government stated it was committed to pressing for increased borrowing limits and reaffirmed its commitment to borrowing the full sum available in 2021-22.

What next?

The Finance Committee will scrutinise the Minister for Finance and Local Government, Rebecca Evans MS, on 2 July 2021 and will subsequently publish its report. The Supplementary Budget will also be debated in Plenary on 13 July 2021. Both sessions will be available to watch live on SeneddTV. Further information about the impact of the Welsh Government Budgets from 2020-21 is set out in our article.

Article by Owain Davies, Senedd Research, Welsh Parliament