Introduction

UCAS publishes higher education application data throughout the year to coincide with its three main application deadlines, and every day during Clearing. This article, written on the first day of the 2019 Clearing process, presents three key early findings for the higher education sector in Wales:

- Demand to study at Welsh providers (as measured by the volume of applications) declined again in 2019 when compared to 2018 (4 per cent lower at the time of writing). This may mean a drop in student numbers at Welsh providers at the start of the 2019/20 academic year.

- Likely linked to the above, and perhaps contributing to the reduction, is the growing demand amongst applicants in Wales to study outside of Wales.

- The UK wide trend of increasing demand to study at so-called higher tariff providers, and decreasing demand for lower-tariff providers appears to be continuing. This trend may impact on providers in Wales due to the size and structure of the sector. This means any reduction in enrolments may disproportionately impact on some providers.

These findings are discussed in more detail below.

Applications to providers in Wales have fallen for the third year in a row, and so have acceptances

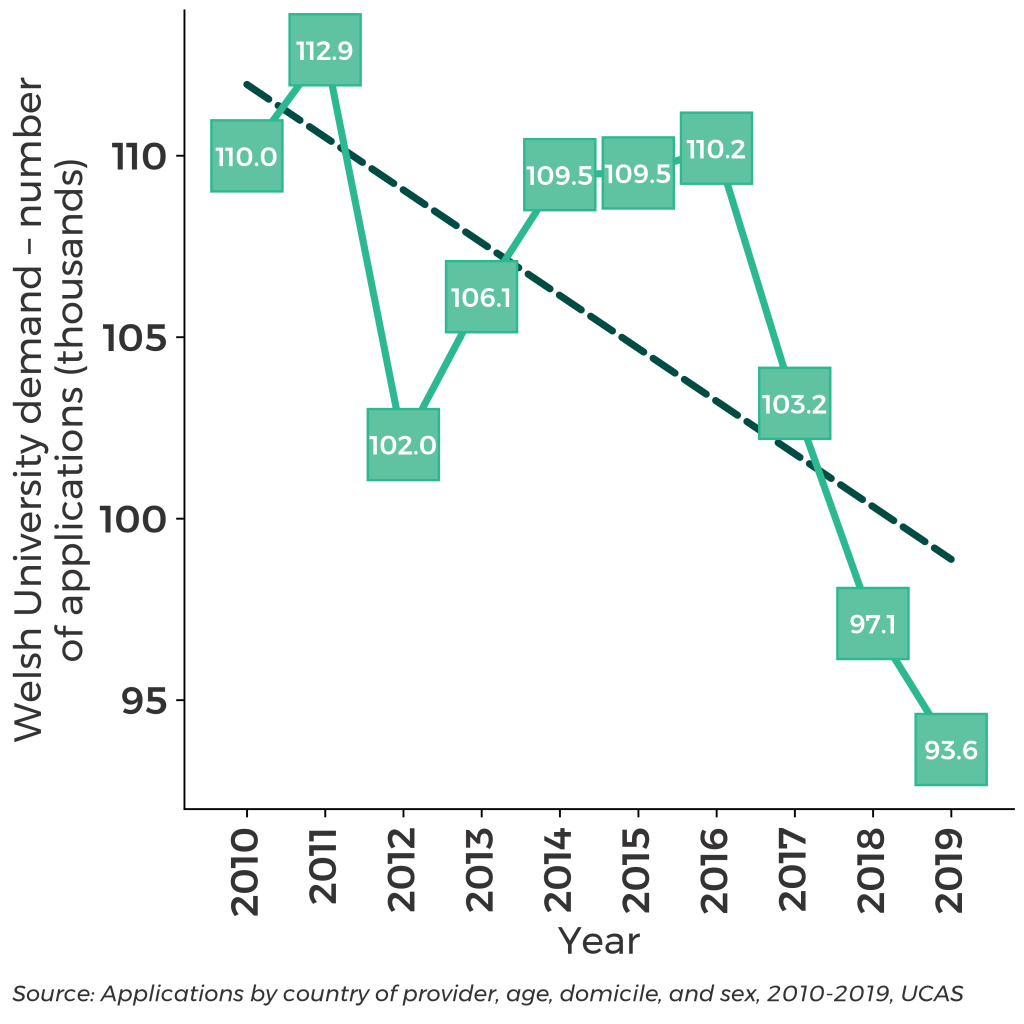

The number of applications to providers in Wales has steadily declined between 2016 and 2019 by 15 per cent, compared to an overall UK total decline of 6% for the same period.

The number of applications to Welsh universities between 2010-19 is shown below:

In the past, there has sometimes been a correlation between UCAS application volume and the number of full-time first degree enrolments in the relevant academic year.

At the time of writing, on the first day of Clearing (A-Level results day), UCAS data is indeed showing that there has so far been a 4 per cent drop in the number of people who have secured a place at a provider in Wales. This matches the 4 per cent drop in volume of applications this year.

If the correlation is repeated this academic year (and of course, there is a chance, for various reasons, that it won’t), the sector can expect slightly fewer enrolments, and potentially, slightly less full-time undergraduate fee income.

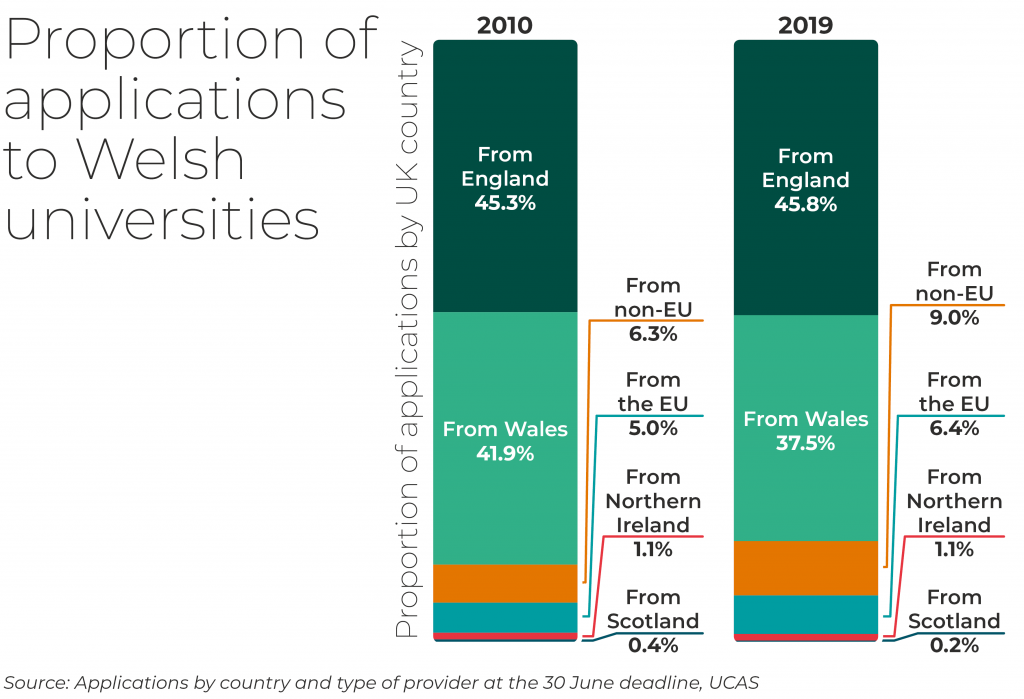

Providers in Wales benefit from cross-border demand from people in England who come to Wales to study.

The share of applications made to Welsh universities from outside Wales is shown below, as well as how this has changed since 2010:

This discussion demonstrates the high-level of uncertainty that providers in Wales must work with as they seek to set realistic / balanced budgets each year.

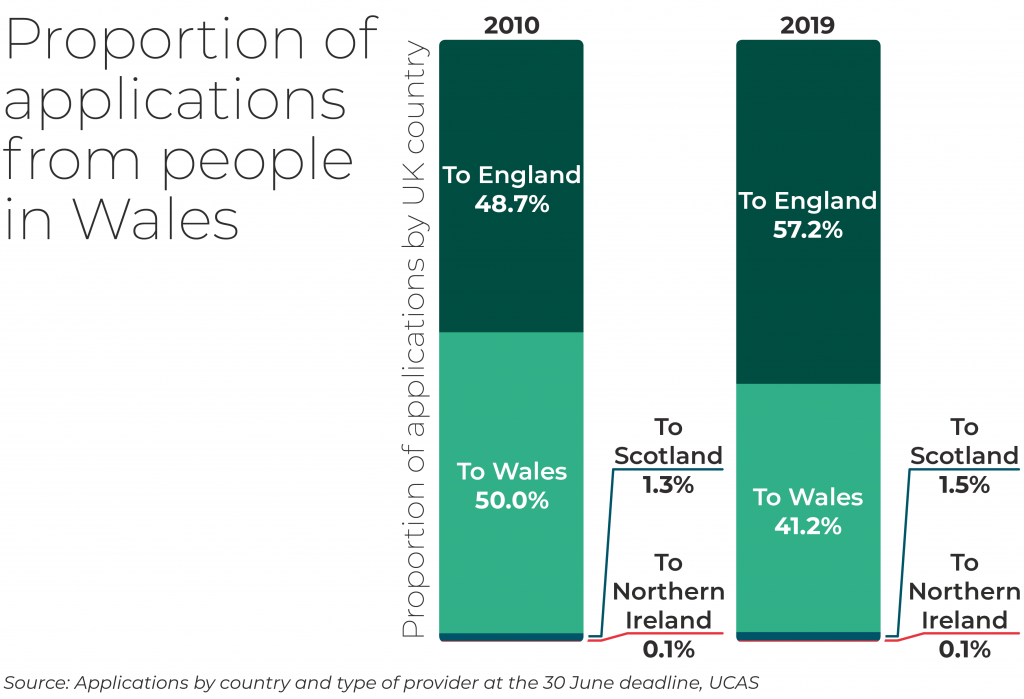

Brain Drain? An increasing proportion of applications from people in Wales are to providers in England

The diagram below shows that the share of applications by people in Wales to providers in England has increased since 2010 showing that there is a growing demand to study in England.

Again, using the very latest UCAS data on secured places available on 15 August, 45% of the total number of people in Wales with a secured university place have gained that place in England.

Some argue that this cross-border flow of students increases the financial pressure on Welsh providers since a considerable sum of fees are following students from Wales to their English providers.

Welsh Government however has stated that its policy is to support the individual student wherever they choose to study in the UK.

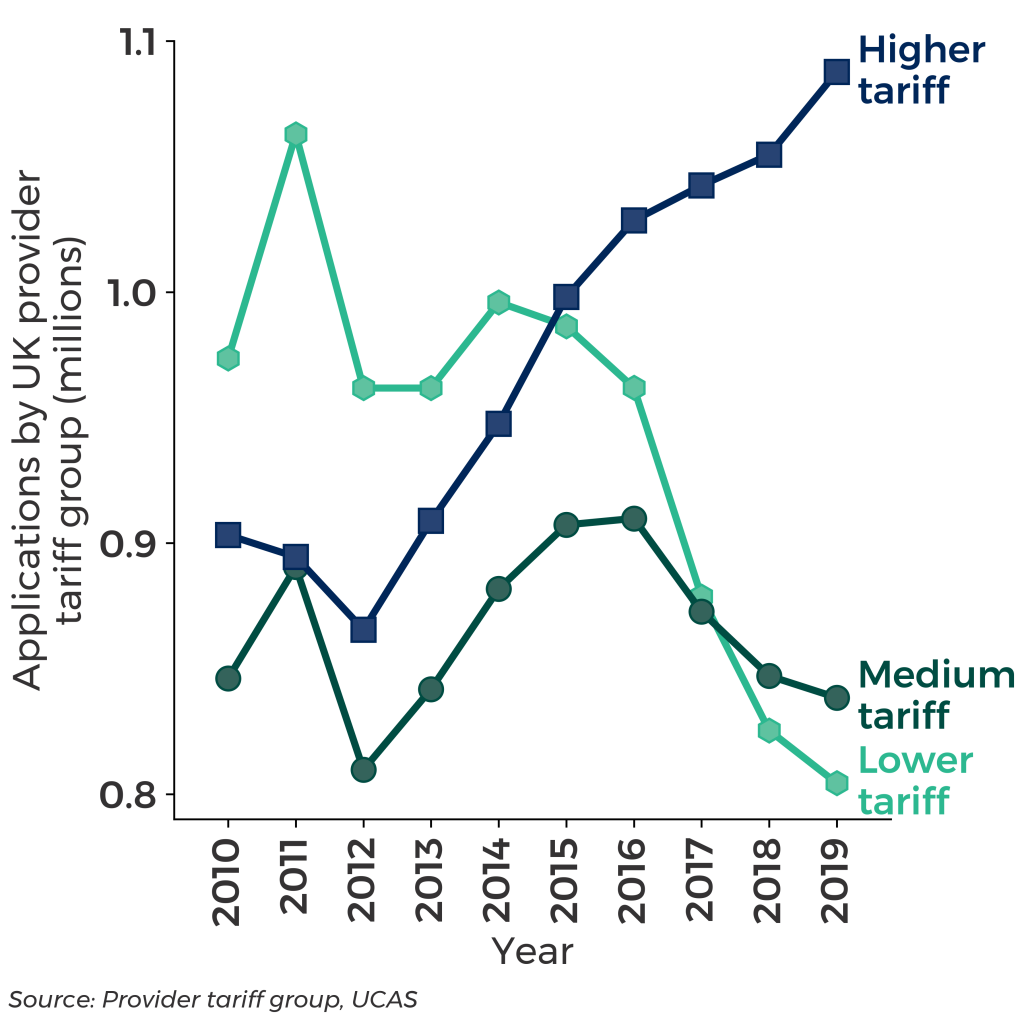

More people want to study at higher tariff providers in the UK, and fewer at low tariff providers. This might have implications for the sector.

UCAS data shows a UK-wide trend of increasing demand for study at high tariff providers, and falling demand for low tariff providers.

The chart below shows that the change has become particularly pronounced since 2015. High tariff providers are those where applicants need higher grades to secure an offer or a place.

UCAS data is showing that this pattern of demand has translated into lower-tariff providers having fewer placed applicants so far in 2019 when compared to the same time in 2010 (143,650 to 138,570), whilst medium and higher-tariff providers have increased their numbers and share over the same period.

For Welsh providers it means that the previously discussed reduction in application volume and number of secured places may disproportionately impact on a small number of Welsh providers. Until UCAS release provider level data next year, it’s not possible to draw a firm conclusion for Welsh providers, only at this stage to note the UK trend and the possibility of it being replicated in Wales.

Conclusion

UCAS application and acceptance data do not represent the whole story for the sector in Wales – there are other types of students and other sources of income. Furthermore, for various reasons, numbers might recover by the time the academic year starts and providers may be able to retain more of those who do enrol.

However, a trend of decreasing demand for study in Wales, proportionally less demand amongst people in Wales to stay and study in Wales, and a wider UK level trend regarding tariff groups, may see a reduction in full-time undergraduate recruitment in Wales for the next academic year. A fuller picture will begin to emerge after Clearing, and again in January 2020 when UCAS release data at the provider level, showing individual Welsh university data.

FOOTNOTE

UCAS data can provide an early indication of broad trends for Welsh universities and prospective undergraduate students. It is the main route into university for the overwhelming majority of UK full-time undergraduate students. However, it should be interpreted with care for the following reasons:

- Most Scottish students are not included in the UCAS data;

- UCAS data does not include large numbers of EU and international students;

- Nor does it include postgraduate and research students who apply outside the UCAS scheme.

- Application figures and placement data does not necessarily reflect final enrolment figures as for various reasons some successful applicants will defer or not take up their place

Article by Phil Boshier, Sara Moran & Joe Wilkes, Senedd Research, National Assembly for Wales