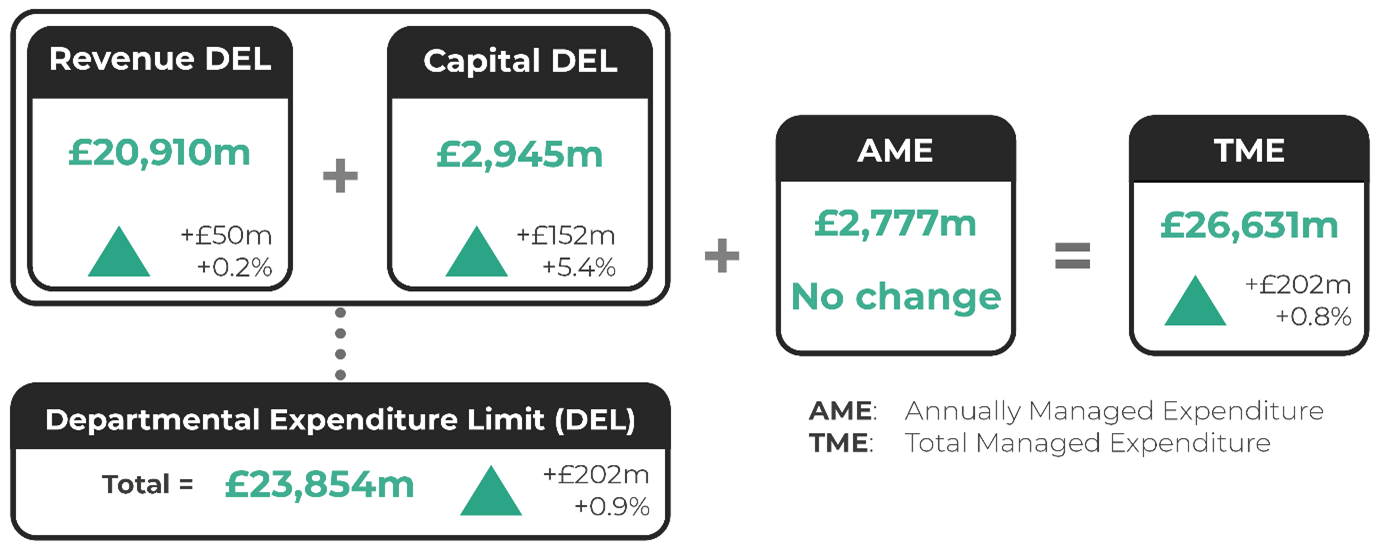

The Welsh Government’s Budget for next year sets out how it will use around £27bn to fund health, local government and a multitude of other services.

With the Draft Budget published back in December, the Final Budget Debate on 5 March represents the end of the process for setting the Welsh Government’s budget. The Minister for Finance and Local Government (“the Minister") referred to the 2024-25 Draft Budget process as involving “the starkest and most painful” decisions since devolution.

In this article we explore the changes between the Draft and Final Budget. You can read more about the Welsh Government’s Draft Budget in our article that explores five things we learnt during this year’s scrutiny.

The Final Budget 2024-25

Following scrutiny and debate of the Draft Budget, the Welsh Government published the Final Budget on 27 February 2024.

In her written statement, the Minister for Finance and Local Government noted:

The Final Budget 2024-25 builds on the spending plans we have already set out in the Draft Budget by announcing additional resource and capital allocations and a number of administrative changes.

What further funding has Welsh Government received?

The Welsh Government received further Barnett consequential funding allocations from the UK Government as part of the UK Supplementary Estimates process. The Minister noted the consequentials were confirmed late in the financial year

This information [funding consequentials] has come through very late in the year. At £231 million, the additional revenue represents around two-thirds of our reserve capacity.

Funding allocations include an additional £231m in resource and £8m in general capital funding, with a reduction of £38m to Financial Transactions (FT) capital.

However, the Welsh Government received confirmation from HM Treasury of an additional £107m FT capital for 2024-25, giving a total of £133.2m. Of the FT capital £31.8m was allocated in the Draft Budget, and £66.5m in the Final Budget.

It also received a £25m resource consequential arising from the Department for Levelling Up, Housing and Communities’ announcement of additional funding for the English Local Government settlement. This related to pressures in social care. On 7 February, the Finance Minister published a Written Statement setting out that this funding would be used to support local government in Wales.

£10.6m will be used to reverse the decision to reduce the social workforce grant made in the draft budget for 2024-25. The remaining £14.4m will be allocated to the Revenue Support Grant as part of the Settlement to support pressures in both social care and education, including teachers’ pay.

Other allocations made in the Final Budget include:

- £10m for apprenticeship and employability programmes in response to possible Tata redundancies

- £40m of new capital funding to support the NHS;

- £30m for Holyhead Breakwater; and

- £20m to help small and medium-sized businesses future-proof their businesses.

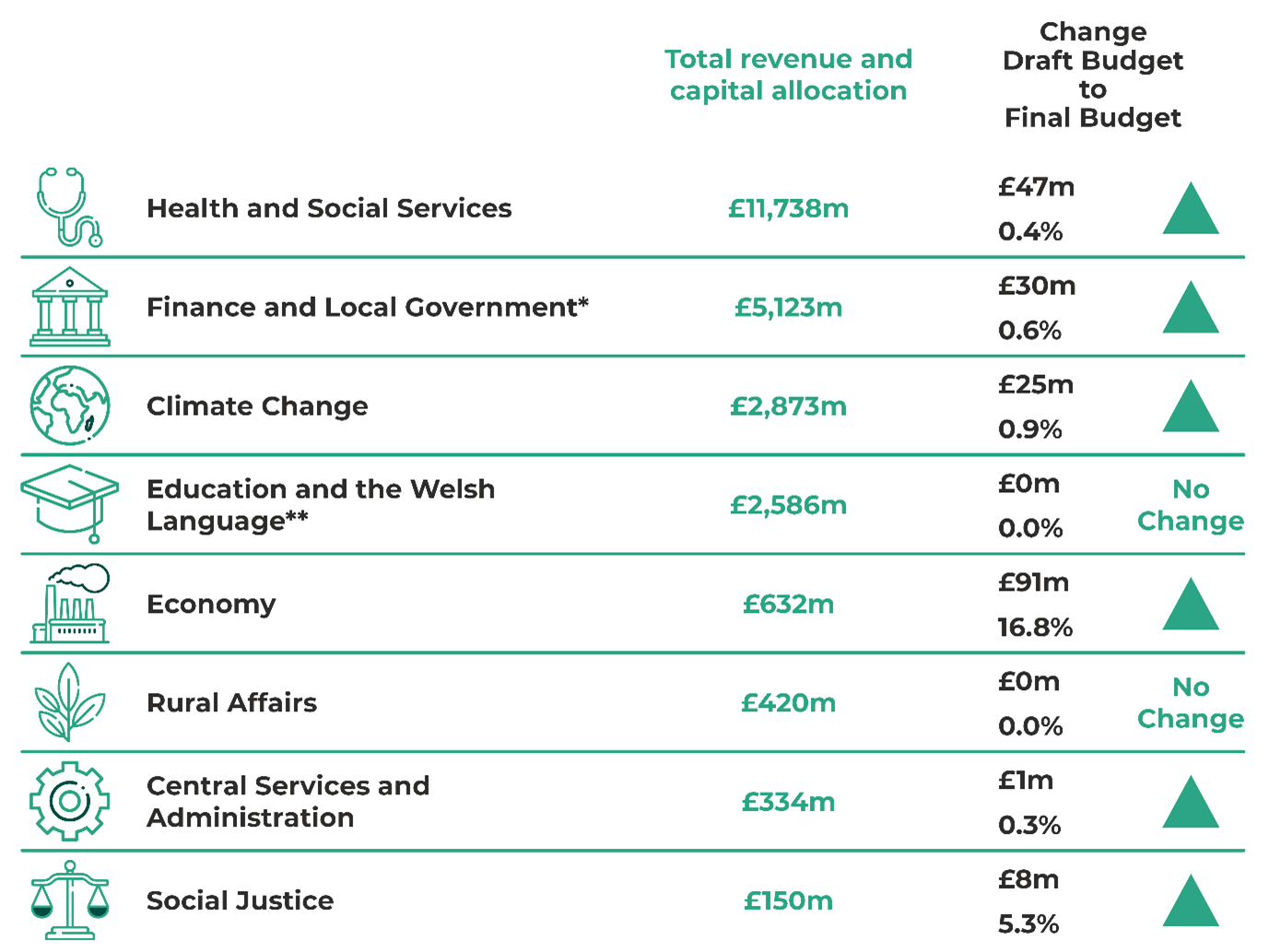

The key allocations by government department and how these have changed from the Draft Budget 2024-25 are summarised below.

Welsh Government Final Budget 2024-25 Allocations

Changes between the Departmental Expenditure Limits in the Final Budget 2024-25, from the Draft Budget 2024-25

* Excludes around £1.1 billion non-domestic rates income.

** Includes allocation of £514 million of non-fiscal revenue due to student loans.

Figures are rounded. Refer to the Welsh Government Final Budget 2024-25 for exact figures.

Welsh Rates of Income Tax

Alongside the debate on the Final Budget itself, there will be a debate to set the Welsh Rates of Income Tax (WRIT). The Welsh Government isn’t intending to change WRIT for 2024-25, which will keep WRIT at 10p for basic, higher and additional rates

This means taxpayers living in both Wales and England will continue to pay the same amount of income tax.

Confirmation of funding for local government

During scrutiny of the Draft Budget, local authority leaders suggested the funding in the Provisional Settlement for 2024-25 might not be enough to protect services. Alongside the Final Budget, we also got the final funding levels for local government. This follows a consultation on the Provisional Local Government Settlement, which was published in December.

The additional £14.4m for the Revenue Support Grant means the total core revenue funding, adjusted for transfers, will increase by 3.3% compared to 2023-24, rather than the 3.1% outlined at the Provisional Settlement. The 22 local authorities will therefore receive a share of £5.72bn in Revenue Support Grant and non-domestic rates.

The changes between the Provisional and Final Settlements also mean no local authority will receive less than a 2.3% increase in core revenue funding, up from 2.0% at the Provisional Settlement.

The Final Settlement also provides information on general capital funding, which remains unchanged. It also outlines further details of the over £1.3bn revenue and £956m capital grants available to local authorities.

Responding to the announcement around the additional consequential funding, the Leader of the WLGA said local authorities still face a £432m funding gap. He suggested “extremely difficult decisions will still need to be taken including raising Council Tax rates and around service provision”.

Not quite the final word on funding for 2024-25

While this might be the Welsh Government’s ‘Final’ Budget, it’s not the last we’ll hear on funding and budgets for 2024-25. In fact, the UK Government will publish its Spring Budget the day after the Senedd debates the Welsh Government’s Final Budget.

Announcements at Westminster could have an impact on the funding available to the Welsh Government in 2024-25. The Minister intends to make a statement as early as possible following the Spring Budget, which will provide an update on forecasts and details of any funding consequentials for Wales. However, it’s likely that we won’t see the details of any subsequent allocations until the First Supplementary Budget (which is normally in June).

The 5 March is a significant day for Welsh finances, with the Senedd due to debate the Final Budget, the Welsh Rates of Income Tax and the Local Government Settlement. You can tune in and watch all the debates on Senedd tv, check the transcript afterwards and follow Senedd Research on ‘X’ (formerly Twitter) for the latest articles exploring the budget and more.

Article by Christian Tipples, Owen Holzinger, and Joe Wilkes, Senedd Research, Welsh Parliament