The Welsh Government says the decisions made in the Draft Budget 2024-25 have been the “starkest and most painful since devolution”. Ahead of the Committees publishing their reports, this article sets out five things we’ve learnt during the scrutiny sessions.

Overview of the Draft Budget

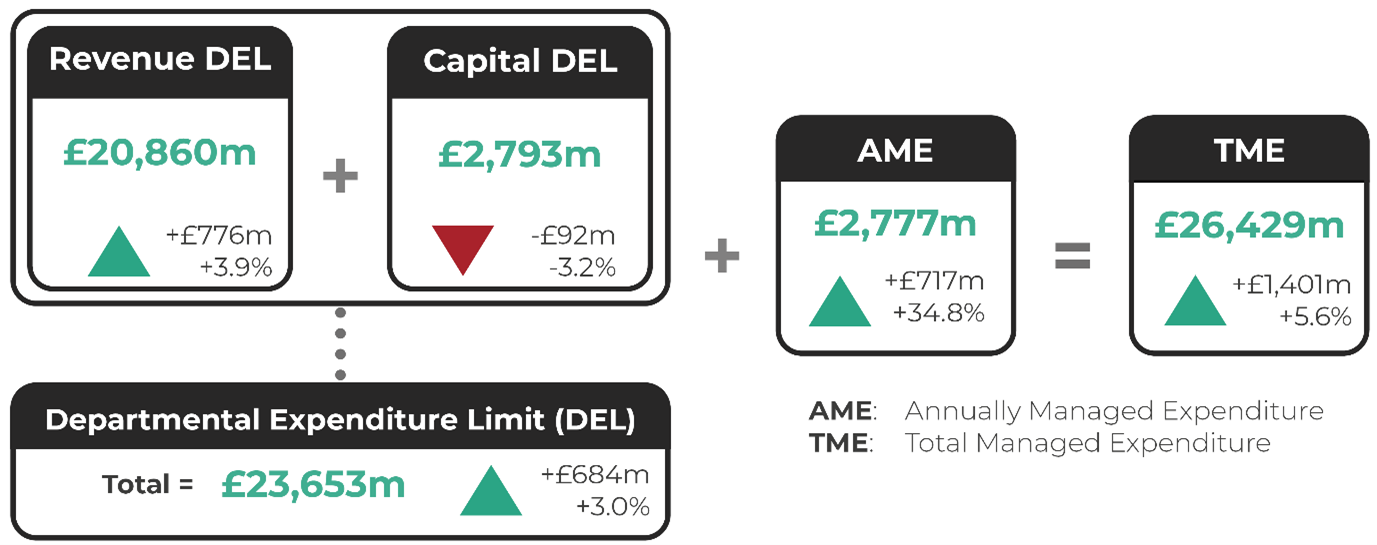

The total Welsh Government budget for 2024-25 is over £26.4bn (see Figure 1, below). Of this, £20.9bn is allocated to Welsh Government departments for day-to-day spending.

Figure 1. Welsh Government Draft Budget 2024-25 Allocations

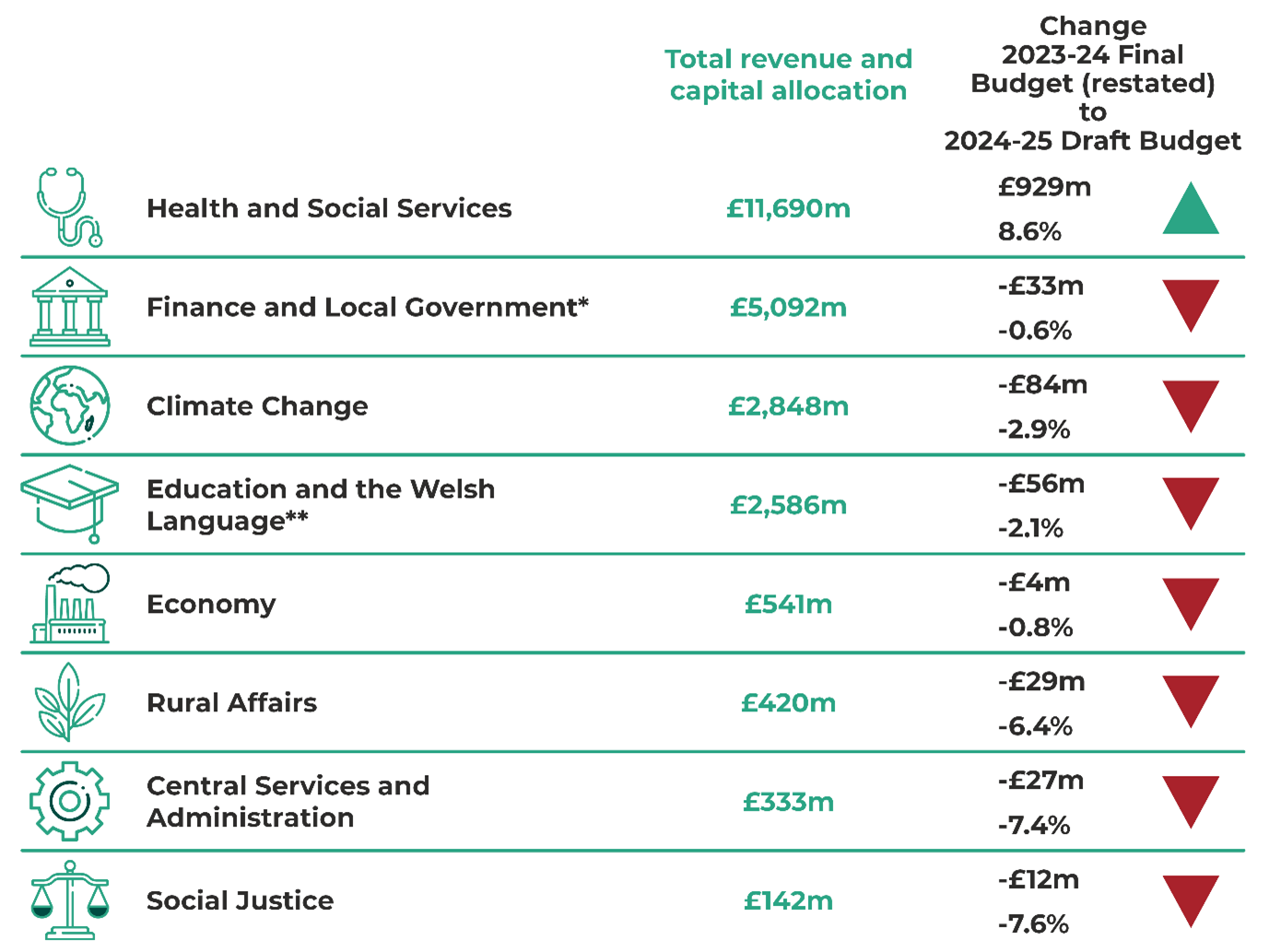

The largest total increase for 2024-25 in value terms, compared with the restated Final Budget 2023-24, is for the Health and Social Services department (£929m, see Figure 2 below), which will receive 49% of the total amount allocated for spending within the Welsh Government’s control in 2024-25. Funding in all other departments sees a comparative decrease.

Figure 2. Draft Budget 2024-25 spend by Department

* Excludes around £1.1 billion non-domestic rates income.

** Includes allocation of £514 million of non-fiscal revenue due to student loans.

Figures are rounded. Refer to the Welsh Government Draft Budget 2024-25 for exact figures.

1. Is this a “radically reshaped” budget?

The higher than expected inflation over the past two years, has eroded the value of the Welsh Government's budget for 2024-25. The Welsh Government says this budget has been “radically reshaped” to focus on more investment into the NHS and protecting the core local government settlement.

The NHS will receive £450m in additional funding to the £425m made available in October for 2023-24. The local government settlement will be 3.1% higher than last year, with a total core funding contribution of £5.7bn. There is also additional funding for Transport for Wales of £111 million in addition to existing plans for 2024-25.

Capital budgets see the largest real term reductions. It is unclear how this will impact on delivery of existing plans. The Draft Budget states that the majority of allocations for general capital will remain static and that a “full update on capital mapping will be provided at the Final Budget”.

2. If “difficult decisions” have been made, what are the outcomes?

Questions about whether increased funding will improve outcomes in the NHS have been raised. The Wales Fiscal Analysis, has mentioned that while health spending had increased by about 13% in real terms from 2019-20, activity rates had not grown by as much.

The Finance Committee has previously recommended the Welsh Government provide information about the outcomes it expected NHS Wales to deliver for additional funding allocated. A range of information was provided by the Welsh Government in response, however it didn’t include quantified outcomes.

The Wales Fiscal Analysis has highlighted four other UK rail operators who have recorded more journeys than before the pandemic by March 2023 and questioned whether the additional rail funding is sustainable in the medium term.

Similarly, concerns have been raised regarding the lack of information quantifying the impact on the delivery of services in areas where funding has been not been “protected”.

3. Local authorities may not to be able to protect key services

The local government settlement was highlighted as a priority area by the Welsh Government in the Draft Budget 2024-25.

Local authority leaders have raised concerns that the 3.1% increase in the local government settlement will not be enough to protect services, including non-statutory services. Pay and service delivery costs for local authorities have risen considerably following public sector pay awards that were far higher than budgeted in 2023-24 and given real living wages will rise again by almost 10% in April 2024.

The Welsh Local Government Association (WLGA) told the Finance Committee the uplift in funding for 2024-25 “only amounts to around a third of the pressure facing local services” which may lead to “difficult choices, job losses and service cuts”.

There are also significant concerns for the social care sector. The WLGA said:

the level of protection that has been afforded to social services to date will not be possible for much longer putting councils’ ability to successfully deliver social care services at risk in future years

4. The cost of living is still a major cause for concern

The Welsh Chief Economist’s Report says:

High and prolonged inflation has eroded living standards, with high energy and food prices disproportionately affecting people on low incomes and other disadvantaged groups

According to the Office for Budget Responsibility (OBR), inflation is not predicted to return to its 2% target until the first half of 2025. Living standards are forecast to be 3.5% lower in 2024-25 than their pre-pandemic level.

In giving evidence to the Finance Committee the Bevan Foundation welcomed the discretionary assistance fund being maintained at £38.5 million in the Draft Budget, but highlighted disappointment at the halt to free school meals in holidays and the winter fuel support scheme.

The Welsh Women’s Budget Group/Women’s Equality Network (WWBG/WEN) said:

[…] we're not seeing an easing of these pressures. Women in Wales continue to be hit harder by the impacts of the cost-of-living crisis, and this is to do with their unequal position in the labour market.

The Bevan Foundation said it was “hard to see” the impact of the Wales Expert Group on the cost of living crisis (of which it is a member), on how the Welsh Government has set its spending priorities for this Draft Budget.

While, the Welsh Government has the power to vary the income tax by 10p in every £1 of income for each band, it has decided to not increase the rate due to the cost of living that “people are still experiencing”. Our income tax tool shows how much tax you pay, or would pay, the Welsh and UK Governments.

5. There is a “dire need for affordable childcare”

The Welsh Government says that, based on the latest forecast for demand, it is reprioritising £11.2 million of its childcare offer and £7 million from the Children and Communities Grant, which supports early intervention and prevention activities for children, young people and their families.

The WWBG/WEN said there is a “dire need for affordable childcare” and highlighted the limitations both in terms of eligibility and suggested that “people aren't able to get childcare at the times and places where they effectively need it”.

The Wales Fiscal Analysis agreed this may be impacting demand rather than an “actual shortfall”.

What’s next?

Monday (5 February 2024) is the deadline for Committees to publish their budget reports, which will be available on the Senedd’s website. The Draft Budget will then be debated in Plenary on 6 February, which will available to watch live on Senedd TV.

The Welsh Government will publish its Final Budget 2023-24 on 27 February 2024. For more information in addition to this article, see our interactive tool on the Draft Budget 2024-25.

Article by Božo Lugonja and Joe Wilkes, Senedd Research, Welsh Parliament