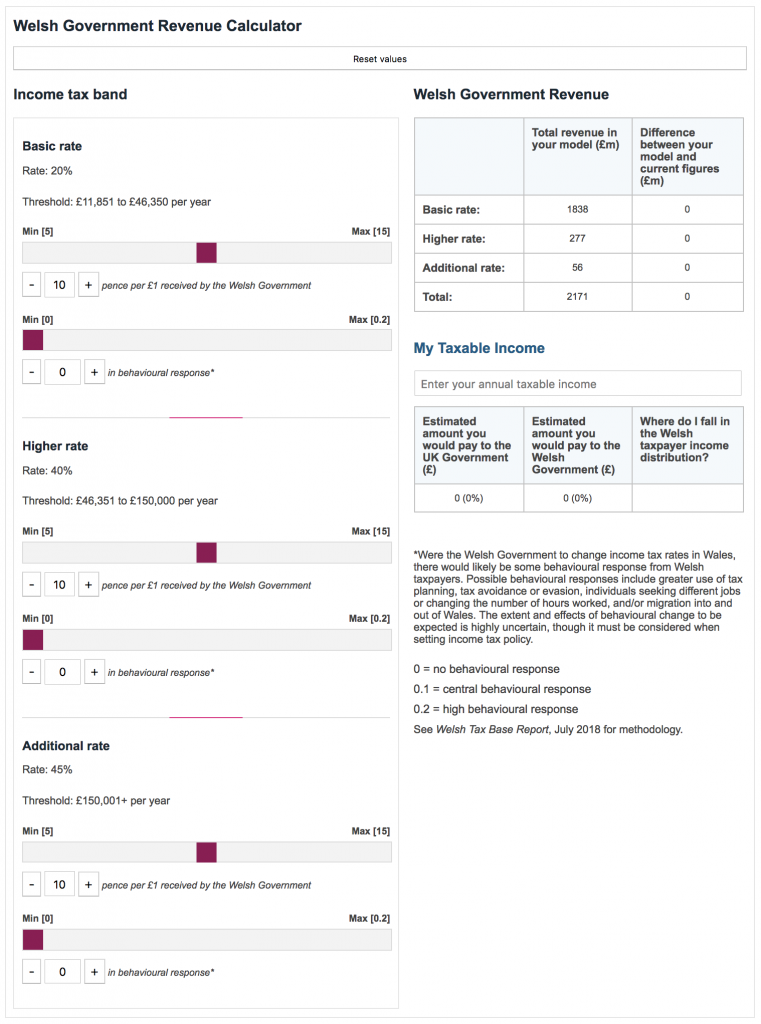

From 6 April 2019, income tax rates paid on non-savings, non-dividend (‘NSND’) income by Welsh taxpayers will fall by 10p in the pound and will be replaced by the Welsh Rates of Income Tax. Keeping tax rates paid by Welsh taxpayers unchanged by setting a 10p rate in each band is forecasted to raise over £2 billion for the Welsh Government in 2019-20. This model has been produced in partnership with the Welsh Governance Centre at Cardiff University, using modelling from the Wales Centre for Public Policy’s report: The Welsh Tax Base, July 2018. Adjust the sliders to vary the income tax rates and behavioural changes and see the effects on the Welsh Government's income tax revenue. Enter your annual taxable income (excluding any allowances) to see how much you could be paying towards the Welsh and UK Governments and where you lie in the Welsh income distribution.

Article by Martin Jennings and Joel Dyer National Assembly for Wales Research Service