Article by Owen Holzinger and David Millett, National Assembly for Wales Research Service

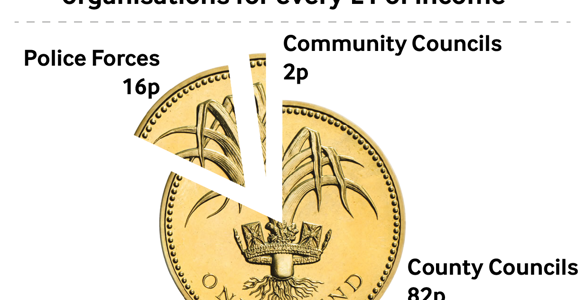

On Thursday the Welsh Government released its annual statistical release on Council tax levels, this follows local authorities and Police and Crime Commissioners setting their budgets for 2016-17 prior to the 11 March deadline. The release collates changes to council tax across Wales and breaks down its constituent elements. Council tax is usually compared through an average price paid for band D properties throughout local authorities, police and community councils. In 2015-16 average band D council tax for Wales was £1,328, a 4.1% rise on the previous year. 2016-17 will again see a rise to £1,374, representing an increase of 3.5% or £47. The council tax charge is made up of three elements, each can be changed independently of the others. The organisations that receive income from council tax are listed in the below chart, along with the proportion they receive from every pound of council tax collected:

Council tax across Wales

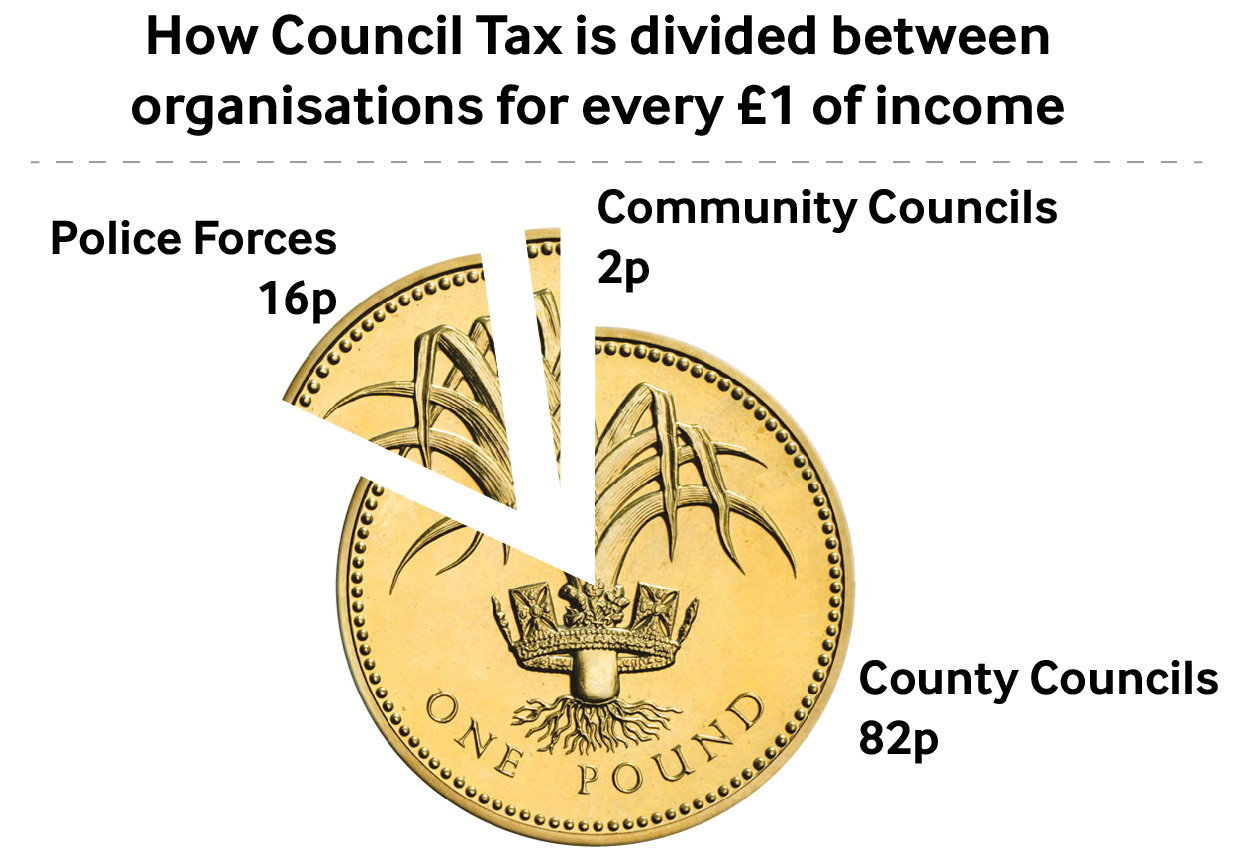

Council tax makes up around 25% of funding for local authorities and over 40% of funding for police, as such it is a significant consideration during the budget setting process. Last year saw all local authorities and three of the four Police and Crime Commissioners raise council tax. There is a similar picture this year, with one authority (Dyfed Powys Police) freezing its council tax level and all others increasing their rate. The local authorities of Ceredigion, Conwy and Pembrokeshire have the highest increases of 5.0% and Caerphilly the lowest at 1.0% (excluding community councils).  Council tax is controlled and set by local authorities leading to a range of charges for each band across Wales, each authority will also have different proportions of dwellings in each band, and both factors have an impact on the average band D value. Pembrokeshire currently charges the lowest average band D rate at £1,071 and Blaenau Gwent the highest at £1,695 a difference of £624. Since 1996-97 Welsh council tax for an average band D property has risen by £912 (this does not take into account inflation). Based on the per dwelling charge Caerphilly has the lowest rate (£958) and Monmouthshire the highest (£1,573). Taking into consideration the total variations in local authority, police and community councils the highest overall percentage increase is in Conwy (4.4%) with the highest overall cash increase in Blaenau Gwent (£60). At the other end of the scale Caerphilly has the lowest overall percentage increase (1.5%) and Denbighshire has the lowest overall cash increase (£22).

Council tax is controlled and set by local authorities leading to a range of charges for each band across Wales, each authority will also have different proportions of dwellings in each band, and both factors have an impact on the average band D value. Pembrokeshire currently charges the lowest average band D rate at £1,071 and Blaenau Gwent the highest at £1,695 a difference of £624. Since 1996-97 Welsh council tax for an average band D property has risen by £912 (this does not take into account inflation). Based on the per dwelling charge Caerphilly has the lowest rate (£958) and Monmouthshire the highest (£1,573). Taking into consideration the total variations in local authority, police and community councils the highest overall percentage increase is in Conwy (4.4%) with the highest overall cash increase in Blaenau Gwent (£60). At the other end of the scale Caerphilly has the lowest overall percentage increase (1.5%) and Denbighshire has the lowest overall cash increase (£22).

Comparisons and limitations

The Department for Communities and Local Government is due to release information for English local authorities on 31 March 2016. There has been no announcement that the freeze grant offered in previous years will be available in 2016-17. Information from the Chartered Institute of Public Finance and Accountancy in the Welsh Government release estimate an average council tax rise in England of 3.1%. The cost of an average band D property in England for 2016-17 is estimated to be £1,530, around 10% higher than the Welsh average. In England the Localism Act 2011 stipulates that where Local Government raises Council Tax 2% or above it must hold a referendum on the matter, this is not the case in Wales. The Chancellor is also allowing English local authorities that provide adult social care the option of (up to) an additional 2% precept increase. In Wales the Local Government Finance Act (1999) allows the Welsh Assembly to cap rises deemed “excessive”. In recent years an increase by local authorities of over 5% has informally been seen as the threshold that could trigger ministerial intervention. Council tax bands are allocated based on the value of properties, in Wales a re-valuation exercise was undertaken in 2003, this means bands reflect the value of properties as of 1 April 2003. In England and Scotland there has been no such re-valuation exercise and so bands are based on the value of property as of 1 April 1991. There is a process for challenging council tax banding through the Government and Valuation Office Agency.

Reductions, exemptions and premiums

Council Tax Benefit was abolished in 2013 and replaced by the Council Tax Reduction Scheme. The new regulations are closely based on the council tax benefit rules but allows local authorities a few small areas of local discretion. It is also possible to be exempt from paying council tax all together, for example, if all people living in a house are full-time students. The Welsh Government conducts a council tax dwellings survey every year to understand the number of council tax eligible properties for the next period. The data collection shows us that for 2016-17 there will be approximately 56,909 exemptions out of approximately 1,358,980 dwellings (4%). As well as the possibility of exemption, in some situations it is also possible to pay a premium on top of the standard council tax rate. Legislation has recently been passed which allows second homes to be charged a premium of up to 100% council tax. The Housing (Wales) Act 2014 comes into force in April 2016 and gives local authorities the power to introduce a charge to homes that are not a person’s sole or main residence. Isle of Anglesey County Council has agreed a 25% premium and Pembrokeshire Council a 50% premium. Further statistical information regarding council tax can be found on the Welsh Government statistical website StatsWales