From 1 April business rates payers may see a change in the amount they are charged.

In this article we take a look at the revaluation process, what we know about the changes and the support the Welsh Government intends to make available to ratepayers.

What is a revaluation?

Business rates, also referred to as non-domestic rates, are a tax levied against most property used for non-domestic purposes. They’re calculated using the ‘rateable value’ of a property, which is broadly based on the property’s annual rental value. A revaluation is an update of the rateable values of all business, and other non-domestic property, at a particular point in time.

The next revaluation comes into force on 1 April 2023, based on rateable values at 1 April 2021. Non-domestic property across the UK is being revalued along the same timescales. In Wales and England, the revaluation is undertaken by the Valuation Office Agency (VOA). The VOA says revaluations “maintain fairness in the system” and that they:

…help to redistribute the total amount payable in business rates. They are not carried out to generate extra revenue.

Revaluations have been scheduled every five years. However, in August 2020, the Welsh Government postponed the planned revaluation, meaning there’s been a slightly longer gap between it and the previous one, which happened in 2017 (based on rateable values from 1 April 2015).

The Welsh Government says it did this so “the rateable values on which rates bills are based will better reflect the impact of COVID-19”. It also meant the revaluation would happen at the same time as England. The revaluation therefore reflects changes in value between 2015 and 2021.

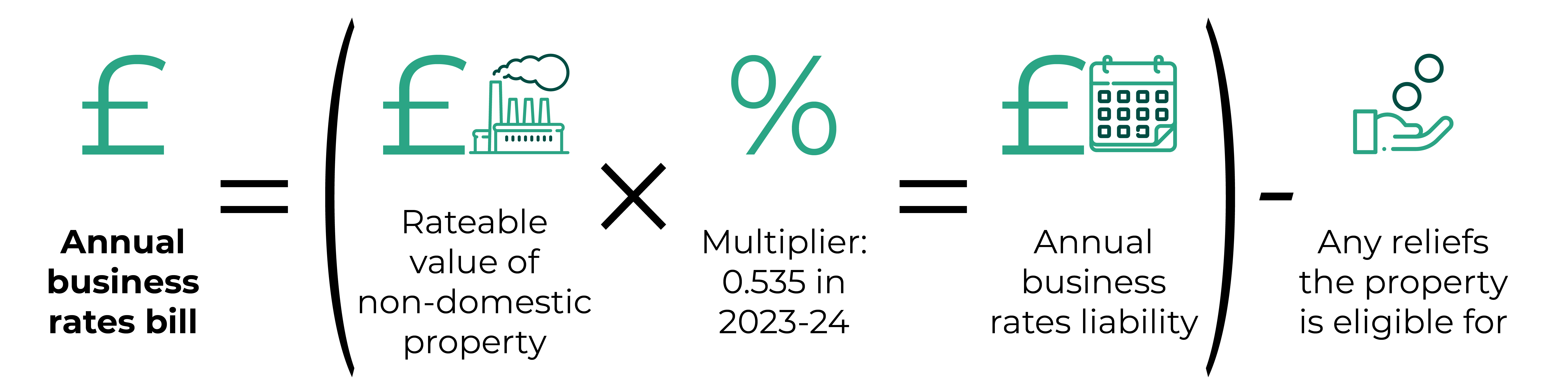

The amount of business rates that must be paid on a non-domestic property is calculated by applying an annually set ‘multiplier’ to the rateable value of a property and then taking off any relevant reliefs.

What does the revaluation mean for businesses?

In November 2022, the VOA published a draft rating list. Statistics associated with that list provide information on changes in rateable values, including analysis across sectors.

Non-domestic rateable properties fall into either a local rating list or a central rating list. Shops, pubs, offices and other properties are on the local list, whereas the central list contains properties associated with the transport network, utilities and telecommunications, among other things.

Compared to the 2017 list, the total rateable value of the local list across Wales and England will increase by 7.1%, to just over £70bn, just under £2.5bn of that total relates to Wales. England sees a 7.3% increase in rateable values across sectors but for Wales it’s 1.3%. In England there are variations by region, with the largest increase in the East of England (14.4%) and the smallest increase in the North East (2.2%), which is still higher than in Wales.

Figure 1: Percentage change in Rateable Value from 2017 to 2023 Local Rating List by country and English region

Looking at sectors in Wales and England, the total rateable value of the retail sector decreases by around 10%. The rateable value of property in the other three sectors increases, with the largest increase in the industry sector (27.1%). Again, there is a difference in how that falls between Wales and England. In Wales the rateable value of the industry sector increases by around 12.1%, but in England it’s increasing by 27.8%.

Figure 2: Percentage change in Rateable Value from 2017 to 2023 Local Rating List by sector

In terms of the central rating list, there’s been an overall decrease in rateable value of 0.6%, but again, the story is different by country. In England we see a 0.7% decrease, but Wales is due to increase by 1.7%.

In the period from the draft list publication and the final compiled list going live on 1 April 2023, changes will be made. Updated statistics, based on the live 2023 rating lists, are due to be published in April 2023.

The Welsh Government is offering transitional relief

The Welsh Government will offer relief specifically for those experiencing an increase in business rates due to the revaluation. It will provide all ratepayers whose liability is increasing by more than £300 with a reduction to their bill. As a result, the increase will be phased in over two years, meaning a ratepayer will pay 33% of their additional liability in the first year (2023-24), 66% in the second year (2024-25) and 100% of their liability in the third year (2025-26).

In addition to relief associated with the revaluation, there are a number of other schemes offered by the Welsh Government. Some of these are ‘permanent’, such as Small Business Rates Relief, whereas others are defined as ‘temporary’. For example, the Welsh Government announced in December it would continue to offer specific relief for retail, leisure and hospitality, on a temporary basis, in 2023-24, discounting bills for eligible properties by 75% (in 2022-23 relief was offered at 50%).

Similar to the UK Government for England, the Welsh Government announced in December it would also freeze the ‘multiplier’ for 2023-24 at 0.535. Normally the multiplier increases in line with inflation (CPI) annually. Increasing the multiplier has the effect of increasing the amount paid by ratepayers.

The appeals process

Ratepayers can appeal their new rateable value from 1 April 2023.

The way in which appeals work in Wales is changing, with the Welsh Government proposing a new approach that will be similar to the process in England.

From 1 April 2023, ratepayers in Wales who want to appeal their rateable value will need to use a ‘business rates valuation account’, having previously been able to use the ‘find a business rates valuation’ service. The VOA has guidance on what to do at each of the appeal stages.

Non-domestic rates reform

The Welsh Government has outlined its plans to reform business rates, alongside proposals to reform council tax. It published a summary of research in February 2021, looking at the role of local taxes.

More recently, it ran a consultation on a range of proposals for the reform of business rates in autumn 2022. A summary of responses (February 2023) included options to move to three-yearly revaluations. The consultation proposals also include:

- improving the flow of information between government and ratepayers;

- providing the Welsh Government with more flexibility to amend reliefs and exemptions;

- a review of reliefs and exemptions;

- providing greater scope to vary the multiplier;

- improving the administration of valuation functions and rating lists;

- further measures to ensure the Welsh Government can continue to tackle avoidance; and

- consideration of an alternative approach, such as a local land value tax, to raising local taxes over the longer-term.

Following the consultation, the Finance Minister, Rebecca Evans, said the Welsh Government:

…will further develop our proposals for our planned Local Government Finance Bill. In particular, we remain committed to introducing three-yearly revaluations and the measures required to support them.

With reform on the horizon, we might be writing about the next revaluation sooner than you think.

Article by Owen Holzinger and Joe Wilkes Senedd Research, Welsh Parliament