The poorest in our communities have been hit the hardest by the pandemic. Low-paid workers have been the most likely to be furloughed or to lose their job over the last couple of years. The Bevan Foundation found that groups who were already more likely to be in problem debt before the pandemic are now at even greater risk. And the Senedd’s Equality and Social Justice (ESJ) Committee heard from debt advice providers that factors such as energy price rises, the end of the temporary Universal Credit uplift, and the upcoming National Insurance increase may lead to a “perfect storm” or “tsunami” of problem debt over the coming months and years.

What impact has the pandemic had on problem debt and those most affected by it?

The ESJ Committee heard that demand for debt advice declined considerably at the start of the pandemic, contrary to expectations that it would increase dramatically. Support from the Welsh and UK Governments such as the pause on debt enforcement, the furlough scheme and the evictions moratorium influenced this and mitigated some of the severest consequences of the pandemic. However, recent analysis from Citizens Advice Cymru found that demand for debt advice now exceeds pre-pandemic levels, with the latest figures showing a 17% increase in debt clients compared to November 2019.

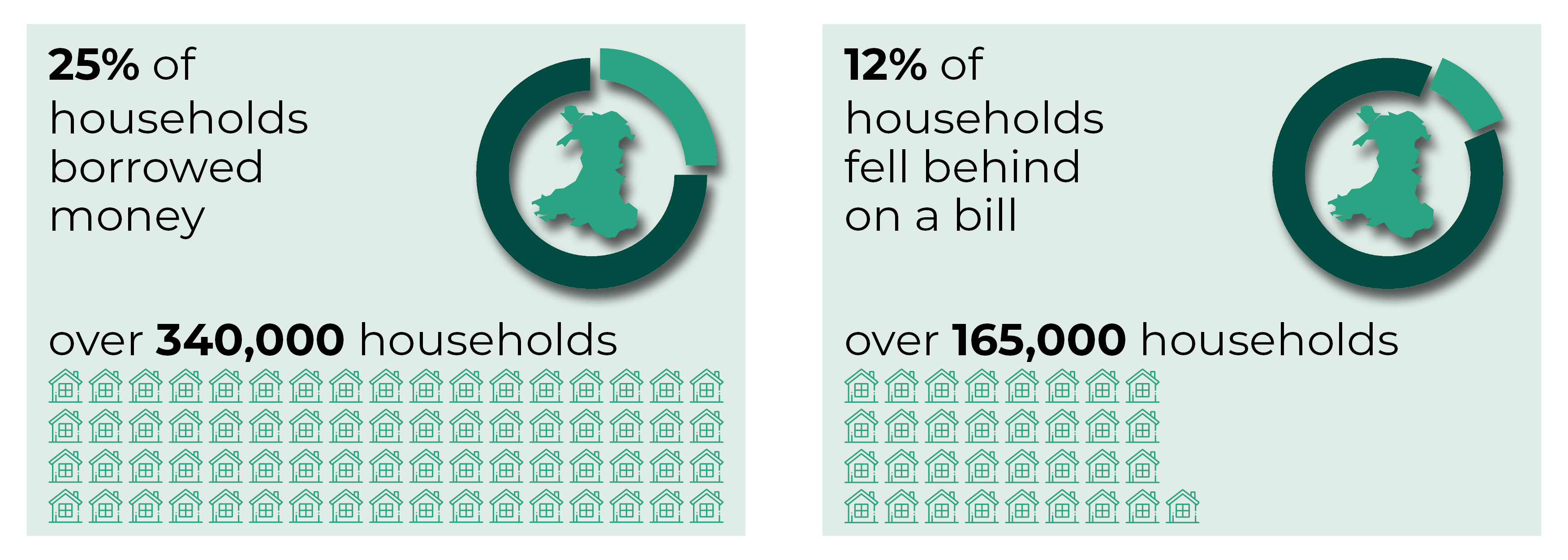

The Bevan Foundation highlights that between May and November 2021, a quarter of Welsh households borrowed money, while 12% fell behind on a household bill by at least a month.

Figure 1: Percentage of households in Wales that had borrowed money or fallen behind on a bill, May-November 2021

Source: Bevan Foundation, A snapshot of poverty in winter 2021

Organisations such as StepChange, Citizens Advice Cymru and the Bevan Foundation all found that some groups are more likely to be in problem debt than others. These include households on lower incomes; single parents; families with young children; renters; people from some ethnic minority communities; and people with disabilities.

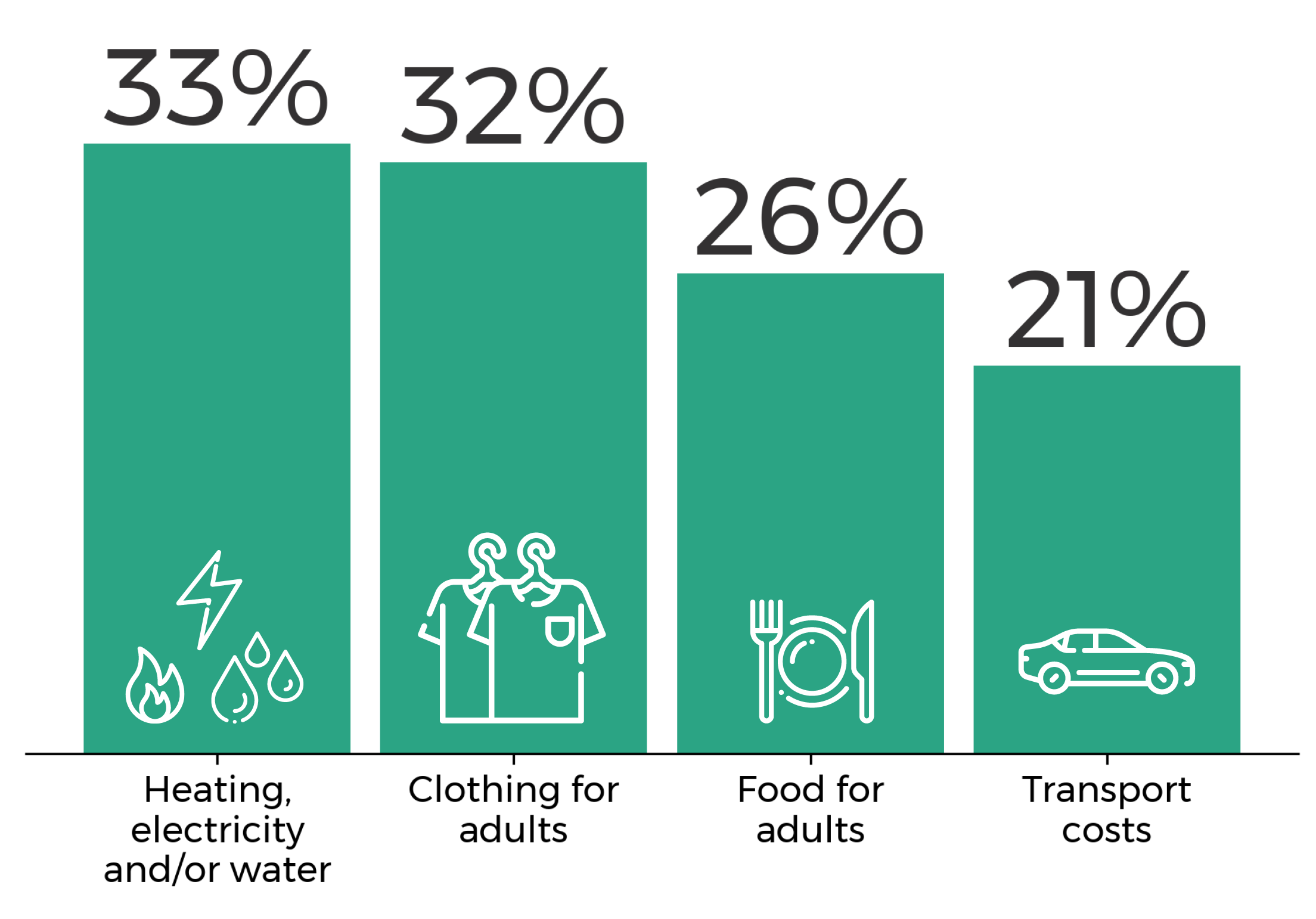

The Bevan Foundation highlights that nearly 40% of Welsh households do not have enough money for anything beyond the essentials, with people on low incomes, renters and those with a disability most affected. At the same time, living costs such as food, utility bills and transport are rising. Consequently, households have been cutting back on essential items, with the Bevan Foundation stating that this could become more prevalent over the winter.

Figure 2: Percentage of households in Wales that cut back on essentials, May-November 2021

Source: Bevan Foundation, A snapshot of poverty in winter 2021

How should the Welsh Government support those in arrears?

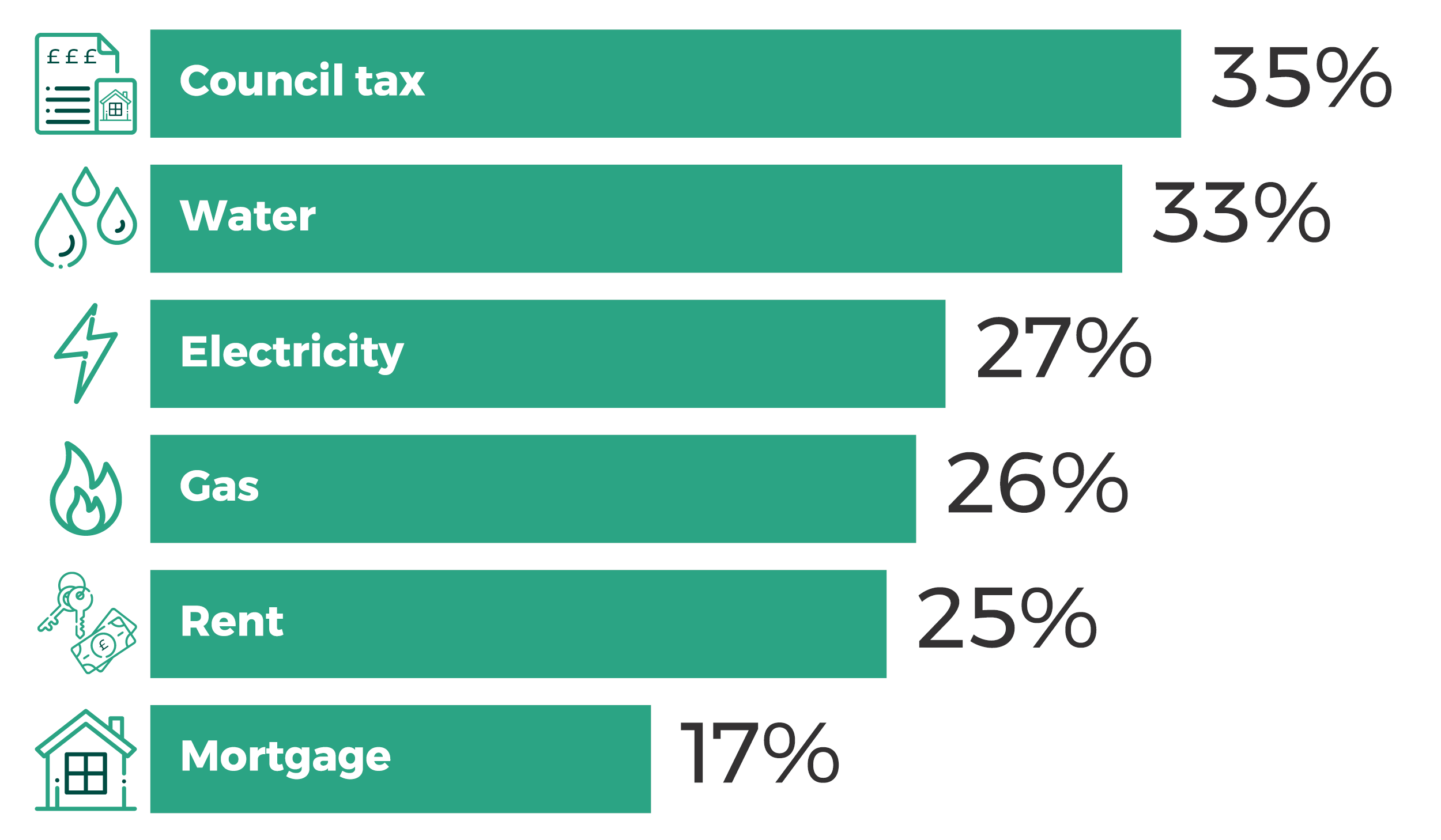

With bankruptcy and consumer debt reserved to Westminster, supporting people with arrears to devolved public service organisations is one of the key levers the Welsh Government has to assist those in debt. Citizens Advice Cymru and StepChange have found that council tax and utilities debts are the most common types of arrears people have fallen into during the pandemic.

Figure 3: Percentage of StepChange clients in arrears by type, January 2021

Source: StepChange, Written evidence to the Equality and Social Justice Committee

In 2020-21, council tax debt rose to £157 million, an increase of over £46 million compared to 2019-20. While the ESJ Committee concluded that “local authorities and other public sector bodies are well within their rights to take steps to protect revenue streams on which the funding of our vital public services rely”, it also heard concerns about how some organisations collect debts. Shelter Cymru and Citizens Advice Cymru raised instances of poor practices by bailiffs collecting council tax debts on behalf of local authorities, in relation to their behaviour towards people in debt and the affordability of repayment plans.

The Welsh Government is currently reviewing its council tax protocol, which outlines good practice for collecting council tax, and the ESJ Committee recommended that the review should consider strengthening the protocol or putting it into law.

Rent arrears have also increased during the pandemic, although Shelter Cymru and the Bevan Foundation have said that social rent arrears are not as large as initially feared. The Welsh Government has introduced the Tenancy Hardship Grant, to support private rented sector tenants in rent arrears due to the impact of the pandemic. The Bevan Foundation called for this to be extended to social housing tenants who are not eligible for Discretionary Housing Payments as they may be affected by above inflation rent rises. This was also recommended by the ESJ Committee. The Welsh Government agreed to discuss whether the grants should be extended with relevant organisations.

Energy price rises have hit the headlines over recent months due to increases caused by high gas prices. There are concerns that annual energy bills could go up by around £500-£550 once the energy price cap is updated in April, hitting the poorest hardest. The UK Government is considering support for customers hit by higher bills. The Welsh Government has introduced the Winter Fuel Support Scheme to provide £100 to help households on certain welfare benefits pay fuel bills. The ESJ Committee was concerned that this one-off funding may not be “in any way sufficient”. It called on the Welsh Government to urgently publish revised plans to tackle fuel poverty, and to set out plans to accelerate retrofitting of social housing to improve energy efficiency.

What wider debt-related support can the Welsh Government provide?

Wider debt-related support measures have also played an important role during the pandemic. The Welsh Government has consolidated advice funding into its Single Advice Fund - a proportion of this is required to be spent on debt advice. The Welsh Government has allocated an additional £1.7 million in 2022-23 to fund advice services, and will ensure that providers work with community-based organisations to encourage groups in need of debt advice to access support.

Emergency assistance provided through the Discretionary Assistance Fund (DAF) has seen a considerable rise in applications, having been temporarily expanded until 31 March 2022 to support those hit hardest during the pandemic. Given its key role in providing support, the ESJ Committee called for the Welsh Government to make the temporary flexibilities for the DAF permanent. The Welsh Government has not committed to this, and said that it will maximise impact by referring applicants to other support to improve their long-term financial wellbeing. The budget allocation for the DAF in 2022-23 will be lower than for the previous two financial years. The DAF will be reviewed ahead of the start of the new contract to deliver it from April 2023, and this review will cover areas of priority for the Committee such as eligibility criteria; simplifying the application process; and clear and accessible guidance.

A storm on the horizon?

With concerns from the Resolution Foundation that 2022 will be the “year of the squeeze” for family budgets, the cost of living will probably remain high on the political agenda. If the worst is yet to come, as predicted by debt advice services and think tanks, it seems likely there will be considerable debt-related challenges for the Welsh and UK Governments to respond to in the coming year.

You can watch the Senedd debate the ESJ Committee’s report on 12 January.

Article by Gareth Thomas, Senedd Research, Welsh Parliament