This article is the first of two parts looking at Universal Credit. Part 1 covers design, rollout and impact on Wales. Part 2 will explore the various issues with Universal Credit and recent developments.

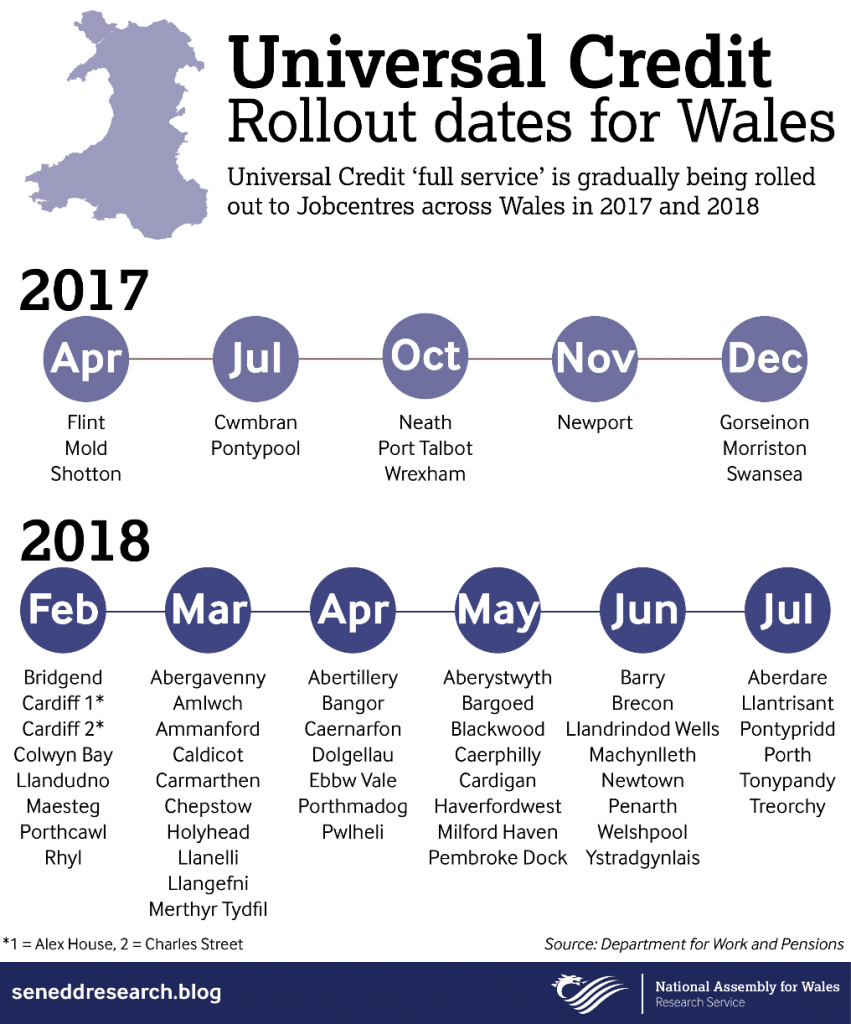

It is a critical time for the UK Government’s new social security benefit, Universal Credit (UC). Its rollout is accelerating from this month, with 54 of the 59 Jobcentres in Wales moving to ‘full service’ (which means almost all new applicants will claim UC) between October 2017 and July 2018.

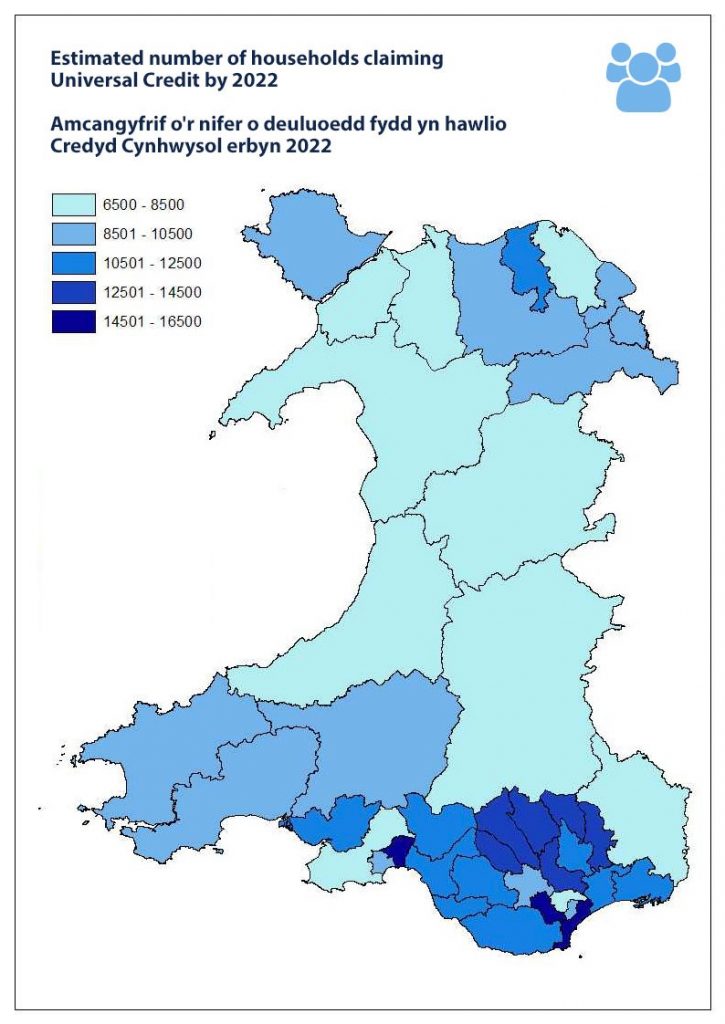

By 2022, Citizens Advice estimate that 400,000 households in Wales will be on UC. As of June 2017, 21,500 households were claiming the benefit, meaning that the rollout is only 5% complete in Wales.

What is Universal Credit?

Universal Credit is a new social security benefit that is being gradually rolled out across the UK. It replaces six means-tested benefits and tax credits for working-age people and families, which are:

- Housing Benefit;

- Working Tax Credit;

- Child Tax Credit;

- Income-Based Jobseekers’ Allowance;

- Income-Based Employment and Support Allowance, and

- Income Support

Other benefits such as Disability Living Allowance (DLA)/ Personal Independent Payment (PIP), Child Benefit and Carers Allowance are not being replaced by UC.

Why is it being introduced?

Universal Credit is designed to simplify the benefits system by replacing six benefits with one simple, monthly payment paid directly to claimants whether they are in or out of work.

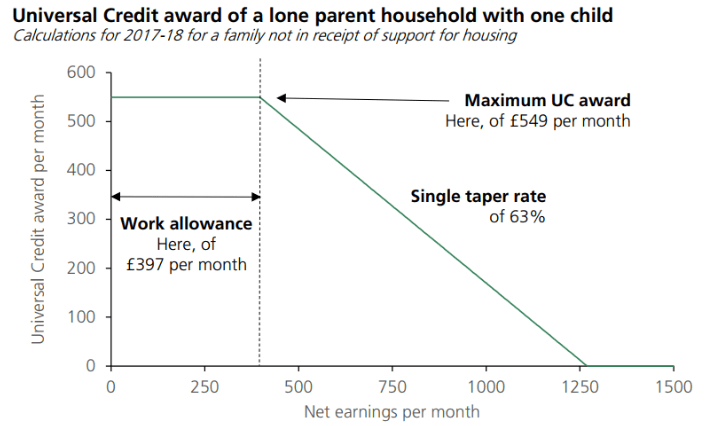

There's no limit to the number of hours claimants can work per week, but their payment reduces gradually as they earn more. It aims to make sure that no one is better off claiming benefits than working.

Under the old system, many faced a ‘cliff edge’, where people on a low income would lose all their benefits at once as soon as they started working more than 16 hours. In the new system, UC payments are reduced at a consistent rate as income and earnings increase - for every extra £1 a claimant earns after tax, they will lose 63p in benefits. The example below illustrates how earnings affect a Universal Credit award:  People across the political spectrum agreed that the benefits system needed simplifying, but changes to the design and generosity of UC since its conception have led to criticism that its principle is being undermined by cost-saving measures and administrative failures.

People across the political spectrum agreed that the benefits system needed simplifying, but changes to the design and generosity of UC since its conception have led to criticism that its principle is being undermined by cost-saving measures and administrative failures.

UC is the core part of a long-running programme of welfare reform from the UK Government, which aimed to save £18 billion over four years (from 2010).

When is it being rolled out in Wales?

The new scheme began to roll out in 2013 and was supposed to have been completed by October 2017. IT and admin issues led to successive delays, and it is now expected to be complete by 2022, with an accelerated rollout from October 2017.

People making new claims, or are already claiming benefits but have a change in their circumstances may have to claim UC before September 2018.

In ‘full service’ areas almost all types of claimant can claim UC. In ‘live service’ areas some types of claimants (like unemployed single people) can claim UC.

All Welsh Jobcentres were ‘live service’ as of March 2016. Full service areas are gradually replacing live service areas, and the UK Government expects that the whole of the UK will be ‘full service’ by September 2018.  Once the full service roll out for new claims is complete, existing benefit claimants who have not had a change in circumstances will be moved over to UC at some point between July 2019 and March 2022. There is a postcode checker to see if UC is available in a particular area.

Once the full service roll out for new claims is complete, existing benefit claimants who have not had a change in circumstances will be moved over to UC at some point between July 2019 and March 2022. There is a postcode checker to see if UC is available in a particular area.

How will it affect people on benefits?

The actual impact of UC is hard to judge because the design of the benefit has changed significantly since the DWP published its original impact assessment in 2012. Last year when asked if the assessment would be updated, the UK Government said that “whilst there have been changes to Universal Credit since the impact assessment in 2012, these have not fundamentally altered the service.”

UC is likely to result in gains and losses depending on the circumstances of claimants. In 2016, the Institute for Fiscal Studies (IFS) concluded that, across the UK:

- Introducing UC will cut annual benefit spending by £2.7 billion in total - this is on top of other benefit cuts (such as the four-year freeze to most benefit rates). When first proposed, UC was intended to be more generous than the current system but cuts to how much recipients can earn before their benefits start to be withdrawn have reversed this.

- Among working households, 2.1 million will get less in benefits as a result of UC’s introduction (an average loss of £1,600 a year) and 1.8 million will get more (£1,500 average gain). Among the 4.1 million households of working age with no-one in paid work, 1.1 million will get less (average loss of £2,300 a year) and 0.5 million will get more (average gain of £1,000 a year).

- Working single parents and two-earner couples are relatively likely to lose, and one-earner couples with children are relatively likely to gain. Among those currently receiving one of the benefits being replaced by UC, working single parents would be over £1,000 a year worse off on average if the long run UC system applied now, but one-earner couples with children would gain over £500 a year on average.

- Owner-occupiers and those with assets or unearned income are relatively likely to lose, but working renters are relatively likely to gain.

Impact in Wales

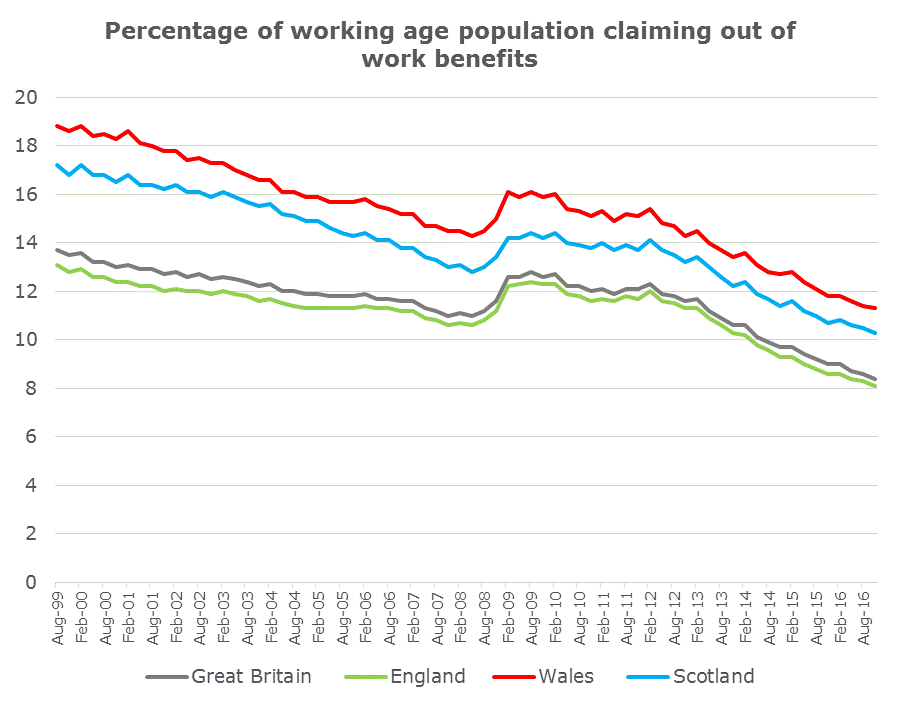

The full introduction of UC is likely to have a significant impact on Wales, which has a higher dependence on working age social security benefits compared to England and Scotland. According to the latest statistics, in Wales:

- 216,000 people (11.3% of the working age population) claim some kind of out of work benefits, which includes Jobseekers Allowance, Employment and Support Allowance, Income Support and Pension Credit (as of November 2016);

- 223,000 households received tax credits in 2015-16: 155,000 were working, and 68,000 were out of work;

- 233,272 people claimed Housing Benefit (as of May 2017).

It’s worth noting that many of these people will claim a combination of these benefits together.  There is no up to date assessment of the overall impact of UC on Wales. The Welsh Government’s welfare reform impact assessments (2012-15) considered the other reforms to benefits and the impact of individual changes to the design of UC, but not the overall impact of its introduction.

There is no up to date assessment of the overall impact of UC on Wales. The Welsh Government’s welfare reform impact assessments (2012-15) considered the other reforms to benefits and the impact of individual changes to the design of UC, but not the overall impact of its introduction.

Citizens Advice has estimated the number of households that are likely to be claiming UC by 2022, by analysing DWP projections and benefit take-up rates. Its analysis, which it has shared with the Research Service, shows that more than 400,000 households in Wales are likely to be on UC by 2022. The estimates for constituency areas are shown on the map below:

Article by Hannah Johnson, National Assembly for Wales Research Service

Source: House of Commons Library

Source: StatsWales Benefits include: Jobseekers Allowance, Employment and Support Allowance, Income Support, Pension Credit

Source: Citizens Advice statistics obtained by the Research Service