On 15th January 2019, the Assembly will debate the first-ever setting of Welsh Rates of Income Tax (WRIT) for 2019-20.

What are Welsh Rates of Income Tax?

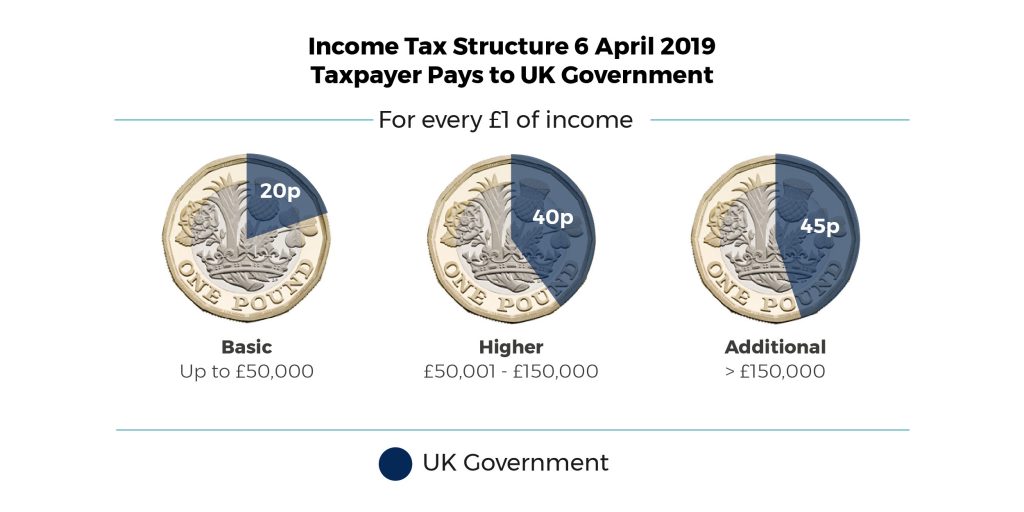

From 6 April 2019, the Welsh Government will be responsible for setting WRIT in Wales. Currently, all Welsh taxpayers pay income tax to the UK Government.

Figure 1. Current income tax structure

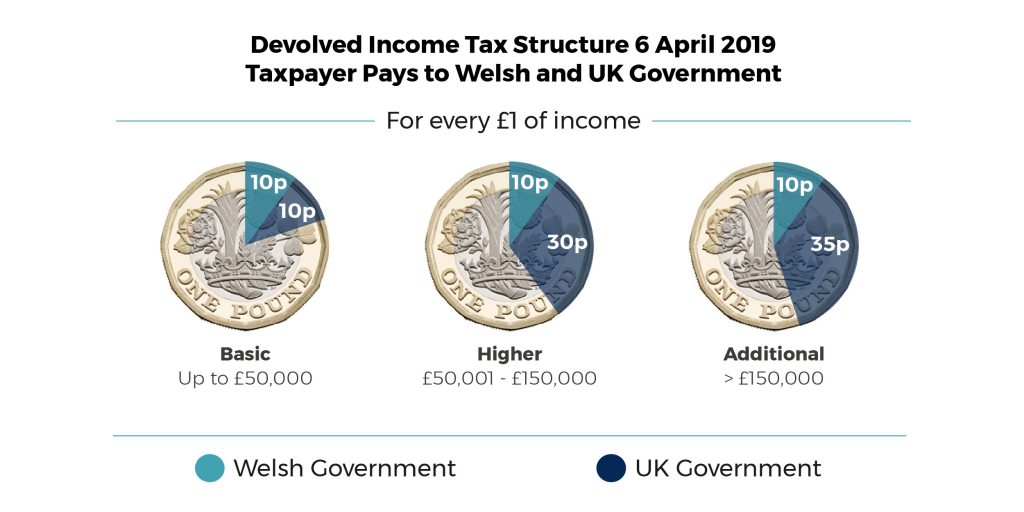

From April 2019, the UK Government will reduce each of the three rates of income tax paid by Welsh taxpayers by 10p. The Welsh Government will then introduce its own rates in each tax band, which will be debated and approved by the Assembly with revenues from these rates forming a part of its budget. Welsh Government, in its tax policy report 2018, proposes to set the first Welsh rates of income tax at 10p.

What will this mean for Welsh taxpayers?

This means that Welsh taxpayers will pay 10p of each income tax rate to Welsh Government with the remainder paid to UK government. There would be no impact on Welsh taxpayers as income tax rates would remain the same as what is currently being paid to UK Government.

Figure 1. Devolved income tax structure if proposed rates of 10p are applied

HMRC will be responsible for collecting income tax with WRIT revenue being transferred to Welsh Government. It is important to note that Welsh Government only has powers to change the Welsh Rates of Income Tax and not income tax bands or the personal allowance threshold.

What would the impact of changing Welsh income tax rates be?

The impact of changes to the Welsh rate of income tax on Welsh Government and individuals income has been estimated by the Wales Governance Centre.

Article by Christian Tipples, National Assembly for Wales Research Service