Article by Christian Tipples, National Assembly for Wales Research Service

This article is taken from ‘Key issues for the Fifth Assembly’, published on 12 May 2016.

Welsh taxes will give Wales control over its own revenue streams for the first time in the devolution era. How will the block grant be adjusted to ensure Wales receives its fair share of funding?

In 2018 the Welsh Government will have direct control of Welsh tax revenues for the first time in over 800 years. Failure to agree an appropriate mechanism to offset these revenues in the block grant could result in Wales being hundreds of millions of pounds worse off once all taxes are devolved.

How is Wales currently funded?

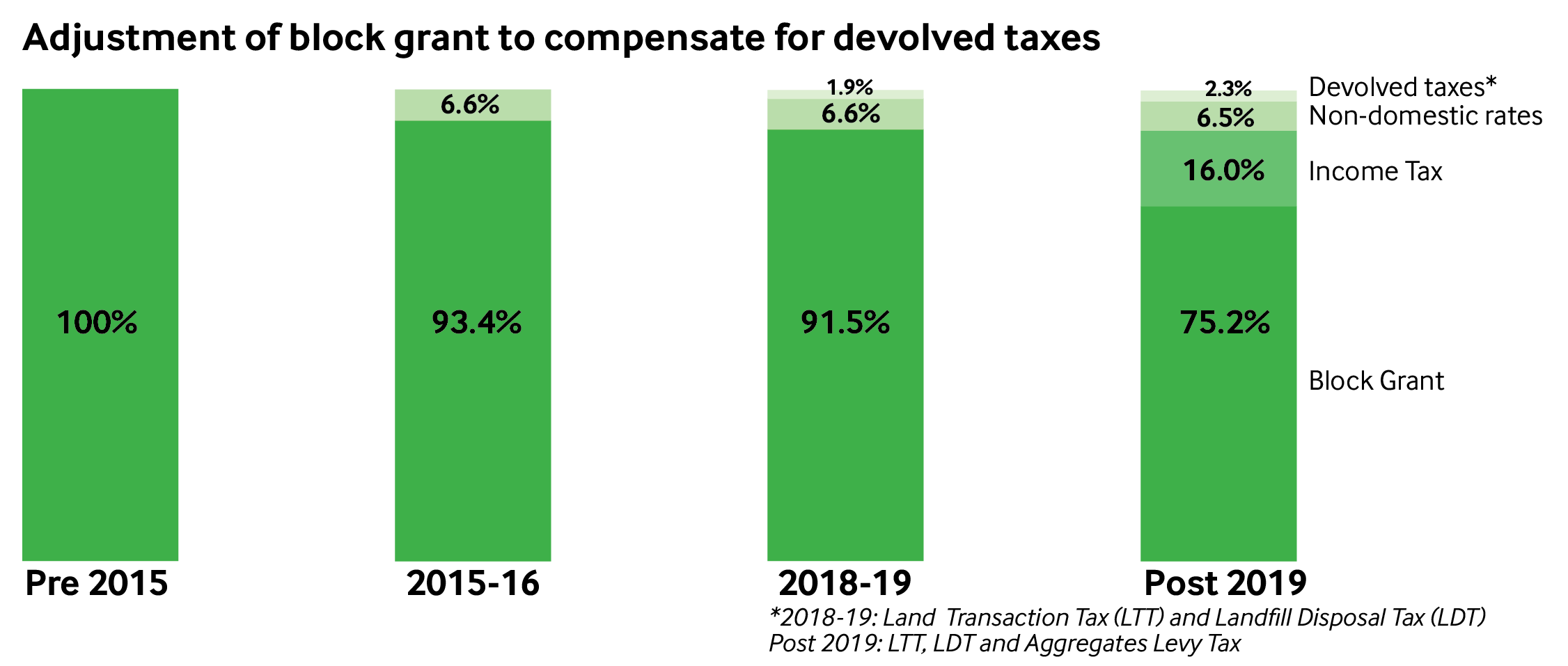

Prior to April 2015, the Welsh Government’s budget was entirely funded through a block grant from the UK Government.

Example

If there was an increase of £100 million in the planned spend of the UK transport department, whose activities are 73.1% devolved to Wales, and the estimate of the Welsh population as a proportion of the English population is 5.69%, then the change to the Wales block grant would be an increase of £4.16 million.

£100m x 73.1% x 5.69%

In the November 2015 Spending Review, the UK Government announced a funding floor of 15%. This means the Welsh block grant will not fall below 115% of comparable spending per head in England. The funding floor will expire at the end of the parliamentary term in 2020, creating uncertainty over future block grant funding.

How will devolved taxes affect funding in Wales?

Devolving non-domestic rates (business rates) in April 2015 gave the Welsh Government its first independent revenue source outside the block grant. A one-off adjustment to the block grant has already been applied. Council tax has also been devolved to local authorities in Wales. The introduction of Land Transaction Tax (LTT) and Landfill Disposals Tax (LDT) in April 2018 will generate further revenue sources for the new Welsh Government independent of the block grant. The UK Government also intends to devolve the aggregates levy and partly devolve income tax although the timescales remain unclear. The Office for Budget Responsibility (OBR) forecasts show the new Welsh Government would control an additional 18.3% of its total funding by 2019-20 (excluding non-domestic rates) if we assume the aggregates levy and income tax are devolved in that year.  This raises the question of how the block grant will be adjusted to compensate for these devolved taxes in the future.

This raises the question of how the block grant will be adjusted to compensate for these devolved taxes in the future.

What will happen once taxes have been devolved?

The block grant will undergo a process known as the ‘block grant adjustment’ (BGA) to compensate for devolved tax revenues. It is currently unclear when and how the adjustment will be made. However, in the first year of taxes being devolved, the block grant will simply be reduced by the expected revenues raised through Welsh taxes. This adjustment would not be appropriate for subsequent years as it would not incentivise the Welsh Government to grow the tax base. The Holtham and Silk Commissions considered a range of possible long-term mechanisms with both recommending a method where the block grant would be adjusted in line with the annual change in the UK tax base. This is known as the ‘indexed deduction method’. If the wrong mechanism is used to adjust the block grant, it could result in Wales losing hundreds of millions of pounds from the budget after all taxes have been devolved. The Fifth Assembly will have a key role in reviewing the discussions between the Welsh and UK Governments and in ensuring the mechanism chosen is suitable for Wales. The lengthy negotiations between the Scottish and UK Governments to agree a fair funding mechanism for Scotland also illustrate the importance of getting the BGA right. However, the five-year mechanism agreed for Scotland may not necessarily be an acceptable outcome in Wales given the differing income distribution of taxpayers.

What does this mean for Wales?

According to the OBR, the Welsh share of UK income tax has fallen since 2009-10 with ‘the main factors… likely to be the asymmetric effects of (UK Government) policy measures’. In recent years, revenue-raising policies have generally targeted the top end of the income distribution while tax cuts have had more of an effect at the lower end (eg increasing the personal allowance, which is likely to continue as a UK Government policy). Given Wales has income levels that are well below the UK average, such policy changes have had a disproportionate impact on Welsh income tax receipts, resulting in relatively lower revenues in Wales. The Wales Governance Centre published a report on income tax in Wales in February 2016 detailing the inconsistent effect UK policy has on Welsh income tax revenue. It suggested as a result ‘there is no reason to believe that the Welsh Government’s Income Tax losses from UK tax policy will be adequately offset’. This demonstrates the challenges faced by the new Welsh Government and the Fifth Assembly in preventing potentially damaging implications for Wales.

Key sources

- Commission on Devolution in Wales (the ‘Silk Commission’), Empowerment and Responsibility: Financial Powers to Strengthen Wales (PDF 2.5MB) (2012)

- Independent Commission on Funding and Finance for Wales (the ‘Holtham Commission’), Fairness and Accountability: A New Funding Settlement for Wales (PDF 3.06MB) (2010)

- Office for Budget Responsibility, Devolved Taxes Forecast – March 2016 (PDF 332KB) (2016)

- Research Service, Budget Series 1: Funding Welsh Devolution (PDF 181KB) (2013)

- UK Government, Spending Review and Autumn Statement 2015 (PDF 1.38MB) (2015)

- Wales Governance Centre, Income Tax and Wales: The Risks and Rewards of New Model Devolution (PDF 612KB) (2016)

- Welsh Government, Consultation Document: Landfill Disposals Tax (PDF 0.99MB) (2015)

- Welsh Government, Consultation Document: Tax Devolution in Wales – Land Transaction Tax (PDF 809KB) (2015)