Article by Gareth Thomas, National Assembly for Wales Research Service

This article is taken from ‘Key issues for the Fifth Assembly’, published on 12 May 2016.

Developments in the steel industry have been one of the most high profile political issues of 2016. What are the key pressures facing the industry and how might the new Welsh Government help it secure a sustainable long-term future?

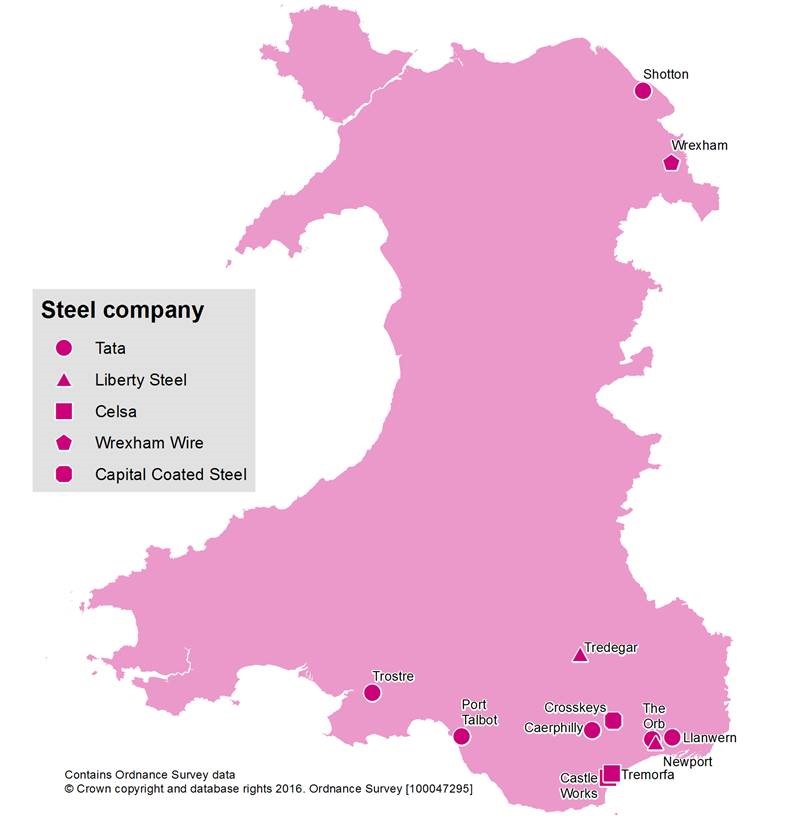

The decision by Tata Steel in March 2016 to put its UK assets up for sale was the latest development in a ‘perfect storm’ of recent challenges for the steel industry in both Wales and the UK. As well as the Port Talbot steelworks, Tata has a number of other operations in Wales, at Llanwern, the Orb in Newport, Shotton and Trostre near Llanelli. Other producers with Welsh operations include Celsa Steel and Liberty House Steel UK. The iron and steel industries employed 6,420 people across Wales in 2015, with the primary steel industry and its supply chain accounting for close to 20,000 jobs. The Welsh Economy Research Unit at Cardiff University found that the total economic impact of Tata was £3.2 billion in Wales per year, with a supported gross value added of £1.6 billion. Tata contributes £200 million in wages into the Welsh economy each year, and each job at Tata supports an additional 1.22 jobs throughout the Welsh economy.

What are the options for securing the future of the Tata Steel plants?

Reaching a conditional sale agreement for the Tata plant in Scunthorpe in April 2016 took nine months, and both UK and Welsh Governments have urged Tata to allow sufficient time for a sale to take place. In March 2016, the Scottish Government purchased two Tata steel plants before selling them on to Liberty Steel the same day. Potential options for the Tata sites include the sale of all plants; management buyouts of certain sites; nationalisation; co-investment between the public and private sectors; temporary ‘mothballing’ of sites in their current condition to enable future reopening; or closure. The previous Welsh Government offered Tata a package of over £60 million, which included funding for environmental products and skills and training, and a commercial loan to develop a galvanising line for steel coating. It also discussed co-investing in a power plant at the Port Talbot works, which would lead to lower energy costs and greater energy efficiency. Given the scale of the investment needed across the Tata plants, UK Government assistance will also be required. The UK Government has indicated that it would consider co-investing with a buyer on commercial terms, including potentially taking on some of the debts associated with the plants. Other areas for potential UK Government support include the power supply, the British Steel Pension Scheme and infrastructure.

How can the key challenges facing the sector be addressed?

Of the industry’s five ‘key asks' at the start of the crisis, four remain major concerns for the sector. Some of these are in non-devolved areas, meaning that the new Welsh Government will need to work in partnership to address these issues.

What is dumping, and what measures are currently used to combat it?

Dumping is where the export price of a product such as steel is lower than the exporter’s home market price, or perhaps even lower than cost price. The EU investigates these cases, and can impose tariffs that are based on the dumping margin unless a lower tariff would remove the injury caused to EU producers. This is known as the ‘lesser duty’ rule

The ‘dumping’ of steel is dealt with at EU level, and concerns centre on the global competitiveness of European steel against exports from China and Russia. The European Commission launched proposals to address these challenges in March 2016, including reducing the length of time that anti-dumping investigations take and changing the way that anti-dumping tariffs are calculated in certain circumstances. A further issue is the impact that awarding Market Economy Status to China would have on action that could be taken against ‘dumping’. Energy prices for UK steel producers are higher than other European nations, despite the UK Government introducing compensation for energy intensive industries. While steel producers have welcomed the compensation package, they are still paying significantly more for electricity than European competitors and would like further action taken. Business rates paid by UK producers are said to be between five and ten times higher than in other European nations. In Wales, powers over business rates are wholly devolved to the Welsh Government. The sector has called for the removal of plant and machinery from business rates bills, which are seen as a disincentive to invest. At the end of the Fourth Assembly, the previous Welsh Government was still considering how to address this issue across the whole of the manufacturing industry in Wales. The steel industry also wants the Welsh public sector and the Welsh and UK Governments to use procurement for major infrastructure projects to better support UK steel. The previous Welsh Government considered that its procurement policies support the principles of the Charter for Sustainable British Steel, although the industry has called for procurement policies to be implemented and monitored more closely. The Tata Taskforce, established by the previous Welsh Government, is developing a list of infrastructure projects that could help the steel industry, and looking at how major capital projects are setting criteria for steel procurement. The steel industry has also cited Welsh and UK Government co-investment in research and development as ways to take the steel sector forward. The decisions taken by the Welsh and UK Governments will affect both the immediate and long-term future of steel. With thousands of jobs and the future of an industry at stake, working with partners to relieve the pressures faced by the sector will be one of the first major challenges for the new Welsh Government. Since this article was produced for the hard copy Key Issues publication, there have been a number of developments:

- The UK Government has provided further details of potential support available to the successful buyer, including the possibility of it taking an equity stake of up to 25%;

- Tata has announced that seven bidders have reached the next stage of the bidding process. These include Liberty Steel and Excalibur Steel UK, and are also rumoured to include Greybull Capital, JSW Steel and Nucor; and

- The Welsh Government has confirmed that it has made an offer of financial support to the Excalibur Steel UK bid, although the value of this support is not yet known. However, this is not a formal endorsement of the Excalibur bid as support is open to other bidders should they request it.

Key sources

- Cardiff University Welsh Economy Research Unit, The Economic Impact of Tata Steel in Wales (PDF 723 KB) (2012)

- European Commission, Anti-dumping (website)

- House of Commons Business, Innovation and Skills Select Committee, The UK steel industry: Government response to the crisis (2015)

- Institute for Public Policy and Research, Strong foundation industries: How improving conditions for core material producers could boost UK manufacturing (PDF 3.97 MB) (2016)

- UK Steel, Energy costs and the steel sector (PDF 633 KB) (2016)

- UK Steel, The future of the UK steel sector (PDF 350 KB) (2016)

- Welsh Government, Tata Task Force (website)

Promoted by the National Assembly for Wales Commission, Cardiff Bay, Cardiff, CF99 1NA