Article by Christian Tipples, National Assembly for Wales Research Service

This article is taken from ‘Key issues for the Fifth Assembly’, published on 12 May 2016.

Wales will take control of its own taxes for the first time in over 800 years during the Fifth Assembly. What does this mean for Welsh taxpayers?

In 2018, Wales will receive the first tranche of newly devolved taxes. The Welsh Government will also acquire significant borrowing powers in this historic period. Such powers will give the new Welsh Government greater financial accountability that will require close scrutiny in the Fifth Assembly.

Which taxes are being devolved to Wales?

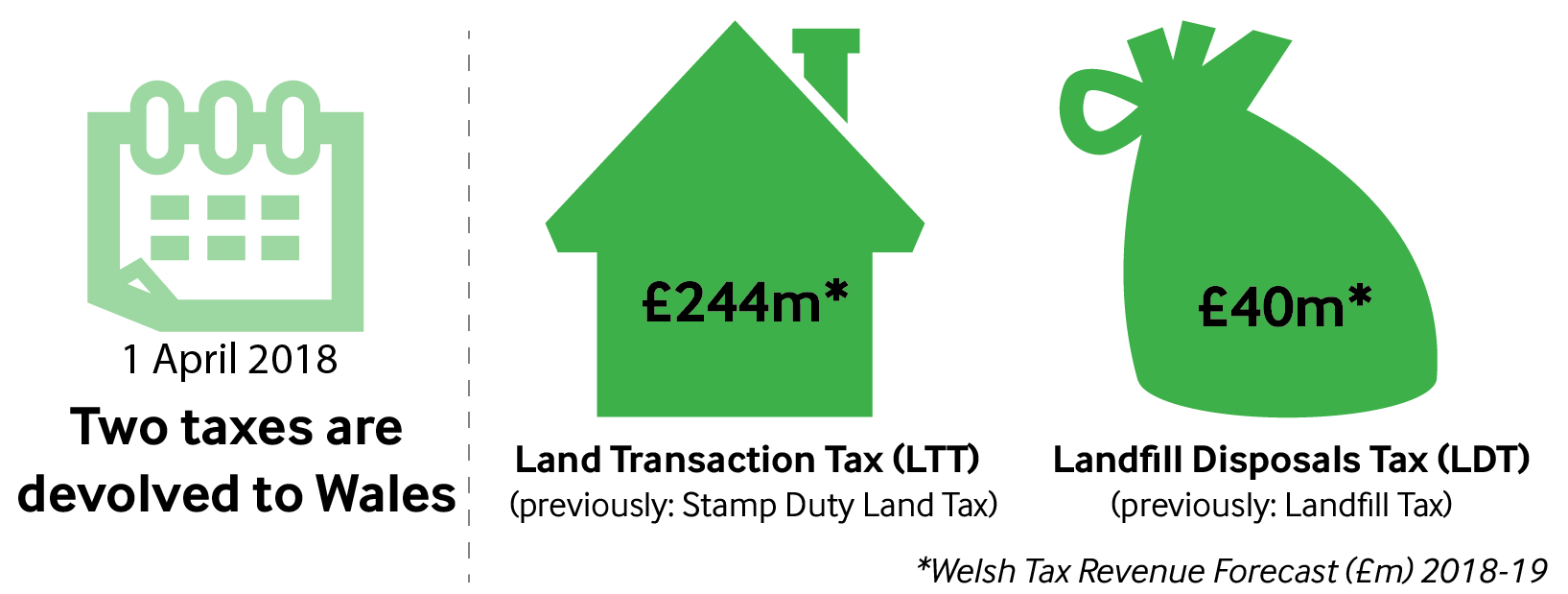

The Wales Act 2014 made provision for a range of taxes to be devolved to the Welsh Government. In April 2018, Wales will take control of Land Transaction Tax (LTT) and Landfill Disposals Tax (LDT).  What is being done to prepare for devolved taxes? The Fourth Assembly passed the Tax Collection and Management (Wales) Act 2016 in March 2016. The Act establishes the Welsh Revenue Authority (WRA) whose main function will be to collect and manage devolved taxes. The new Welsh Government is expected to introduce two tax-specific Bills soon after the 2016 Assembly elections to provide arrangements for implementing LTT and LDT.

What is being done to prepare for devolved taxes? The Fourth Assembly passed the Tax Collection and Management (Wales) Act 2016 in March 2016. The Act establishes the Welsh Revenue Authority (WRA) whose main function will be to collect and manage devolved taxes. The new Welsh Government is expected to introduce two tax-specific Bills soon after the 2016 Assembly elections to provide arrangements for implementing LTT and LDT.

How will Welsh taxes work?

1. Land Transaction Tax (LTT)

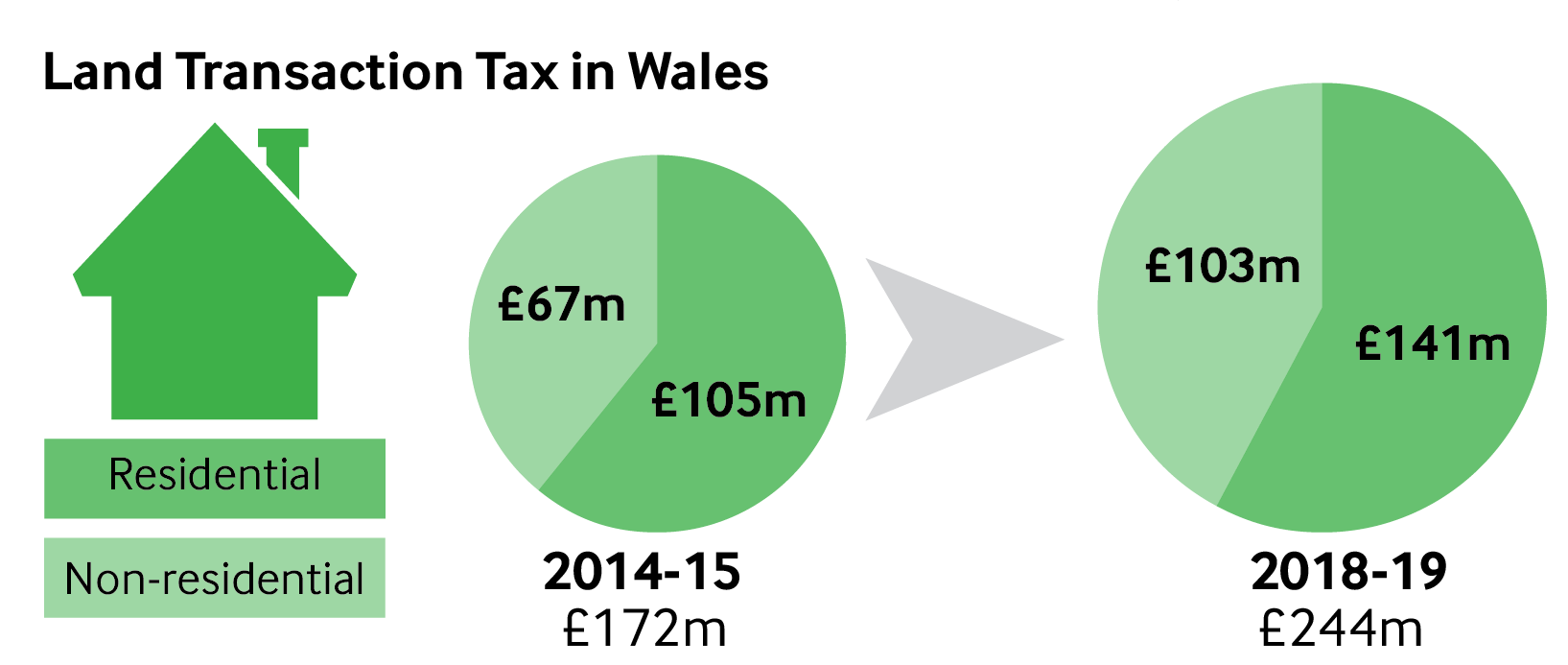

LTT will replace Stamp Duty Land Tax (SDLT) in Wales and will apply to both residential and non-residential property transactions. The major share of LTT will come from residential property transactions.  In December 2014, the UK Government changed its approach to calculating stamp duty for residential property transactions by moving to a marginal rate system. This means each new SDLT rate will only be payable on the portion of the property value which falls within each SDLT band. In its consultation document Tax Devolution in Wales – Land Transaction Tax the Welsh Government deemed this a fairer system for home buyers and proposed to continue operating the marginal rate system. However, the new Welsh Government will make the final decision and establish new tax rates and bands. The UK Government also changed SDLT for non-residential property transactions (such as commercial property, agricultural land and development land) to a marginal rate system in March 2016. The new Welsh Government will need to determine how non-residential transactions are taxed when the LTT Bill is introduced in the Fifth Assembly.

In December 2014, the UK Government changed its approach to calculating stamp duty for residential property transactions by moving to a marginal rate system. This means each new SDLT rate will only be payable on the portion of the property value which falls within each SDLT band. In its consultation document Tax Devolution in Wales – Land Transaction Tax the Welsh Government deemed this a fairer system for home buyers and proposed to continue operating the marginal rate system. However, the new Welsh Government will make the final decision and establish new tax rates and bands. The UK Government also changed SDLT for non-residential property transactions (such as commercial property, agricultural land and development land) to a marginal rate system in March 2016. The new Welsh Government will need to determine how non-residential transactions are taxed when the LTT Bill is introduced in the Fifth Assembly.

2. Landfill Disposals Tax (LDT)

LDT will replace the UK Government’s Landfill Tax – a tax on disposing of waste at landfill sites. The new tax is intended to support the Welsh Government’s policies on climate change, waste, the environment and sustainable development. The Welsh Government will confirm tax rates nearer the introduction of LDT. Will anything else be happening once taxes have been devolved? The new Welsh Government will be given additional powers to manage its finances through a cash reserve and extensive borrowing powers.

3. Cash reserve

The Welsh Government will have access to a new cash reserve to help manage tax revenue volatility or support additional spending by providing a means for saving surplus revenues.

4. Borrowing powers

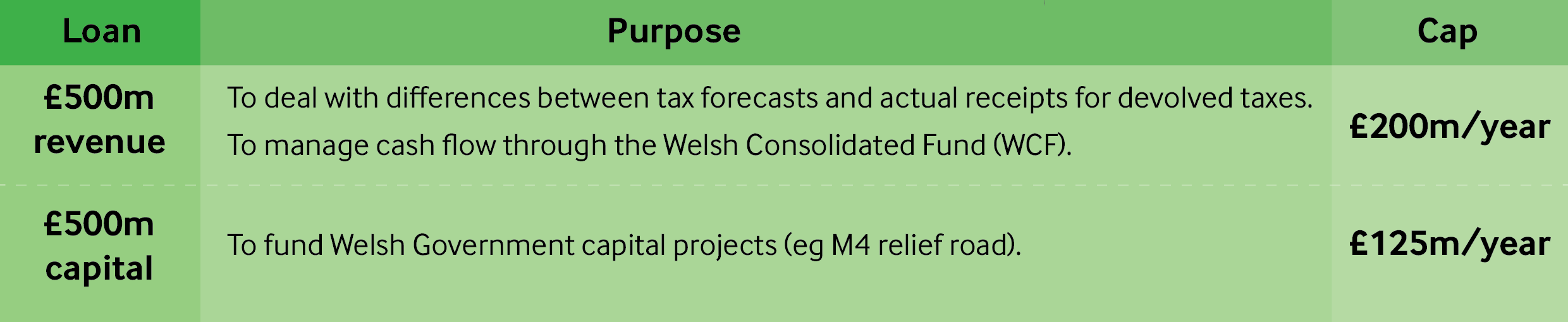

The Wales Act 2014 also includes new borrowing powers for the Welsh Government through either the National Loans Fund (NLF) or another lender. The new Welsh Government will be able to borrow from April 2018.  Will other taxes be devolved in the future? There are plans for devolving additional tax streams to Wales in the future. Timescales are unclear but there is potential for these taxes to either be fully devolved or start to be devolved during the Fifth Assembly.

Will other taxes be devolved in the future? There are plans for devolving additional tax streams to Wales in the future. Timescales are unclear but there is potential for these taxes to either be fully devolved or start to be devolved during the Fifth Assembly.

5. Aggregates Levy

This levy is a tax on the commercial exploitation of rock, sand and gravel in the UK. The UK Government announced its intention to devolve the levy subject to the resolution of current legal challenges. The aggregates levy would raise £32 million if devolved in 2018-19 according to the Office for Budget Responsibility (OBR) forecasts.

6. Income Tax

The UK Government announced in the 2015 Spending Review its intention to remove the requirement to hold a referendum in Wales before partially devolving income tax. For each income tax rate, the Welsh Government is expected to collect 10 pence for every pound earnt over the personal allowance (up to £11,000 for 2016-17). The OBR forecasts that the Welsh Government would collect over £2 billion a year from Welsh taxpayers to spend on public services once income tax has been partly devolved.

Key sources

- Office for Budget Responsibility, Devolved taxes forecast – March 2016 (PDF 332KB) (2016)

- UK Government, Wales Act 2014 (PDF 694KB) (2014)

- UK Government, Wales Bill: Financial Empowerment and Accountability (PDF 322KB) (2014)

- Welsh Government, Consultation Document: Landfill Disposals Tax (PDF 0.99MB) (2015)

- Welsh Government, Consultation Document: Tax Devolution in Wales – Land Transaction Tax (PDF 809KB) (2015)

- Welsh Government, Tax Collection and Management (Wales) Bill (PDF 485KB) (2015)