Article by Gareth Thomas, National Assembly for Wales Research Service

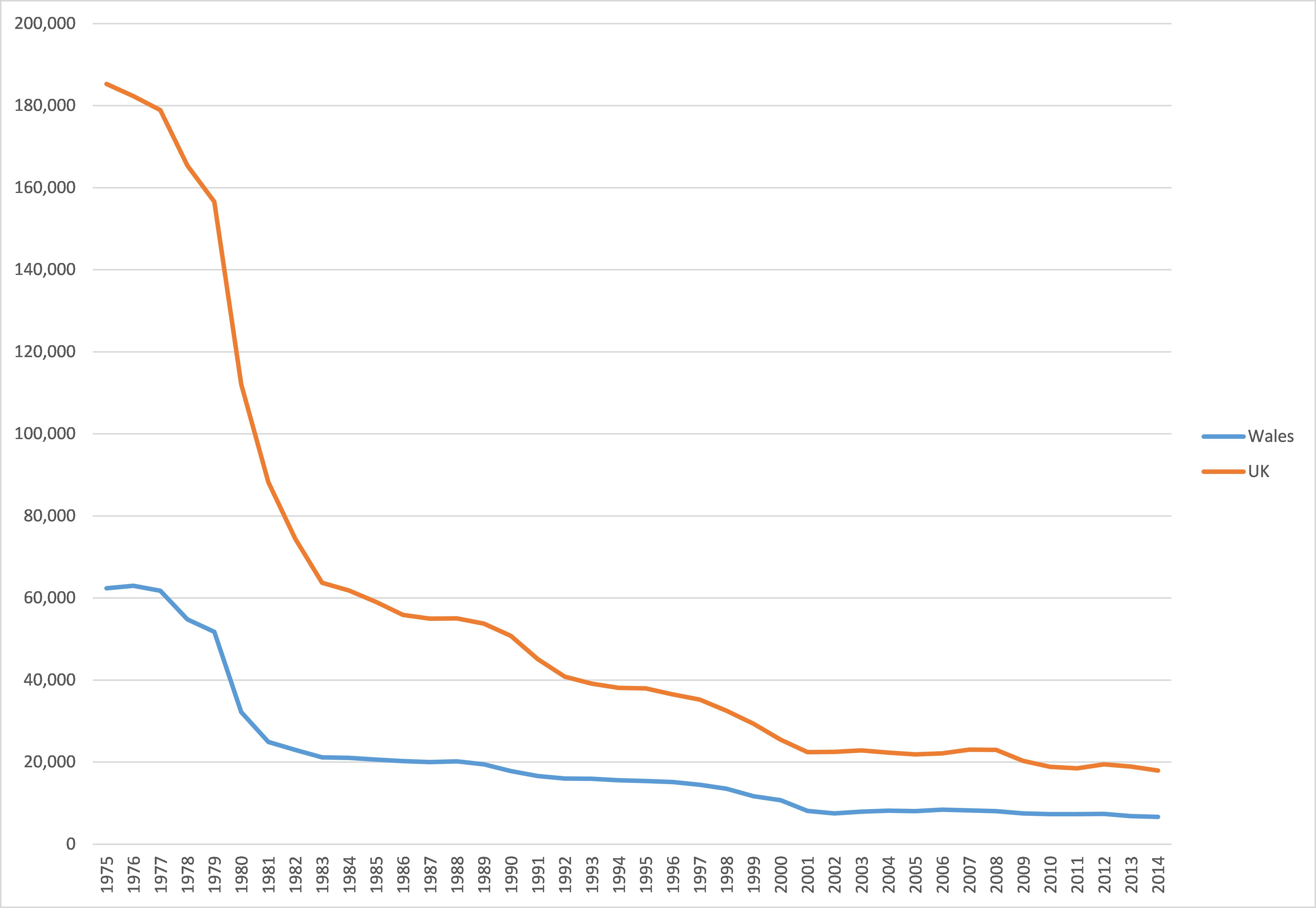

The recent uncertainty facing the steel sector across the UK has had a major impact on communities across Wales, with the job losses announced by Tata Steel on Monday following those announced at the end of last year. Given the importance of the steel industry to Wales, we’re taking a look at the key issues. This article provides an overview of the Welsh steel industry and the challenges it faces, and later on today in a second article we’ll be looking in more detail at the support that the Welsh Government is able to offer. What economic contribution does the steel industry make to Wales? It has been reported that Tata Steel contributes £200 million in wages into the Welsh economy. A study by the Welsh Economy Research Unit at Cardiff University found that the total economic impact of Tata was £3.2 billion in Wales, with a supported GVA of £1.6 billion. There has been a considerable decrease in the number of people employed in the steel industry over the past four decades. The number of people employed in the iron and steel industries in Wales in 2014 was 6,630, just 10% of the 62,400 people employed in the sector 40 years ago and the lowest level at any point over the past 40 years. Much of this decrease was seen in the late 1970s and early 1980s. Number of people employed in the iron and steel industry in Wales and the UK  Source: Stats Wales, Iron and steel production by year, measure and area It is worth being aware that there are a number of different figures out there on employment in the Welsh steel industry. Alternative figures using a different definition of the steel industry suggest that it employed 8,100 people in Wales in 2014. The Minister for Economy, Science and Transport has suggested that in total the primary steel industry, and its supply chain in Wales accounts for close to 20,000 jobs. In Wales, 4,400 kilo-tonnes of crude steel were produced in 2014, 37% of the UK total of 12,030 kilo-tonnes. Production tends to fluctuate between years at both Welsh and UK level. Imports of iron and steel into Wales have increased at a much faster pace over recent years than exports from Wales. Figures show that in 2014 Wales exported nearly £1.3 billion in iron and steel, with imports of just over £400 million. However, between 1996 and 2014 (the time period for which figures are available), the annual value of iron and steel imports into Wales has increased by 370% over this period, compared to a 69% increase in the annual value of exports. Put another way, the annual value of exports in 1996 was nearly nine times higher than imports. In 2014, the annual value of exports was just over three times the value of imports. In terms of overall steel production, the UK steel industry has reduced substantially over the last forty years. Over the same period, other countries have increased production considerably. Over the last four decades steel production in the UK has fallen behind that of nations such as France, Spain and Italy, and has remained behind that of Germany. The difficulties faced by the industry have been known for some years, and have received considerable media and political attention over recent months. What are the key challenges faced by the steel industry, and what are the potential solutions? A number of factors have been cited as potential explanations for the pressures facing the steel industry and the recent job losses. These include the availability of cheap imports, the strong pound, energy costs and business rates. The industry has identified five areas where action can be taken to address the challenges it faces. A number of these policy areas are non-devolved, and action at UK Government or EU level is required. Action against trading practices such as the ‘dumping’ of steel – where the export price is lower than the exporter’s home market price, or perhaps even lower than cost price. This is an issue to be dealt with at the EU level, and centres on concerns about the global competitiveness of European steel against the record level of exports from China. This is seen by the Business, Innovation and Skills Select Committee at Westminster as the most important challenge, and they conclude that there is no guarantee that this will be resolved imminently. The UK Government has voted in favour of ‘anti-dumping’ measures on certain steel imports, and secured an extraordinary meeting of the EU’s Competitiveness Council on this issue. Energy Prices for steel producers are higher than in other EU nations. The steel industry has been calling for an Energy Intensive Industries package since 2011. In December 2015 the UK Government secured state aid approval to pay further compensation to energy-intensive industries, including steel, to include renewables policy costs. However the UK Government has stated that it has already paid about £60 million to the steel industry to help to mitigate the costs of existing energy policies prior to the announcement in December 2015. The Industrial Emissions Directive threatens further pressure on costs. In October 2015, the UK Government announced, subject to final approval by the Commission, a four and a half year postponement in implementing the Industrial Emissions Directive for the steel sector. Business rates across the UK are higher than in other EU nations, UK Steel has highlighted that UK-based steel firms pay between five and 10 times more in business rates than their EU competitors. A particular concern for the steel sector is the inclusion of plant and machinery in the calculation of business rates, as it is seen as a disincentive to invest in these if they then result in a business paying more in business rates. Concerns that UK steel companies are losing out on defence and major infrastructure projects, due to procurement processes not sufficiently taking into account social, sustainability and environmental considerations as well as price. Other issues raised in a recent briefing by UK Steel include EU-level action on Market Economy Status for China and direct funding assistance for the sector on Research and Development (R&D) and environmental improvements, which would come under the responsibility of both Welsh and UK Governments. The key challenges that the Welsh Government is able to respond to are those around business rates and procurement. The Welsh Government will also play a key role in supporting workers who have been made redundant through the ReAct programme, and through other economic development policy levers. These areas will be discussed in more detail later on today.

Source: Stats Wales, Iron and steel production by year, measure and area It is worth being aware that there are a number of different figures out there on employment in the Welsh steel industry. Alternative figures using a different definition of the steel industry suggest that it employed 8,100 people in Wales in 2014. The Minister for Economy, Science and Transport has suggested that in total the primary steel industry, and its supply chain in Wales accounts for close to 20,000 jobs. In Wales, 4,400 kilo-tonnes of crude steel were produced in 2014, 37% of the UK total of 12,030 kilo-tonnes. Production tends to fluctuate between years at both Welsh and UK level. Imports of iron and steel into Wales have increased at a much faster pace over recent years than exports from Wales. Figures show that in 2014 Wales exported nearly £1.3 billion in iron and steel, with imports of just over £400 million. However, between 1996 and 2014 (the time period for which figures are available), the annual value of iron and steel imports into Wales has increased by 370% over this period, compared to a 69% increase in the annual value of exports. Put another way, the annual value of exports in 1996 was nearly nine times higher than imports. In 2014, the annual value of exports was just over three times the value of imports. In terms of overall steel production, the UK steel industry has reduced substantially over the last forty years. Over the same period, other countries have increased production considerably. Over the last four decades steel production in the UK has fallen behind that of nations such as France, Spain and Italy, and has remained behind that of Germany. The difficulties faced by the industry have been known for some years, and have received considerable media and political attention over recent months. What are the key challenges faced by the steel industry, and what are the potential solutions? A number of factors have been cited as potential explanations for the pressures facing the steel industry and the recent job losses. These include the availability of cheap imports, the strong pound, energy costs and business rates. The industry has identified five areas where action can be taken to address the challenges it faces. A number of these policy areas are non-devolved, and action at UK Government or EU level is required. Action against trading practices such as the ‘dumping’ of steel – where the export price is lower than the exporter’s home market price, or perhaps even lower than cost price. This is an issue to be dealt with at the EU level, and centres on concerns about the global competitiveness of European steel against the record level of exports from China. This is seen by the Business, Innovation and Skills Select Committee at Westminster as the most important challenge, and they conclude that there is no guarantee that this will be resolved imminently. The UK Government has voted in favour of ‘anti-dumping’ measures on certain steel imports, and secured an extraordinary meeting of the EU’s Competitiveness Council on this issue. Energy Prices for steel producers are higher than in other EU nations. The steel industry has been calling for an Energy Intensive Industries package since 2011. In December 2015 the UK Government secured state aid approval to pay further compensation to energy-intensive industries, including steel, to include renewables policy costs. However the UK Government has stated that it has already paid about £60 million to the steel industry to help to mitigate the costs of existing energy policies prior to the announcement in December 2015. The Industrial Emissions Directive threatens further pressure on costs. In October 2015, the UK Government announced, subject to final approval by the Commission, a four and a half year postponement in implementing the Industrial Emissions Directive for the steel sector. Business rates across the UK are higher than in other EU nations, UK Steel has highlighted that UK-based steel firms pay between five and 10 times more in business rates than their EU competitors. A particular concern for the steel sector is the inclusion of plant and machinery in the calculation of business rates, as it is seen as a disincentive to invest in these if they then result in a business paying more in business rates. Concerns that UK steel companies are losing out on defence and major infrastructure projects, due to procurement processes not sufficiently taking into account social, sustainability and environmental considerations as well as price. Other issues raised in a recent briefing by UK Steel include EU-level action on Market Economy Status for China and direct funding assistance for the sector on Research and Development (R&D) and environmental improvements, which would come under the responsibility of both Welsh and UK Governments. The key challenges that the Welsh Government is able to respond to are those around business rates and procurement. The Welsh Government will also play a key role in supporting workers who have been made redundant through the ReAct programme, and through other economic development policy levers. These areas will be discussed in more detail later on today.