On 1 April 2018, the first Welsh taxes for almost 800 years will ‘go live’. The new Land Transaction Tax (LTT) and Landfill Disposals Tax (LDT) will replace UK Stamp Duty Land Tax (SDLT) and Landfill Tax (LfT) respectively.

This blog provides information on the new taxes and how these deviate from SDLT and LT currently in effect in Wales. These taxes will be collected and managed by the Welsh Revenue Authority (WRA).

Land Transaction Tax

The Land Transaction Tax and Anti-avoidance of Devolved Taxes (Wales) Act 2017 will legislate for LTT in Wales. The Cabinet Secretary for Finance, Mark Drakeford, announced the new LTT rates and bands alongside the draft budget in October 2017. However, in response to the UK Autumn Budget in November 2017, he revised the rates and bands for residential properties in December 2017.

LTT will be based on a marginal rate system like SDLT, which means the purchase price is taxed at a specific rate which applies to that band. For example, table 1 below shows that a £190,000 residential property would be exempt from the first £180,000 with LTT charged on the remaining £10,000 at 3.5%.

Residential properties

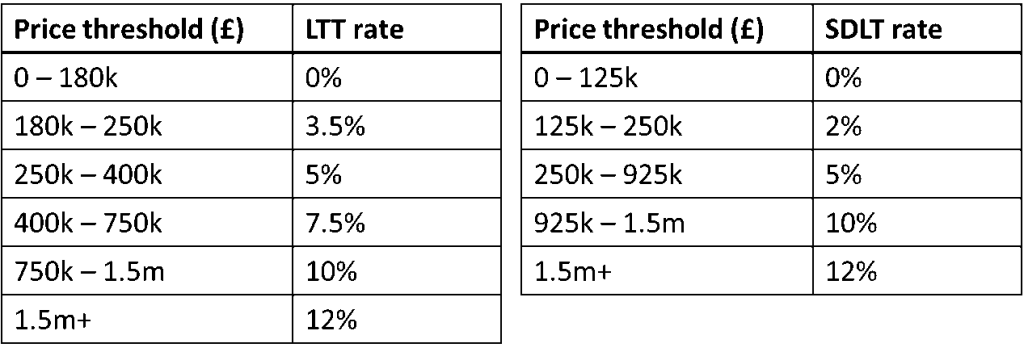

The proposed LTT rates and bands for residential properties are different to those that are currently in place in Wales under SDLT. As shown, residential properties up to £180,000 are exempt from LTT in Wales whilst it is currently properties up to £125,000 for SDLT.

Tables 1 & 2. Comparing Welsh LTT and UK SDLT rates for residential properties  The Cabinet Secretary for Finance commented that “this new threshold, which is £55,000 higher than the starting threshold for SDLT will reduce the tax burden for around 24,000 homebuyers in Wales.”

The Cabinet Secretary for Finance commented that “this new threshold, which is £55,000 higher than the starting threshold for SDLT will reduce the tax burden for around 24,000 homebuyers in Wales.”

Additional rate for residential properties

In November 2015, the UK Government announced the higher rates of SDLT would apply from 1 April 2016 to purchases of additional residential properties, such as second homes and buy-to-let properties.

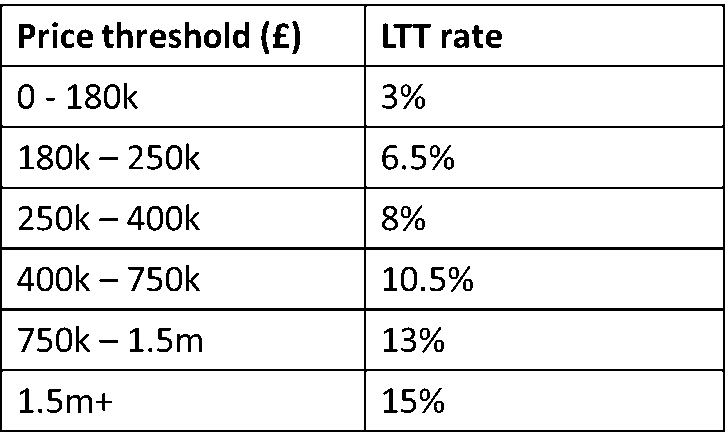

In response to this, the Welsh Government decided to impose an additional rate for LTT of 3% on all price thresholds. LTT rates for purchasing additional residential properties are as follows:

Table 3. Welsh LTT higher rates for additional residential properties

Non-residential properties

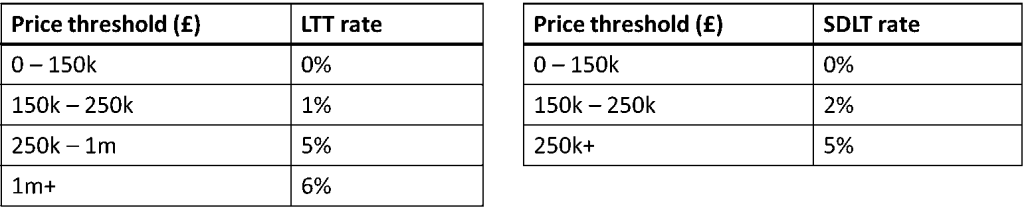

There are also differences in rates and bands between LTT and SDLT for non-residential properties. LTT in Wales will include an additional rate for properties over £1 million. Individuals will pay less LTT for properties between £150,000 and £250,000 when compared to SDLT but more for properties over £1 million.

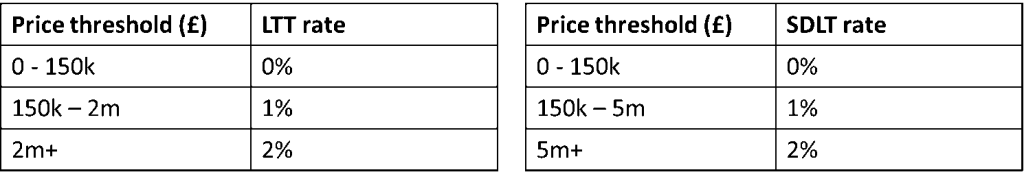

Tables 4 & 5. Comparing Welsh LTT and UK SDLT rates for non-residential properties  The price threshold for incurring a 2% LTT rate for non-residential lease rents is £3 million lower than SDLT. The Welsh Government explained this is due to generally lower lease rates in Wales meaning very few transactions would pay the top rate of LTT if it was consistent with SDLT.

The price threshold for incurring a 2% LTT rate for non-residential lease rents is £3 million lower than SDLT. The Welsh Government explained this is due to generally lower lease rates in Wales meaning very few transactions would pay the top rate of LTT if it was consistent with SDLT.

Tables 6 & 7. Comparing Welsh LTT and UK SDLT rates for non-residential lease rents

Landfill Disposals Tax

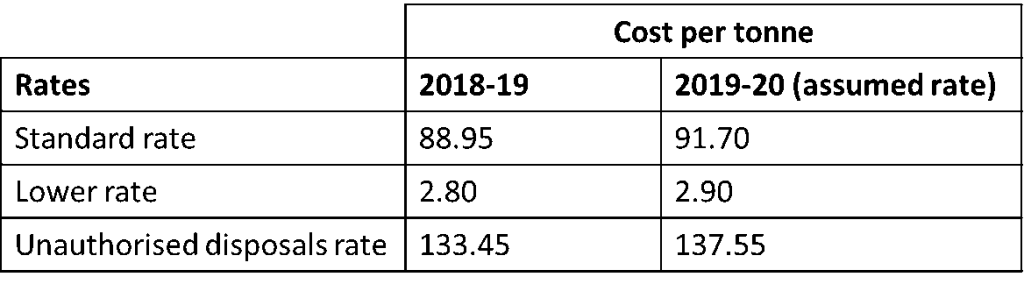

The Landfill Disposals (Wales) Act 2017 legislates for LDT, which will replace UK LfT in Wales from 1 April 2018. It will be a tax on the disposal of waste to landfill payable by landfill site operators. LDT will consist of a lower and standard rate like LfT but will also include a new unauthorised disposals rate.

In the Welsh Government 2018-19 budget, the Cabinet Secretary for Finance confirmed that the lower and standard rates of tax will remain consistent with LfT for 2 years with the unauthorised disposals rate set at 150% of the standard rate.

Table 8. Table showing Welsh LDT rates for 2018-19 and 2019-20

Welsh Revenue Authority

The Welsh Revenue Authority (WRA) has been established to manage and collect devolved taxes in Wales. The WRA was established in October 2017 and is the first non-ministerial department to be set up by the Welsh Government. The authority will operate independently from Welsh Government and be accountable to the Assembly.

Article by Christian Tipples, National Assembly for Wales Research Service