Article by David Millett and Hannah Johnson, National Assembly for Wales Research Service

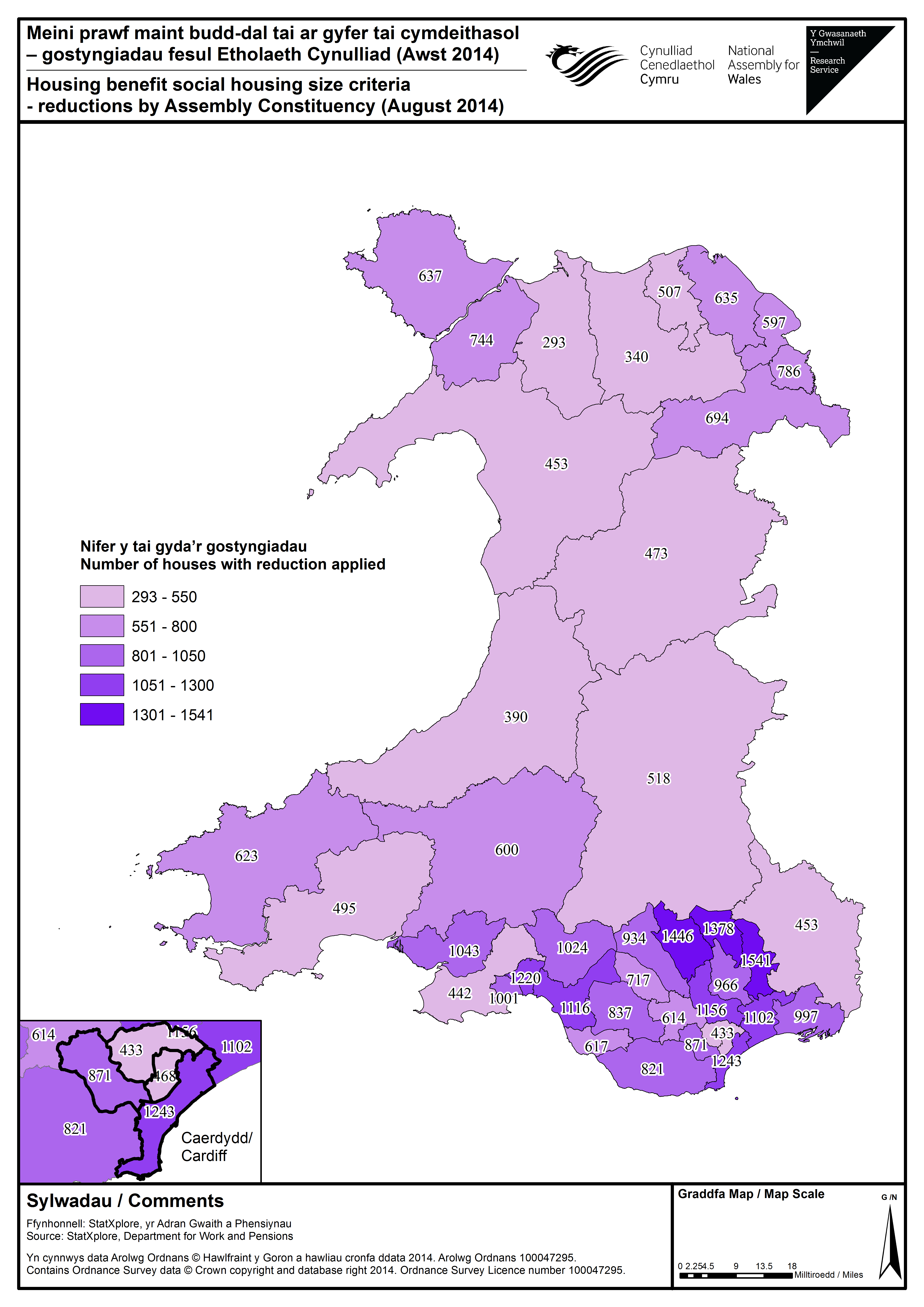

Today, the Assembly is debating the impact of welfare reform on Wales. One of the most controversial measures has been the Housing Benefit social housing size criteria, also known as the 'bedroom tax' or 'spare room subsidy'. Since 1 April 2013, working-age social housing tenants in receipt of Housing Benefit face a reduction in their entitlement if they live in housing that is deemed to be too large for their needs. The size criteria in the social rented sector restricts Housing Benefit to allow for one bedroom for each person or couple living as part of the household, with the following exceptions:

- children under 16 of same gender expected to share;

- children under 10 expected to share regardless of gender;

- disabled tenant or partner who needs non-resident overnight carer will be allowed an extra bedroom; and

- foster carers are allowed one additional room in their homes as long as they have registered as a foster carer or fostered a child within the past 12 months.

If tenants are deemed to be under-occupying their property, they face a reduction in their Housing Benefit of 14% for one spare bedroom and 25% where there are two or more spare bedrooms. Restrictions on entitlement to Housing Benefit based on the size of the accommodation occupied have applied to claimants living in privately rented housing since 1989. The map below illustrates figures from the UK Government's Department for Work and Pensions on the number of households that have had the reduction applied, broken down by Assembly constituency:  Further information and previous statistics are available in our previous post from December 2013.

Further information and previous statistics are available in our previous post from December 2013.