The Welsh Government published its First Supplementary Budget for 2024-25 on 1 October. This details the Welsh Government’s spending decisions since the Senedd approved its Final Budget on 5 March. It also includes a number of technical and administrative changes to the Welsh Government’s budget.

This article highlights the key allocations, the Welsh Government’s funding position and how much it has left to spend, as set out in the Supplementary Budget. Senedd Research has produced a Budget Glossary, which explains some of the terms we have used.

How much has the Welsh Government allocated in the Supplementary Budget?

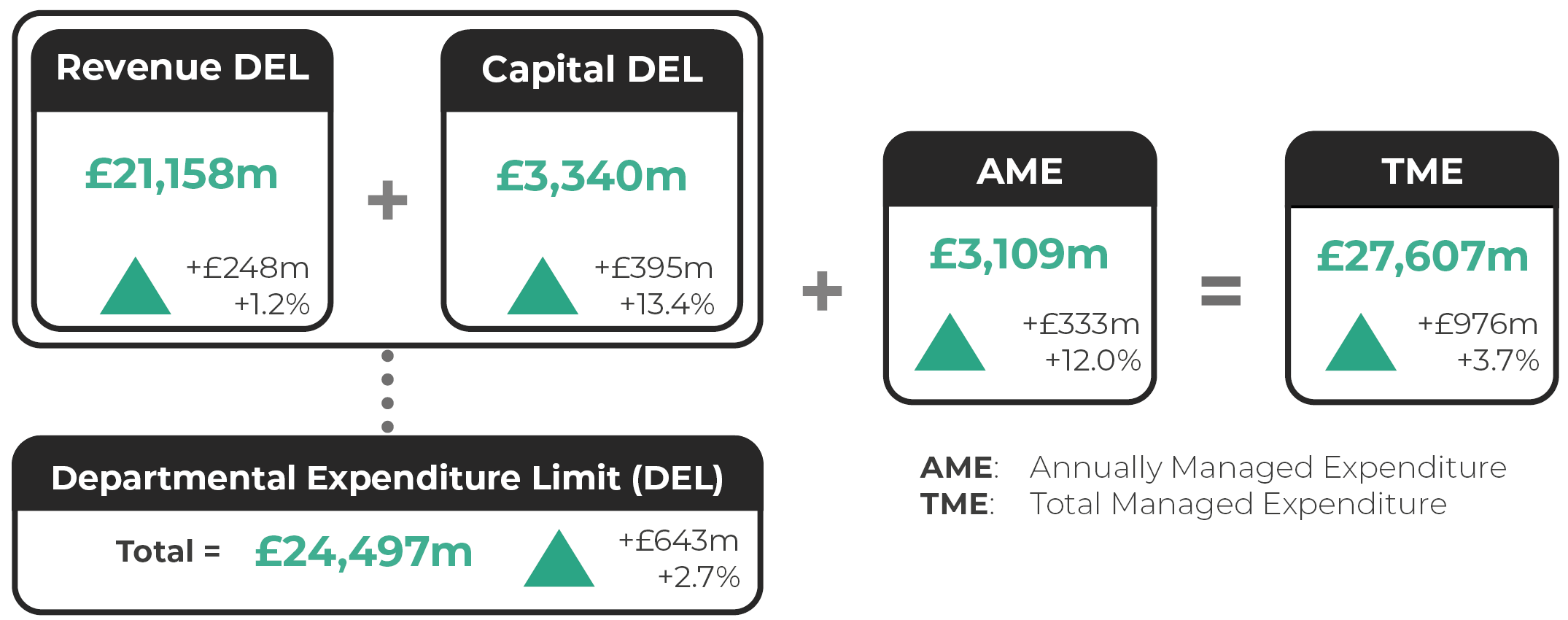

The Supplementary Budget shows an increase in the total revenue and capital (excluding Annually Managed Expenditure or ‘AME’) funding allocated to the Welsh Government departments of £643m or 2.7% compared to the Final Budget for 2024-2025. As shown in Figure 1:

- Revenue has increased by £248m (1.2%) to £21.2bn;

- Capital has increased by £395m (13.4%) to £3.3bn;

Figure 1: Headline figure from the First Supplementary Budget 2024-2025, showing the changes from the restated* Final Budget 2024-2025.

*The Welsh Government restated its 2024-25 Final Budget in June 2024 and further restated it in the First Supplementary Budget to reflect the most recent Cabinet portfolios announced in September.

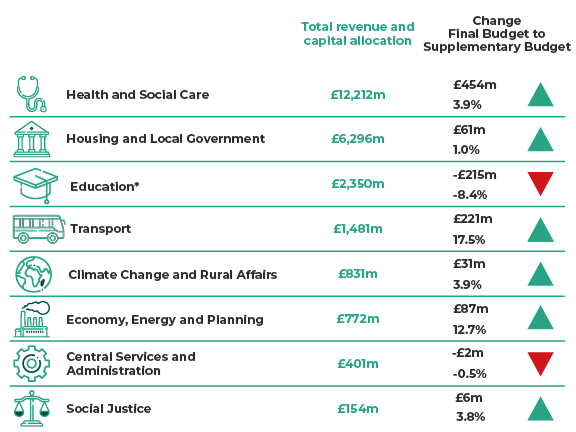

As shown in Figure 2, most government departments have seen an increase in funding, with the largest value increase for Health and Social Care, (an increase of £454m or 3.9%), and the largest percentage increase for Transport (an increase of £221m or 17.5%). The largest decrease in value and percentage is for Education (a decrease of £215m or 8.4%).

The decrease in the Education budget reflects a fiscal (or cash) increase of £25m. This is more than offset by a reduction in non-fiscal (or non-cash) allocations of £237m, which reflects the annual cost of student loans and does not affect Welsh Governments spending power. On 10 October, a Welsh Government official told the Finance Committee:

“It's sort of a double ring fence, in that it is non-fiscal, so there is no cash attached to it, and it can only be used for the purposes of student loans”

Figure 2: Changes between the Departmental Expenditure Limits in the First Supplementary Budget 2024-25, from the Final Budget 2024-25

* Includes allocation of £277 million of non-fiscal revenue due to student loans.

Figures are rounded. Please refer to the Welsh Government First Supplementary Budget 2024-2025 for exact figures.

Not all of the changes relate to Welsh Government policy decisions, some changes relate to technical budget and accounting adjustments, as well as decisions by the UK Government. There are no new allocations in this budget: all changes relate to previously announced funding. Previous allocations can be found in the Final Budget 2024-25. Public sector pay awards announced on 10 September are not included in this Supplementary Budget.

The Welsh Government has also transferred funding between and within its departments.

How has the funding position changed?

Tax revenue forecasts for Welsh Rates of Income Tax (WRIT), Land Transaction Tax, Landfill Disposals Tax and non-domestic rates as “forecasts continue to reflect those published at the time of the Final Budget”.

The Welsh Government hasn’t proposed any changes in borrowing since the Final Budget, and will continue to borrow the maximum of £150m, under the Fiscal Framework.

The Welsh Government will drawdown a further £39m of revenue funding from the Wales Reserve on top of the £86m planned in the Final Budget, bringing the total amount to £125m. There is no change to the drawdown from Wales Reserve for capital, which is unchanged at £50m.

Technical changes

The impact of implementing the new accounting standard for leases (International Financial Reporting Standard (IFRS) 16) has been significant in this Supplementary Budget. As technical adjustments, they do not affect existing spending power. The overall adjustments to the Supplementary Budget are as follows:

- A reduction of revenue (cash) of £116.9m;

- An Increase in revenue (non-cash) of £119.9m; and

- An Increase in capital of £338.9m.

UK Government funding for pension schemes

The UK Government has provided additional funding to UK Departments for increased costs of changes to the rate of Superannuation Contributions Adjusted for Past Experiences (SCAPE), which are non-civil service pension schemes. The Welsh Government has received Barnett consequentials as a result of this, and funding has been allocated in this Supplementary Budget as follows:

- Health and Social Care - £117.1m for NHS staff costs;

- Housing and Local government - £63.8m in total for teachers (pre-16) and the Fire Service;

- Education - £11.9m for teachers in sixth form settings and Further Education colleges.

Impact of inflation, costs and wage pressures

Over the last few years, inflationary pressures have been a cause of concern for the Welsh Government as higher inflation has had a significant impact on providing public services. The latest consumer price index figure, published on 16 October 2024, was 1.7%. The Bank of England confirmed that the inflation figures are expected to rise to 2.5% by the end of the year, but it expects this increase to be temporary with inflation coming back down in 2025.

Annual growth in employees’ average regular earnings (excluding bonuses) was 5.1%; growth was last lower than this in April to June 2022, when it was 4.7%. In March 2024, the OBR estimated that nominal average pay growth will slow to 3.6% in 2024 and will fall to around 2% for 2025 and 2026.

Reserves

The Welsh Government carries in-year reserves, which essentially means the funding it has yet to allocate. The Welsh Government reserves, after making the allocations in its Supplementary Budget, include:

- Fiscal revenue of £35.8m (an increase of £3.2m since the Final Budget); and

- Non-fiscal revenue of £76.8m (a decrease of £415.2m since the Final Budget);

Its general capital reserve is over allocated by £110.1m (it was over-allocated by £109.0m at the Final Budget). Welsh Government does this to ensure that there is not an underspend in capital at the end of the year, and to ensure that any capital coming in the later part of the year can be spent.

What’s next?

The Senedd will debate the Supplementary Budget on 22 Octoberwhich will be available to view on Senedd TV.

Article by Peter Davies and Helen Jones, Senedd Research, Welsh Parliament