The Welsh Government published its First Supplementary Budget 2023-24 on 13 June 2023. This details the Welsh Government’s spending decisions since the Final Budget was approved by the Senedd in March.

This article highlights the key allocations, the Welsh Government’s funding position and how much it has left to spend as set out in the Supplementary Budget. Senedd Research have produced a Budget Glossary, which explains some of the terms we have used.

How much has the Welsh Government allocated in the Supplementary Budget?

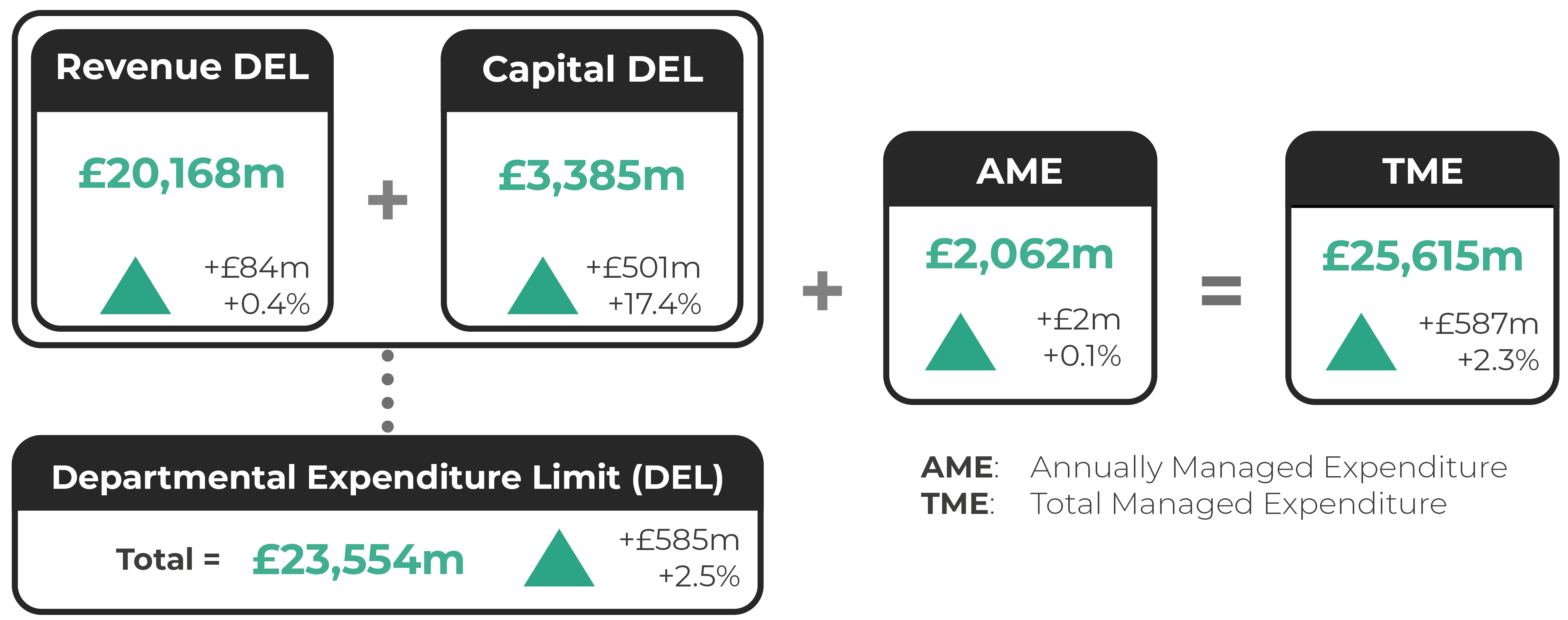

The Supplementary Budget shows an increase in revenue and capital combined (excluding Annually Managed Expenditure or ‘AME’), allocated to Welsh Government departments, of £585.3 million (2.5%).

This is a rise from £23.0 billion to £23.6 billion, compared to the Final Budget for 2023-24 (see Figure 1). The majority of this is an increase in capital:

- revenue has increased by £84 million (0.4%) to £20,168 million;

- capital has increased by £501 million (17.4%) to £3,385 million.

There are few significant ‘new’ allocations in terms of cash allocations in this supplementary budget. Most adjustments relate to changes required for the implementation of the new accounting standard for leases (IFRS 16).

Figure 1: Headline figures from the First Supplementary Budget 2023-24, showing changes from the restated Final Budget 2023-24

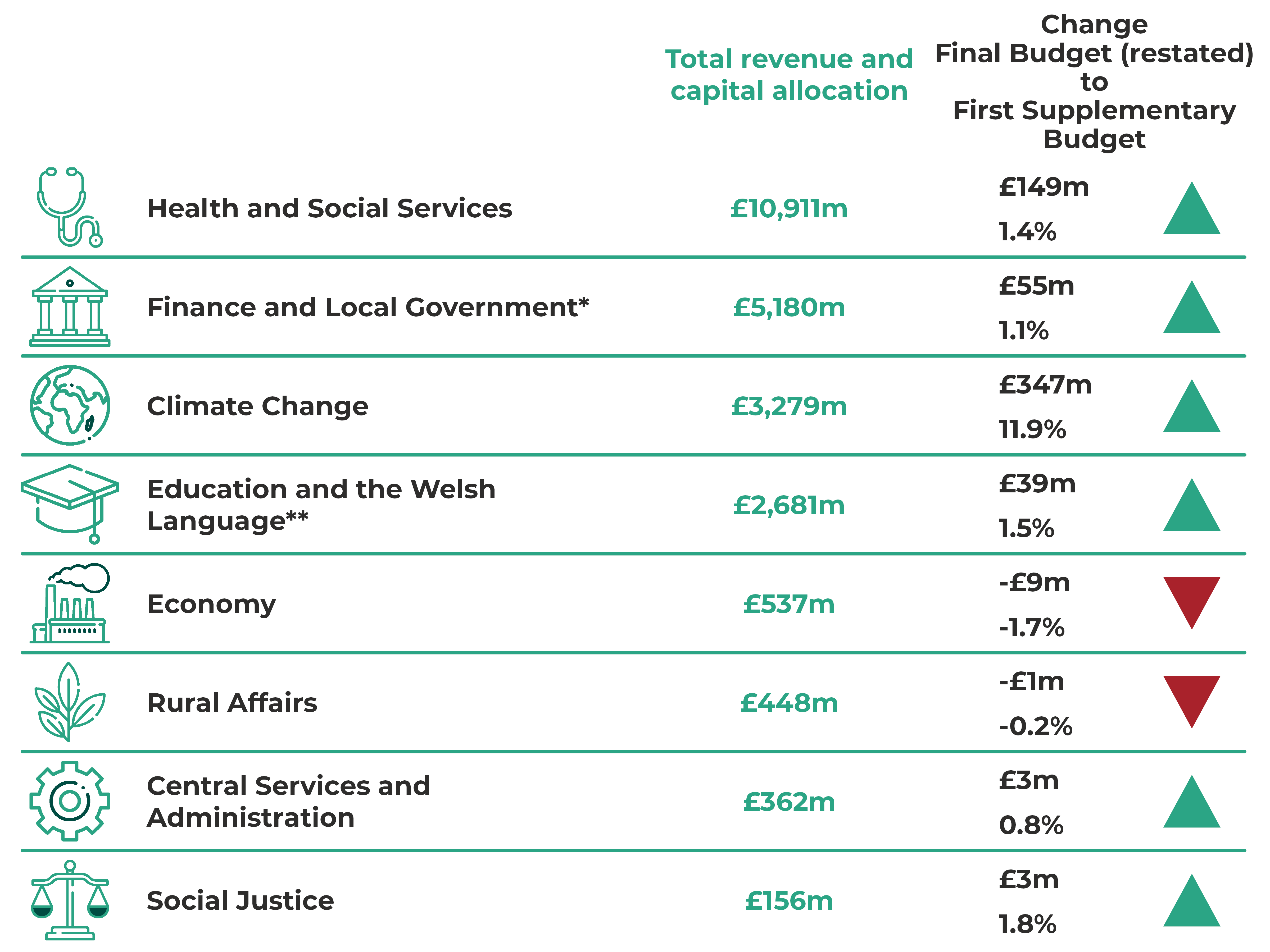

Most government departments see an increase in funding, with the largest in value terms allocated to Climate Change (an increase of £347 million or 11.9%). The largest decrease in value and percentage terms is for Economy (a decrease of £9 million and 1.7%).

Figure 2: Changes between the Departmental Expenditure Limits in the First Supplementary Budget 2023-24, from the restated Final Budget 2023-24

* Excludes around £0.9 billion non-domestic rates income.

** Includes allocation of £488 million of non-fiscal revenue due to student loans.

Figures are rounded. Refer to the Welsh Government First Supplementary Budget 2023-24 for exact figures.

How has the funding position changed?

There are to tax revenue forecasts for Welsh Rates of Income Tax (WRIT), Land Transaction Tax, Landfill Disposals Tax and non-domestic rates as “forecasts continue to reflect those published at the time of the Final Budget”.

The Welsh Government also hasn’t proposed any changes to its borrowing plans, which will see it borrow the maximum permitted (£150 million) under the Fiscal Framework..

The impact of implementing of IFRS 16 have been significant in this supplementary budget. They include:

- a reduction to revenue (cash) of £100.1 million;

- an increase to revenue (non-cash) of £104.8 million; and

- an increase to capital of £436.0 million

However, as confirmed by the Minister for Finance and Local Government, the change is a technical one and “doesn’t aff our spending power”, unfortunately”. Since the Final Budget, there has been a UK Budget and Main Estimates resulting in a net increase in fiscal resource of £27.7 million funding for Wales. There has also been an increase of £220.8 million in non-fiscal resource.

Excluding the £436 million in respect of the implementation of IFRS 16, General Capital funding also increased by £103.2 million. This includes £58 million for Wales’ City and Growth Deals.

There has been a decrease in the Financial Transactions Capital baseline of £3 million as a result of negative consequentials from the Main Estimate. A small increase of £1.7 million revenue and £456,000 capital were also noted in the Health and Social Services MEG.

The Senedd Commission proposed a reduction of £435,000 to its budget, whilst the Public Services Ombudsman submitted a request to increase theirs by £213,000.

Impact of inflation, costs and wage pressures

One of the key issues raised in scrutiny over the past 12 months has been the impact of inflation and the knock-on effects this is having.

While forecasts for economic growth have improved slightly, falls in inflation have been slower than expected and recent wage inflation figures have been higher than expected (although below inflation). The latest figures for the consumer price index measure of inflation, last published on 21 June 2023, stood at 8.7%.

Growth in employees’ average total pay (including bonuses) was 5.8% and growth in regular pay (excluding bonuses) was 6.7% in January to March 2023.

During scrutiny and reflecting on the impact of inflation on this supplementary budget, the Minister for Finance and Local Government said:

I suppose the key place where you would see that is in the £28 million that has been drawn down from the Wales reserve and allocated to the education and Welsh language main expenditure group, and that is for the costs of the 2022-23 pay award for teachers in schools and further education for the remainder of the academic year that falls within this financial year.

The Minister told the Finance Committee that the Welsh Government had not made any further changes to its spending plans, adding the current context “require[s] us to think more creatively about what we deliver”.

Is there enough left in reserve?

There is an additional £28 million in this Supplementary Budget to the planned £38 million revenue planned to be drawn down in the Final Budget. The funding available in the Wales Reserve will be dependent on how much of the budgeted £175 million (revenue and capital) was drawn down in 2022-23 and the final balance at year end.

The Supplementary Budget states that the following reserves are currently held:

- fiscal resource: £60.1 million (an increase of £47.1 million since the Final Budget); and

- non-fiscal resource : £662.0 million (an increase of £119.4 million since the Final Budget).

As “an exception for 2023-24 only” the Treasury has waived annual drawdown limits to the Wales Reserve, which allows Welsh Government to withdraw everything held in the Reserve.

The supplementary budget shows that the Welsh Government continues to over-allocate against its capital budgets. Overallocation of general capital is reduced by £37.5 million to £61 million, however the Financial Transactions capital overallocation has increased by £2.2 million to £28.3 million.

The Minister for Finance and Local Government told the Finance Committee:

I think that the big challenges, really, are the size of the Wales reserve and the amount that we're able to borrow, both annually and in aggregate as well. Those are challenges that continue.

What’s next?

The Senedd will debate the Supplementary Budget on 4 July . This will be available to view on Senedd.TV and a transcript will be available shortly afterwards.

Article by Božo Lugonja and Joe Wilkes Senedd Research, Welsh Parliament