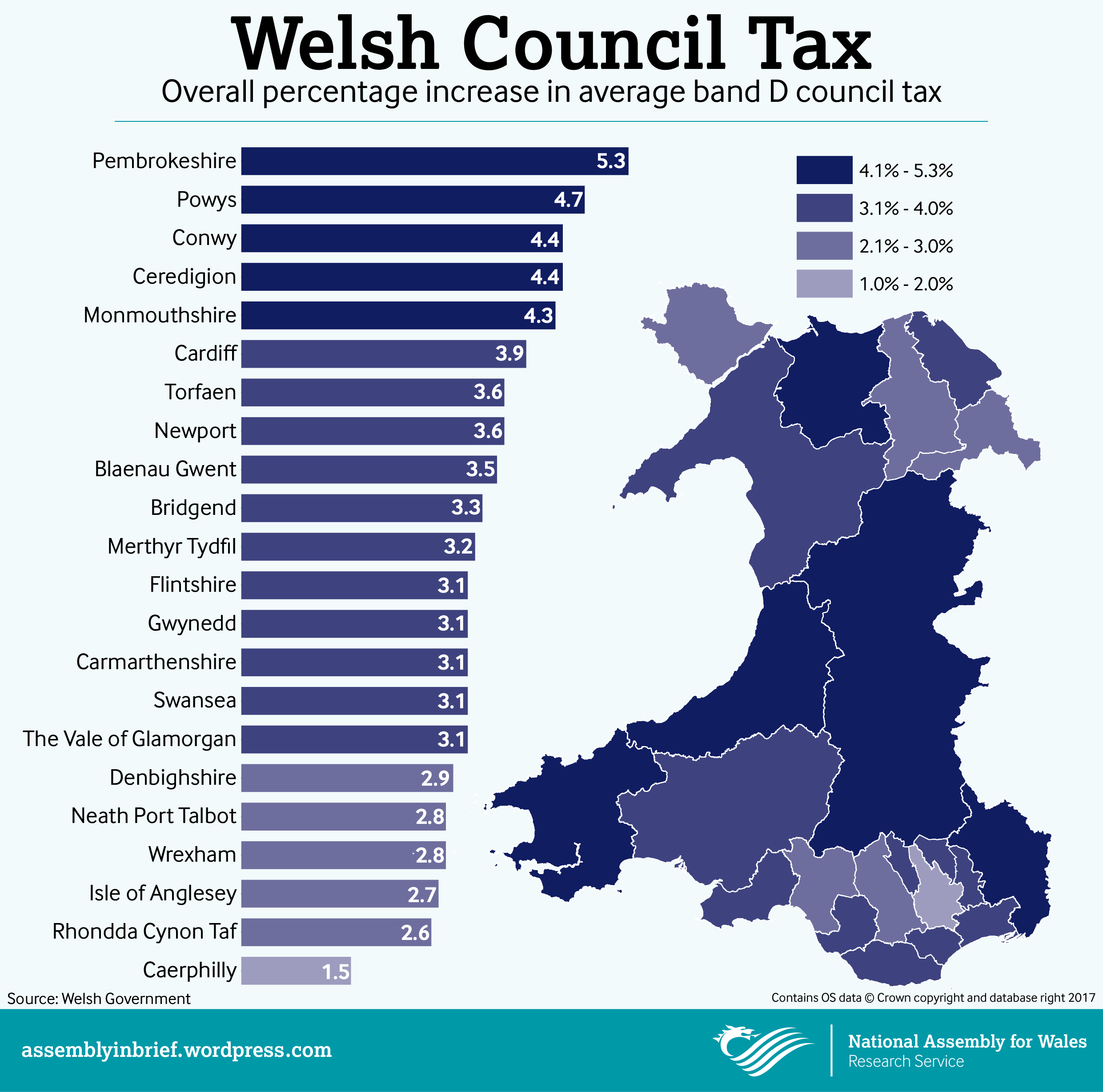

On Thursday (22 March 2017) the Welsh Government published its annual statistical release on Council tax levels, this follows local authorities and Police and Crime Commissioners setting their budgets for 2017-18. The release collates changes to council tax across Wales and breaks down its constituent elements. This blog provides a summary of the data. Council tax is usually compared by looking at the average price paid for band D properties. For 2017-18, the average price of a band D property in Wales will rise by £46, from £1,374 to £1,420. An average overall increase of 3.3%.

Local authorities, Police and Crime Commissioners and community councils all levy council tax (with local authorities the “billing authority” responsible for collection). Of the total £1,420 average band D council tax, local authorities will receive £1,162 (81.8%), community councils £32 (2.2%, average across county) and Police £227 (16%).

In 2017-18, the largest increase in overall council tax will be in Powys, where the combined local authority, community council and Police increase is £62 (4.7%), the largest percentage increase in council tax is in Pembrokeshire, where council tax will rise by 5.3% (£56). Pembrokeshire currently has the lowest charge for a band D property (£1,128); Blaenau Gwent has the highest (£1,754). The average increase by local authorities (including community councils but excluding police) will be £35 (3.1%). The highest percentage increase is in Pembrokeshire (4.9%) with the lowest in Caerphilly (1%). In terms of cash increases, the highest increase is in Monmouthshire (£52) with the lowest in Caerphilly (£10).

Police and Crime Commissioners are increasing their precept by between £9 and £14 or 3.8% and 6.9%. Dyfed-Powys has the highest increase in both cash and percentage terms.

Further statistical information regarding council tax is available on the Welsh Government statistical website StatsWales

Article by Owen Holzinger and David Millett, National Assembly for Wales Research Service.

This post is also available as a print-friendly PDF: Council tax levels 2017-18 (PDF, 197KB)