On 20 February, the Welsh Government published its Final Local Government Settlement 2025-26. It sets out total core funding for local authorities, which will increase by 4.5%. That’s slightly more funding than was originally proposed when the Draft Budget was published in December. However, demand and inflationary pressures mean local authorities are still likely to face difficult decisions in 2025-26.

In this article we also consider the 3.7% increase to core funding for another key local service, police. The funding for both will be debated alongside the Final Budget on Tuesday 4 March.

Core funding for local authorities will increase by 4.5%

Core revenue funding comprises the Revenue Support Grant (RSG) and Redistributed Non-Domestic Rates (NDR), and is also referred to as Aggregate External Finance (AEF). AEF makes up the bulk of the Welsh Government’s funding to local authorities and will be £6.1bn next year. After adjusting the figures to make them comparable, that’s an increase of £261.7m or 4.5%, compared to 2024-25. For context, the annual increase in funding for 2024-25 was 3.3% and for 2023-24 was 7.9%.

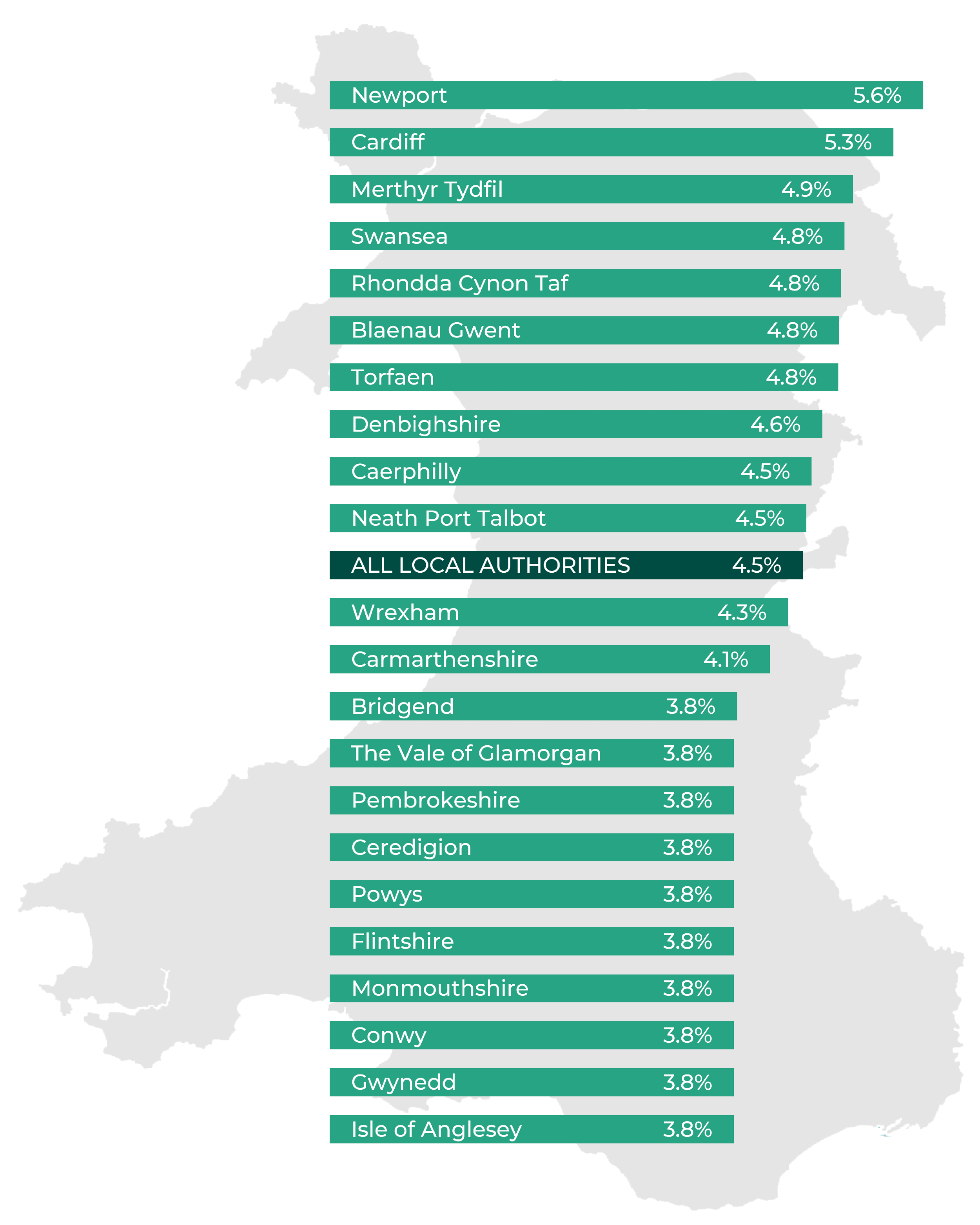

As part of its budget agreement with Jane Dodds MS, leader of the Welsh Liberal Democrats, the Welsh Government has implemented a funding floor in the Final Settlement. This means no authority gets less than a 3.8% increase in 2025-26. There are 9 local authorities benefitting from this approach. The largest increase in percentage terms is for Newport (5.6%).

Figure 1: Change in AEF (adjusted) by local authority (2024-25 to 2025-26)

Source: Welsh Government – Final Local Government Settlement 2025-26 tables

The Final Settlement also sets out some of the other sources of funding for local authorities. There’s £1.1bn of capital grants, including £200m of capital funding which is £20m more than 2024-25, as well as £1.4bn of revenue grants.

All local authorities have seen at least a slight change in what they’re getting next year compared to the Provisional Settlement published in December. This is because of an increase to national park levies, a very small change in the tax setting base and an update to the general capital fund model data to 2025-26, which feeds into the main settlement formula.

Council tax for 2025-26 in the process of being determined

One of the other big areas of income for local authorities is council tax. Local authorities are currently setting their budgets for the forthcoming financial year, including deciding the level of council tax.

The WLGA told the Finance Committee in January increases in council tax were “in the range of probably 5[%]… or upwards for budget planning”. Though we’re likely to see some variation between local authorities. Wales Fiscal Analysis, a research body at Cardiff University, suggests a 5% rise in council tax provides around £110m of income across local authorities.

Pressures for local authorities likely to continue

The Cabinet Secretary for Housing and Local Government, Jayne Bryant MS, acknowledges the “considerable financial pressures faced by local authorities”. Prior to publication of the Draft Budget, the WLGA estimated pressures on local authority budgets totalling £559m in 2025-26.

The WLGA talks about two broad categories mainly responsible for the pressure faced by local authorities: inflation (including things like pay increases) and demand. It says pressures are “unrelenting” and estimates further pressures of £454m in 2026-27 and £464m in 2027-28.

The two big individual areas of pressure are Social Care and Schools. In 2025-26 they make up around 40% and 22% of the pressure, respectively.

Following publication of the Provisional Settlement in December, a member of the WLGA warned that without the necessary funding “the ability of our essential local services to fulfil statutory duties, and support residents’ needs will be severely impeded”. During Draft Budget scrutiny the risk of a council going ‘bankrupt’ (meaning the issuing of a Section 114 report) was discussed with committees. The Leader of the WLGA said he didn’t think that was on the cards for the next 12 months.

Core funding for police to increase by 3.7%

While policing isn’t devolved, funding for policing is delivered through an arrangement involving the Home Office, the Welsh Government and council tax. For 2025-26 the total core support for police forces in Wales will be £476.8m. This is a 3.7% increase compared to 2024-25.

As it has done previously, the Home Office has overlaid the formula for working out the change with a floor mechanism. That means all police forces in England and Wales get the same change in core funding. The Welsh Government element of this funding will be £113.5m, unchanged from the Provisional Police Settlement, published in December.

A portion of funding for police also comes from council tax. Police and Crime Commissioner’s set a council tax precept each year, which forms a part of council tax bills. Increases look like they’ll range from 6.44% for North Wales to 8.6% in Dyfed-Powys.

What next for local services?

Local authorities need to set their budgets by 11 March each year. As part of that, they’ll be considering what services look like in 2025-26 and what level to set council tax. With UK Government and Welsh Government spending reviews underway, future funding for local authorities will be under consideration. Those reviews might result in a longer term indication of local authority funding, something local authorities have called for.

However, in its Final Budget the Welsh Government warns about the implications of lower economic growth and higher borrowing costs on public finances. It also notes the impact this could have on the overall spending envelope beyond 2025-26 for UK departments and devolved nations. The Chief Economist was already anticipating a more challenging situation for public finances after next year. If that ends up being the case, it could mean more difficult decisions to come for the Welsh Government and local authorities.

On Tuesday 4 March, the Senedd debates a raft of budget items including:

- The Final Budget 2025-26

- The Welsh Rates of Income Tax 2025-26

- The Final Local Government Settlement 2025-26

- The Final Police Settlement 2025-26

You can watch live, or after, on SeneddTV.

Article by Owen Holzinger, Senedd Research, Welsh Parliament