Our previous article looked at progress towards net zero and the Welsh Governments commitments in this regard.

Wales won’t be able to deliver its emissions reduction targets without rapid progress in the use of rechargeable batteries across the transport and energy sectors. So, can the technology and manufacturing capacity to produce batteries keep up with “ambitious” Welsh and UK decarbonisation and electrification policies? From electric planes to grid storage, each potential application will require different things from rechargeable battery performance.

The properties of some battery chemistries, important for the energy transition, are summarised in the table below. It includes how ‘ready to go’ the battery technology is and factors relevant to sustainability.

* Energy density is the amount of energy delivered by a battery in a full discharge per kilogram of the battery's mass. In the case of electric vehicles, a higher energy density means more miles of range for the same battery weight.

The push for electric vehicles

The UK Government intends to ban the sale of pure petrol and diesel cars by 2030, and all non-zero emission cars and vans by 2035, forcing manufacturers to shift production to battery electric vehicles (EVs).

The National Transport Delivery Plan sets out further Wales specific goals, like the Welsh Government’s ambition to move to a zero-emission bus fleet by 2035, and a zero-emission taxi fleet by 2028.

Despite these targets, EVs accounted for only 1.3% of all licensed vehicles in Wales at the end of June 2024. To accelerate EV uptake, the Welsh Government developed its EV Charging Strategy in 2021. Recently, it consulted on draft amendments to Building Regulations to ensure charge points are installed in all new residential and non-residential buildings, and buildings undergoing major renovations or material change in use, where car parking is part of the development.

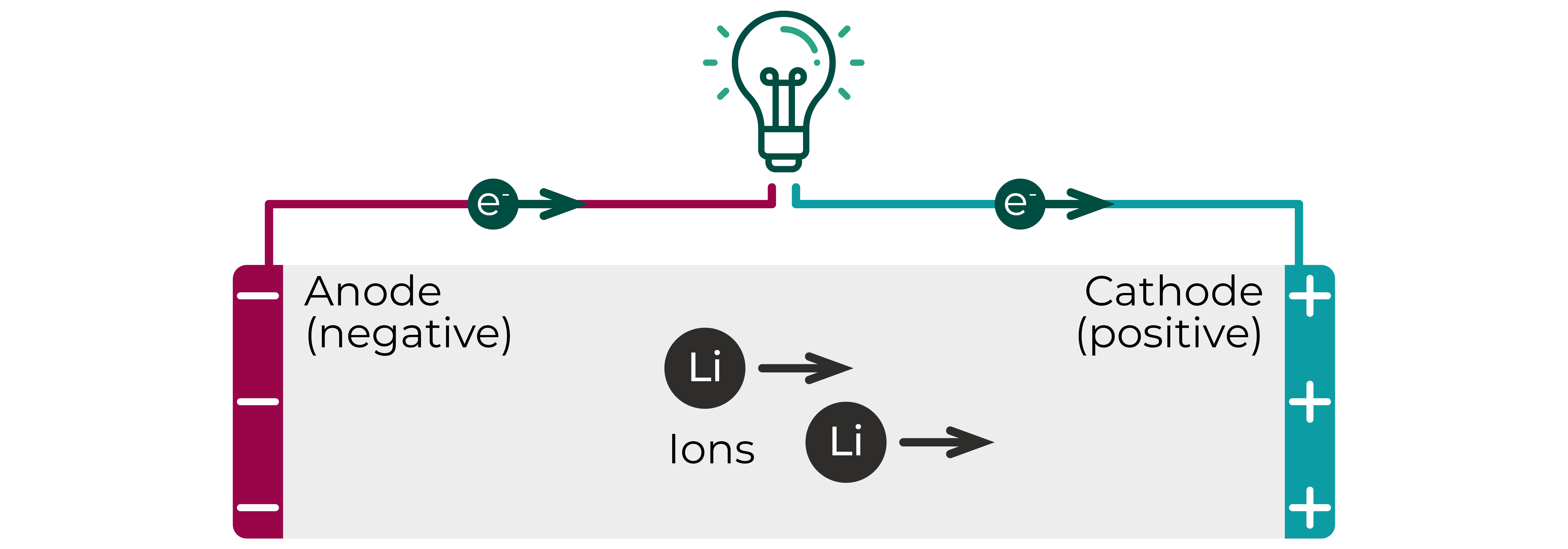

Currently, lithium-ion (Li-ion) batteries dominate the EV market. The most common Li-ion battery in the European EV market uses nickel manganese cobalt oxide (NMC) cathodes. These deliver the best driving range per kilogram. However, extra miles come with drawbacks. They are more likely to catch fire than alternative materials, and serious ethical and environmental concerns exist around the mining of cobalt.

Another common Li-ion battery in the EV market uses lithium iron phosphate (LFP) cathodes. Current production is mainly located in China, but major European carmakers like Volkswagen have announced plans to use LFP in entry level vehicles. These are generally cheaper and safer than NMC, have longer lifespans and use less critical minerals.

Sodium-ion (Na-ion) batteries, an emerging technology, are already manufactured on a large scale in China. Although these batteries store less energy per kilogram, they use abundant, inexpensive raw materials. A future application could be in low-cost urban transport.

It’s still not clear which technology will be most suitable to decarbonise the freight sector; battery electric, hydrogen fuel cell or overhead catenary system.

An ideal candidate for battery powered trains

The UK Government is responsible for the rail system in Wales, with some executive powers devolved. Its ambition is for all diesel-only trains to be removed from the rail network by 2040.

Trains run on tight schedules so charging time is key for electric train batteries. Lithium-titanate (LTO) batteries can be fully charged in 10 minutes or less, making them ideal for rail.

Decarbonisation across Wales’ rail network will likely be driven by rail electrification along with the introduction of battery powered or hybrid trains where it makes economic and operational sense. Recently, Transport for Wales introduced state-of-the-art electric ‘tri-mode’ passenger trains in South Wales. These are the first in the UK switching to diesel or battery power where the track has no overhead electrified wires.

Optimism for the marine and aviation industries

The Senedd agreed to include Wales’ share of emissions from international aviation and shipping in Wales’ carbon budgets, despite these sectors being largely reserved. UK-wide international aviation and shipping emissions will also be included for the first time in the UK’s overall Sixth Carbon Budget. This has put significant pressure on these ‘difficult to decarbonise’ sectors.

The Welsh Government expects zero emission technologies to have a role in aviation and shipping and has announced plans to work with the UK Government and Cardiff Airport to encourage the development of zero emission aircraft.

Current Li-ion batteries could be used in short-range shipping or in hybrid systems, but the Climate Change Committee (CCC), the UK’s statutory advisor on climate change, has said that significant breakthroughs in range and cost will be needed for batteries to out-compete liquid fuels for deep-sea voyages.

Despite what are arguably bold projections in the UK Government’s Jet Zero Strategy, such as the first battery powered aircraft to enter service by 2035, the CCC also predicts electric flight won’t be feasible by 2050.

Electric flight requires batteries to be smaller and lighter. Research has focused on lithium-sulphur (Li-S) batteries which can deliver much more energy per kilogram. However, improvements in longevity and rapid discharge capability are needed before Li-S batteries can be used commercially.

Sustainable grid storage solutions

The UK Government has introduced a target to decarbonise the country’s electricity system by 2030. Since renewables mostly rely on the weather to generate electricity, access to reliable real-time electricity will require support from grid scale energy storage technologies such as batteries.

Battery performance is less critical when used in stationary storage applications. In this case, Na-ion or second life EV batteries could be used instead of Li-ion to reduce demand for lithium and other critical minerals. As our infographic shows, sodium is more abundant in supply than lithium.

A UK-based battery life cycle

The life cycle of a battery begins with raw material extraction. These materials must then be refined before being used to make batteries in gigafactories. After first use, the battery is ideally reused or recycled.

The UK's only existing gigafactory, the Nissan-owned Envision AESC in Sunderland, has 2 GWh of capacity. UK battery demand is forecast to reach nearly 200 GWh by 2040, raising the question – where will these batteries come from?

UK EV manufacturers looking to answer this question face a number of restrictions. To continue exporting EVs into the EU, manufacturers must meet a number of requirements including those set by the post-Brexit UK-EU Trade and Cooperation Agreement (TCA). This includes meeting Rules of Origin thresholds to avoid tariffs, as well as minimum levels of recycled content and the requirement of a battery passport.

The UK Government’s Battery Strategy outlines both the challenges and opportunities arising from these policies. Currently, the UK relies heavily on imports of critical raw materials and batteries, but the Rules of Origin requirements could incentivise companies across the battery life cycle to invest in the UK. The implementation of a digital product passport for batteries could improve transparency in the supply chain, and help identify environmentally friendly materials and manufacturing processes.

To encourage private investment into clean energy industries like batteries, the UK Government launched a National Wealth Fund (NWF). In its manifesto, the Labour Party said it would allocate £1.8 billion to upgrade ports and build supply chains, and £1.5 billion to new gigafactories.

Wales could potentially play a key role in the emerging UK battery industry. Vale’s Clydach refinery based in the South Wales Industrial Cluster is the only high purity nickel refinery in the UK and one of the largest in Europe, making nickel products that can be used to make cathodes, the most valuable component of a battery. Since high nickel chemistries are predicted to dominate UK battery production, a domestic nickel source would ensure UK-made batteries can meet Rules of Origin requirements.

Issues relating to batteries look set to remain on the agenda give the continued political focus on sustainable energy sources, transport and climate change.

Article by Samantha Southern, Senedd Research, Welsh Parliament

Senedd Research acknowledges the parliamentary fellowship provided to Samantha Southern by the Engineering & Physical Sciences Research Council which enabled this briefing to be completed.