The Welsh Government has published its Draft Budget for 2021-22 (the Budget) on 21 December 2020. It sets out significant changes to devolved taxation in Wales and also the funding each Welsh Government department will receive. The Budget is published in the context of considerable uncertainty regarding the direction of the COVID-19 pandemic and associated funding the Welsh Government would receive as a result of additional spending allocations that may be needed in England. There are also uncertainties on trading relations after the Brexit EU transition deadline.

Headline Figures

The Budget confirms that £766m will be provided via Barnett consequentials relating to COVID-19 in 2021-22. This is less than the £5bn in consequentials Wales has received so far during 2020-21, due to the end of various COVID-19 funding schemes in England. Depending on the progress of the pandemic, it is possible that additional consequential funding will be made available for the Welsh Government by the time the Final Budget is ready for publication, or during the course of 2021-22.

Despite this uncertainty, the Welsh Government commits to providing an additional £420m for health and social services and £176m to support pressures on schools and social services. The Budget also includes allocations of:

- £40m in additional funding for the Housing Support Grant;

- £20m to support active travel;

- Over £20m to meet sixth form and further education demographic pressures;

- £8.3m to support curriculum reform;

- £9.4m to support community and school mental health services;

- £274.7m for investment in the rail and metro network;

- £36.8m in additional funding for social housing, taking the total budget to £200m for the forthcoming year;

- £5m to develop the National Forest and to invest in biodiversity.

The Welsh Government’s Provisional Local Government Settlement for 2021-22 was published on 22 December 2020, with £4.65bn of funding for local authorities in core revenue funding and non-domestic rates funds, for the forthcoming year. Don’t forget to read Senedd Research’s upcoming blog on this subject, which will be published early in the New Year.

Departmental Allocations

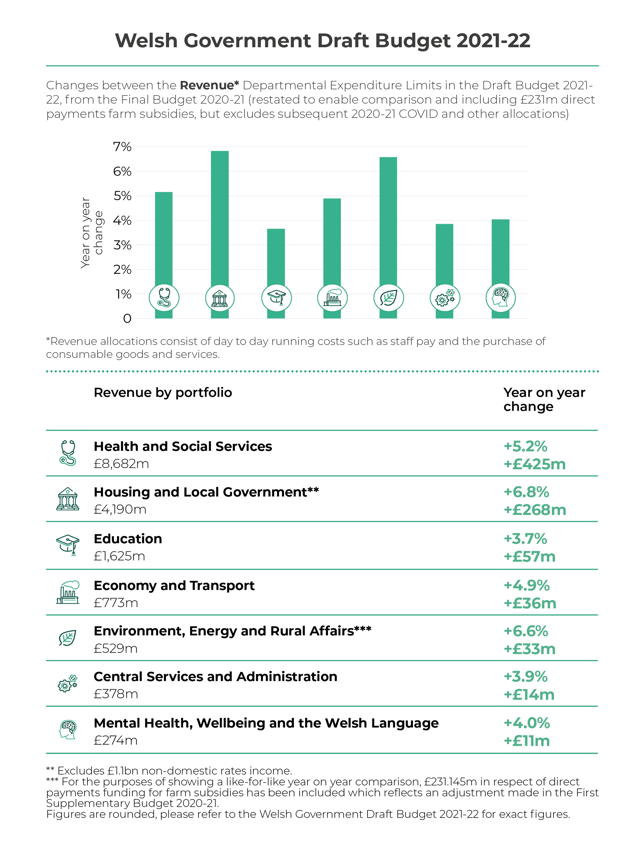

The infographic below outlines the allocations by portfolio in the Budget, with comparisons made with the Welsh Government’s Final Budget for 2020-21.

Typically, the Budget’s figures would be compared with the most recent Supplementary Budget published during the previous year. In this case, this would mean comparison with the Second Supplementary Budget 2020-21, which was published on 20 October 2020. Because of the impact of one-off additional COVID-19 spending during 2020-21, reflected in the Supplementary Budgets for 2020-21, our comparisons below are made with the Final Budget for 2020-21, as this provides a more relevant baseline when comparing year-on-year spend.

The Welsh Government’s allocated core revenue budget for 2021-22 is around £16.5bn, the majority of which is allocated on Health and Social Services spending. There is considerable additional funding across all portfolios, with the most significant increases in financial terms for Health and Social Services (£425m) and Housing and Local Government (£268m). The Budget also provides for an initial package of £77m in COVID-19 funding, to support the provision of free school meals and to ensure the continuation of the contact tracing programme.

Raising more revenue from ‘second homes’

The documents accompanying the Budget set out that the Welsh Government’s is primarily funded by a block grant from the UK Government, but that the devolution of tax powers means that in 2021-22 around 17 per cent of Welsh Government spending will be funded from tax revenue.

One change planned for 2021-22 is that the residential higher rates of Land Transaction Tax (LTT) are to be increased on additional, or ‘second’, properties. This is an additional charge which may apply where an individual who already owns one or more residential properties buys a further residential property’.

At the lowest price threshold, on properties worth up to £180,000, the rate has increased to 4%, up from 3%. The other bands have all increased by 1%, subject to agreement in the Senedd, effective from 22 December 2020, compared with the previous rates that had been in place since 1 April 2019.

| Price Threshold | LTT Residential higher rates (1 April 2019 to 21 December 2020) |

LTT Residential higher rates (22 December 2020 onwards) |

|---|---|---|

| £0 to £180,000 | 3% | 4% |

| More than £180,000 to £250,000 | 6.5% | 7.5% |

| More than £250,000 to £400,000 | 8% | 9% |

| More than £400,000 to £750,000 | 10.5% | 11.5% |

| More than £750,000 to £1,500,000 | 13% | 14% |

| £1.5m plus | 15% | 16% |

This change is forecast to raise £14 million additional tax revenue.

What next?

Many of the Senedd’s Committees will have a busy period in January, questioning relevant Welsh Government Ministers at what this proposed budget means for their portfolios. Their reports and that of the Finance Committee will be debated and voted on in Plenary on 9 February 2021, with the session broadcast live on SeneddTV.

The plan is for the Final Budget for 2021-22 to be published on 2 March 2021 and debated on 9 March 2021, in advance of the publication of the UK Government’s Budget during the same month.

Article by Owain Davies, Senedd Research, Welsh Parliament